This Is a Perfect Long-Term Portfolio for Everyone

- Jared Dillian

- |

- June 29, 2020

- |

- Comments

All my life, I’ve been in search of the perfect portfolio.

One that grows a little bit every day, with almost no drawdowns and no volatility, providing a healthy return over risk-free US Treasuries.

Is it attainable?

Not really, though this is the goal of active money management. The big, multi-strategy hedge funds try to achieve this with portfolio managers in different “pods” pursuing different strategies, balancing out the gains and losses.

But this is the holy grail.

Volatility Leads to Stupid Decisions

These days, people focus on returns to the exclusion of all else. They want the portfolio stuffed with aggressive growth mutual funds that return 12%. They don’t think for a moment about risk.

You have to consider risk, in addition to return.

This gets into the behavioral aspects of investing. I like to say that with any trade you make, at some point, you will be tested. You will experience losses and question your motives for the trade. You will be frightened. You will despair.

The goal in building a portfolio is to not be frightened—it’s to “set it and forget it,” checking in on it once a year or so.

If you only invest for returns without considering risk, there is a pretty good chance you will experience a drawdown severe enough that you will contemplate dumping the position—perhaps at the worst possible time.

Volatility leads to stupid decisions. And your decisions will get worse the more volatile your portfolio is. People don’t do this with money market funds.

There is a fine line between investing and gambling, and a lot of what is going on right now is gambling. There’s a place for rank speculation, but not with your retirement savings, and not with your core portfolio. You can set aside 10% of your assets for “play” money, if you want.

It may seem obvious, but you shouldn’t gamble with money you can’t afford to lose.

Instead, you want to build a portfolio that minimizes volatility. This is the core of absolute return investing—taking a number of individual trades that on their own, should have alpha, but when combined, actually improve the risk characteristics of the portfolio.

Of course, during times of extreme stress, correlations go to one, and all hell breaks loose—but this is why you have a hedge.

The Solution

I’ve spent a lot of time thinking about the perfect long-term portfolio for everyone.

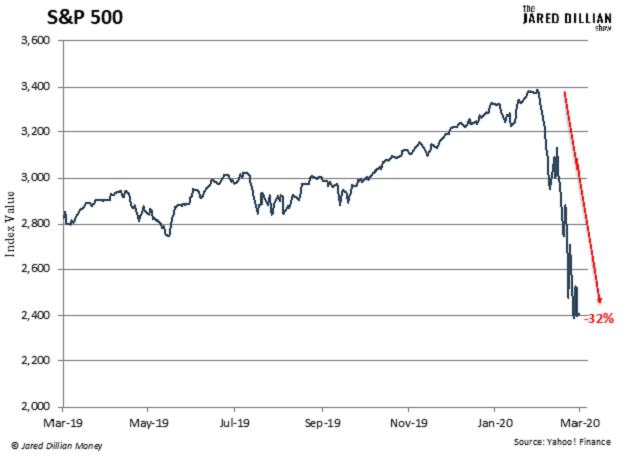

It’s not 100% stocks, for obvious reasons. Sometimes stocks do this:

It’s not 80% stocks/20% bonds—still too high on stocks.

Even the old 60% stocks/40% bonds portfolio gives you too much risk.

A portfolio of 35% stocks/65% bonds has the highest Sharpe ratio along the efficient frontier. But even that won’t work well anymore because of ultra-low interest rates, among other reasons.

So, you have to think about bringing other asset classes into your portfolio. Because stocks and bonds only represent a small part of the investable universe.

In particular, you want to build a portfolio that gives you some positive exposure to inflation, which the 35/65 portfolio does not.

The inflation/deflation argument is all over the place right now. But I can tell you, the government and the Fed have been doing things for the last few months that are not encouraging if you’re worried about inflation.

You want to build a portfolio with a high Sharpe ratio—this gives you a favorable relationship between risk and reward. A portfolio with a high Sharpe ratio will use risk more efficiently. (Portfolios with high allocations to stocks use risk very inefficiently.)

And most importantly, you want to build a portfolio with a very low max drawdown—this is the maximum loss that the portfolio might sustain over any given year. This is where people are tested—an 80/20 portfolio will incur breathtaking losses in periods of market stress.

So I created something called The Awesome Portfolio that does all of these things for you—with some stocks, some bonds, some cash, and some gold. It’s hard to overstate how revolutionary this is—it has the potential to change your life.