Peter Boockvar: Forecast for the 2023 economy

-

Ed D'Agostino

Ed D'Agostino

- |

- January 27, 2023

- |

- Comments

Dear Reader,

This week, I talked to Peter Boockvar, CIO of Bleakley Financial Group, an $8 billion wealth management firm, and editor of The Boock Report.

We all want to know what this year will bring... and Peter is giving you his outlook for 2023 in this episode of Global Macro Update. Some of the topics we discuss: Will inflation eventually drop to pre-pandemic levels?... What are the investment implications now that the $16 trillion Chinese economy is reopening?... Why we’re in a “death by a thousand cuts” environment... Why a “mild and shallow recession” isn’t necessarily a good thing... Are tech stocks a buy yet?... and so much more.

You can access the full transcript of this week’s interview by clicking here.

The video of my full conversation with Peter Boockvar is below.

Tailwinds for International Stocks

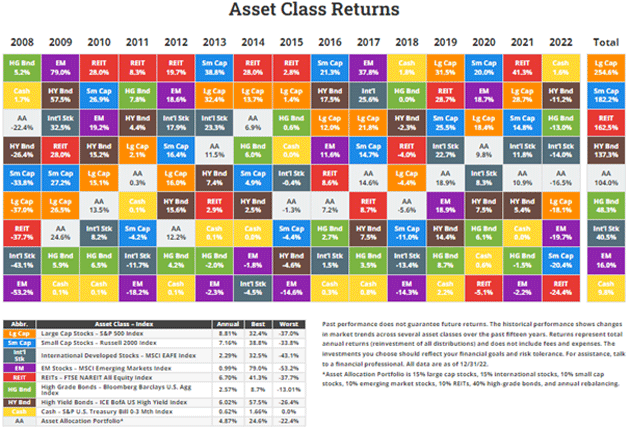

Since 2008, international stocks—both in developed countries and emerging markets—haven’t fared well compared to US equity, real estate, and fixed income. They have returned less than their counterparts, even when we include US investment grade and high-yield fixed income.

In the graphic below, you see the returns of various asset classes going back to 2008. The only thing doing worse than international stocks was cash.

Source: https://novelinvestor.com/asset-class-returns/

However, in our conversation, Peter Boockvar points out certain macroeconomic variables that could turn into tailwinds for these stocks and reverse the longstanding trend. You don’t want to miss his take on the best investment opportunities for 2023.

But first, our market recap...

A Quick Look at the Markets This Past Week…

Gold was up 0.19% to $1,930.

The average 30-year mortgage rate fell .33% to 6.13%.

Yields on 10-year Treasuries increased .26% to 3.49%.

The S&P 500 increased 2.21% to 4,060.

Bitcoin was up 1.83% at $23,091.

Oil was down 0.28% at $81.08/barrel for WTI.

And now...

This Week’s Global Macro Update Interview

Click here or on the screenshot below to watch now…

Click the image above to watch Global Macro Update now

Alternatively, you can click here to read the transcript of this week’s interview.

If you’re interested in reading more of Peter’s insightful commentary on the markets, Fed policy, interest rates, and unemployment stats, click here to subscribe to The Boock Report.

Thank you for reading Global Macro Update.

Sincerely,

Ed D’Agostino

Publisher, Mauldin Economics

If you prefer to listen to Global Macro Update, you can do so here:

Ed D'Agostino

Ed D'Agostino