Here’s what happens when you beat the market by 5% (and how to do it)

-

Thompson Clark

Thompson Clark

- |

- Smart Money Monday

- |

- October 11, 2021

Wall Street is a strange place.

In 2017, the top Wall Street banks published over 40,000 pieces of research… every week. Yet investors read less than 1% of that, according to Quinlan & Associates.

Less than 1%!

This little quirk is part of a bigger transformation on Wall Street—one that has huge implications for you as an investor.

See, the way Wall Street makes money has fundamentally shifted in recent years. So has the way information flows to individual investors. And today I want to show you how savvy stock pickers can profit from these shifts.

-

Wall Street used to make a lot of its money from trading…

A broker would call you up, pitch a “hot stock,” and hope to win your business. If you made a trade, he got a commission. Probably 3% or so on the purchase.

Those hot stocks often came from the bank’s army of analysts. They would pore over financial statements, talk to management teams, and hunt for the best ideas. Then they’d feed their ideas to brokers, who pitched them to investors.

It was a lucrative business model. The bank and the broker made money whether you did or not. But those days have ended. In 2012, the top investment banks earned $103 billion from trading. By 2016, that figure had plunged to $73 billion, and it’s continued to fall since.

-

You’ve likely noticed that brokers don’t call to sell you individual stocks anymore.

Commission-free trading ended all that.

Today, you’re more likely to work with a financial advisor. He probably won’t pitch you on individual stocks. But he’ll help you with asset allocation and long-term planning—and take a percentage of your portfolio for his services.

But what about all those Wall Street analysts? Who needs them if they’re not pitching stocks to brokers… who pitch them to you?

Today, they’re just highly knowledgeable reporters. They have widespread industry contacts, and they know individual companies well. But they mostly help facilitate investment banking deals (which is how Wall Street makes most of its money now). And, like I mentioned earlier, the analysts also produce a ton of research that no one reads.

So, it’s no surprise that Wall Street is thinning its army. Since 2012, the analyst headcount at the 12 largest investment banks has dropped 30%, from 4,400 analysts to just over 3,000 in mid-2020, according to consulting firm CRISIL.

Like what you're reading?

Get this free newsletter in your inbox every Monday! Read our privacy policy here.

-

So, where does that leave investors like you, who don’t get those “hot stocks” from brokers anymore?

If your goal is to own the market, it’s simple. Just buy an index fund, and you’re done—your fate is the fate of the market. There will be good years and bad years. But over time, if you stay invested, you will probably make 8% per year.

Of course, we want more than that here at Smart Money Monday. That’s probably why you’re reading this—because you want to outperform the market, too. And it doesn’t take much to make a huge difference.

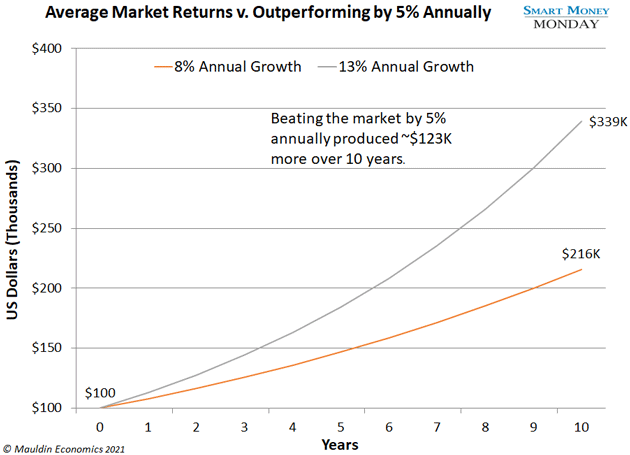

Imagine you have $100,000 to invest. You drop it in an index fund, earn 8% a year, and 10 years later you have $216,000. But what if you could outperform the market, even just a little bit?

If you did 5% better, and made 13% a year, your original $100,000 would turn into $339,000 over the same period.

An extra $123,000 is real money. It could mean the difference between traveling during retirement, or not. Paying for your children to go to college, or not. Buying a vacation home, or not. And there’s only one way to do it.

You have to pick individual stocks.

Not just any stocks… the right stocks. Which means you have to do your homework—or know someone who can do it for you.

-

Beating the market by 5% is more doable than you might think.

Just look at the S&P 500—it’s risen about 17% this year. But nearly 40% of the stocks in the index have shot up 23% or more. There’s your outperformance.

Of course, you have a job and a life. It’s probably not realistic for you to analyze mountains of dense financial data, talk to countless CEOs, and fly around the country doing your own boots-on-the-ground research to pick the best individual stocks.

That is where I come in. One of my goals here at Smart Money Monday is to help you pick the individual stocks most likely to outperform the market. Stocks like Bayer (BAYRY) or Cleveland-Cliffs (CLF), which we’ve talked about before and I’m still bullish on.

Next week we’ll zero in on a small subset of the market that’s fertile ground for these market-beating stocks. Until then…

—Thompson Clark

Editor, Smart Money Monday

Thompson Clark

Thompson Clark