Oil Won’t Drop Below $100 Anytime Soon

-

Thompson Clark

Thompson Clark

- |

- Smart Money Monday

- |

- March 7, 2022

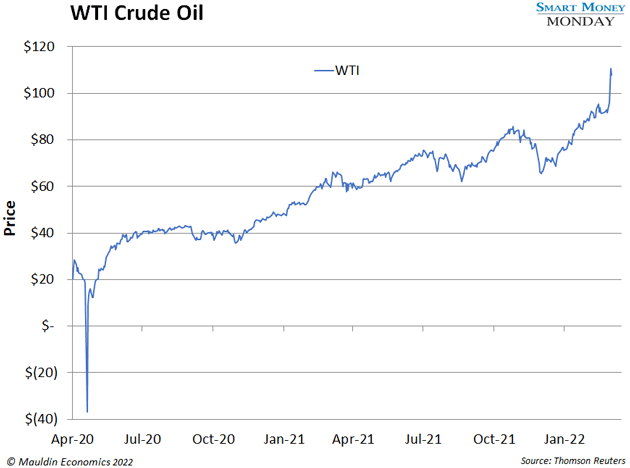

Oil prices spiked 15% last week, reaching an eight-year high of $110.

Investors are pointing to Russia’s war on Ukraine to explain the spike. That makes sense. Russia is the world’s third-largest oil producer and the top exporter to global markets. It produced 12% of the world’s oil supply last year. And 60% of its oil exports went to Europe.

Now the West is refusing to do business with Russia, which should crimp supply. Hence the recent spike. But if you zoom out, you’ll see oil prices have been on a choppy upward march since April 2020, when they briefly went negative.

-

$100+ oil is here to stay, and it’s not just because of the war.

The oil industry runs in cycles. Oil prices rise, production increases, supply exceeds demand, and then prices fall. Rinse and repeat. As the saying goes, the cure for high prices is high prices.

Problem is production isn’t increasing much this time around.

|

[VIDEO] I'm sharing my #1 Wealth Accelerator, which could potentially shoot up 1,000% or more. Watch Video Now |

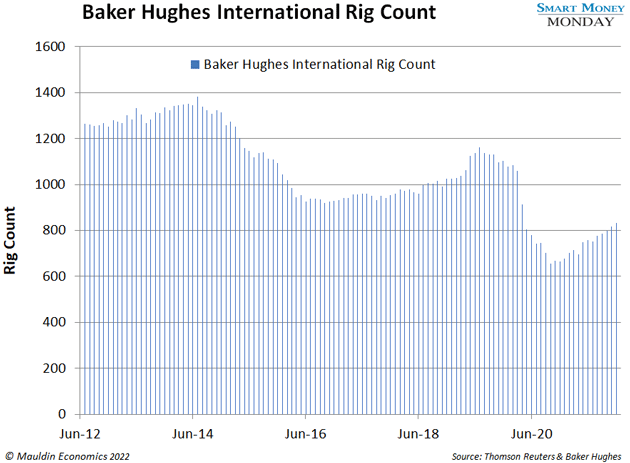

One of the best indicators of oil production is the Baker Hughes international rig count. It measures the number of active drilling rigs around the world.

As you can see in the next chart, the rig count is hovering around 840. That’s 38% lower than the 10-year peak of 1,350.

The last $100-per-barrel cycle lasted around three years, from March 2011 to August 2014. During that stretch, the mood was drill baby drill. The oil boom even spilled into popular culture, with Greg Zuckerman’s The Frackers becoming a nationwide bestseller.

Today, the mood is different. Everyone’s looking to green energy.

-

And oil producers have no plans to ramp up production.

They changed their spending plans after the last energy bear market. Instead of plowing money into exploration and production, they’re returning cash to shareholders through dividends and share buybacks. Oil majors like BP (BP), Exxon Mobil (XOM), and Chevron (CVX) plan to spend $38–$41 billion on buybacks this year, according to the Financial Times.

Let’s take a closer look at BP, and you’ll see how this is playing out…

From 2011 to 2014, BP spent an average of $27.5 billion annually on capital expenditures and acquisitions. In 2021, it spent less than half that—just $12 billion. Analysts expect that figure to stay low for the next few years.

Like what you're reading?

Get this free newsletter in your inbox every Monday! Read our privacy policy here.

Without increased production from BP and its peers, there won’t be enough supply to push oil prices down.

-

Some people say we won’t even need oil in the future.

Maybe. But that future isn’t coming tomorrow.

Just look at the US electric vehicle (EV) market. There are 1.8 million registered EVs compared to 289 million registered cars. Meaning EVs make up less than 1% of vehicles on the road.

Even if EVs grew to 5% of the market, which could happen, it wouldn’t dampen oil demand by much. In fact, the International Energy Agency doesn’t expect global oil demand to peak until 2030.

-

As I wrote in October, the oil majors are a great way to play higher-for-longer oil prices.

I particularly like BP here. BP just announced its plan to dump its 19% stake in Russian oil giant Rosneft. That is going to sting—it will likely lose a few billion on the sale. But even after accounting for the loss, BP is still an inexpensive stock.

BP also sports a steady 4.5% dividend yield. And, as I mentioned earlier, it will likely return more cash to shareholders through buybacks.

Oil is going to stay over $100 for some time, and not just because of Russia. It’s because of cycles and sentiment. BP is a great way to get exposure to higher-for-longer oil.

Thanks for reading,

—Thompson Clark

Editor, Smart Money Monday

Thompson Clark

Thompson Clark