Profitable Small Caps Are Dirt Cheap

-

Thompson Clark

Thompson Clark

- |

- Smart Money Monday

- |

- February 7, 2022

Profitable small caps are dirt cheap.

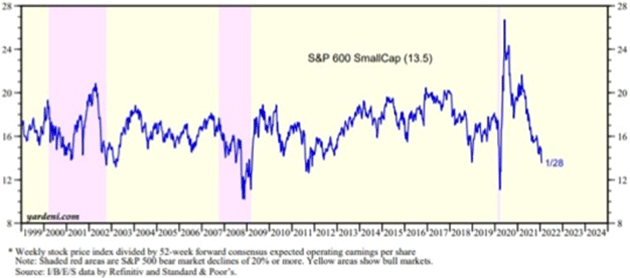

Take a look at the chart below. It shows the forward P/E, a common valuation metric, for the S&P SmallCap 600.

Source: Yardeni.com

At a low-teens multiple of forward earnings, the index hasn’t been this cheap since the coronavirus crash in early 2020. And it’s flirting with all-time record lows not seen since the depths of the 2008 financial crisis.

-

The key word here is profitable.

When analysts (including yours truly) talk about small-cap stocks, they usually cite the Russell 2000. The index includes the 2,000 smallest companies in the Russell 3000, which tracks the 3,000 largest US companies by market cap.

A company doesn’t need to turn a profit to land in the Russell 2000. It just needs to be a US company of a certain size.

-

The S&P indices work a little differently…

Companies can’t get in the club if they don’t make money. Specifically, a company must have made a profit for the past four quarters to get a spot in the S&P 500.

And the same rule applies to the S&P SmallCap 600, which tracks companies with market caps from $850 million to $3.6 billion.

Normally, we focus on individual companies here at Smart Money Monday. However, if we were going to buy a small-cap index, the S&P SmallCap 600 would be the one. It automatically hands you profitable companies. And again, it’s insanely cheap.

-

This is all to say, there are great bargains in small-cap stocks right now.

I’m following two in particular…

AdvanSix (ASIX), a chemical company that Honeywell (HON) spun off in 2016, trades at 8 times earnings. That is extraordinarily cheap. The business is somewhat cyclical. But if it gets back to a market multiple—somewhere around 15─17 times earnings—you’d end up with a cool double on the stock.

Another bargain bin option is children’s clothing retailer Children’s Place (PLCE). It trades for just 6.5 times trailing earnings, which is too cheap.

Keep in mind, Children’s Place generates over half of its revenue from ecommerce. And management has done an excellent job reducing the company’s brick and mortar store count, since it caters to young, tech-savvy parents. So, its future looks bright. But at 6.5X earnings, the market isn’t giving Children’s Place much credit.

Like what you're reading?

Get this free newsletter in your inbox every Monday! Read our privacy policy here.

|

[Video] Thompson Clark shares his #1 Wealth Accelerator, which could potentially shoot up 1,000% or more. |

Monday Mailbag

Many of you wrote in asking for more details about the Series I Bond, the US government bond paying 7%+.

As you’ll recall, the Series I is tied to inflation. Buying it now locks in a 7.12% return until May. At that point, the government will recalculate the yield, based in part on the latest CPI-U reading.

It’s a compelling opportunity. I don’t know where inflation will be in May. But even if it’s cooled off a bit, to say, 4%–5%, it would translate into a nice return on a virtually risk-free investment.

Now, your questions—

Leif wrote:

This sounds good, Thompson, but what happens to the I Bond price as inflation increases? Won't the sales price drop accordingly, canceling out the interest paid?

The I Bond is a little different than other bonds. It doesn’t trade on the open market. You can put in up to $10,000, and the US government guarantees you’ll get that money back.

Remember, the interest rate on the Series I Bond has two pieces: the composite rate and the inflation rate. The government sets the composite rate, and it is somewhat arbitrary. Right now, it’s 0%. The inflation component comes from the CPI-U.

That begs the question—if the CPI shrinks could you see negative returns? In other words, would you lose money? The answer is no. The return on the Series I Bond should never drop below zero.

Rebecca wrote:

Any idea if you can buy this bond in your kids’ names?

Yes! However, every recipient is limited to $10,000 per year. When you buy the bond as a gift, you enter the recipient’s Social Security number. So, buying for your kids is pretty straightforward.

Again, the TreasuryDirect website offers a pretty good overview of the Series I Bond. And you can buy it there, too.

I enjoy reading your questions and appreciate your feedback. You can always reach me at subscribers@mauldineconomics.com.

Thanks for reading,

Like what you're reading?

Get this free newsletter in your inbox every Monday! Read our privacy policy here.

—Thompson Clark

Editor, Smart Money Monday

Thompson Clark

Thompson Clark