This Sector Is in a Recession—Time to Buy?

-

Thompson Clark

Thompson Clark

- |

- Smart Money Monday

- |

- July 24, 2023

The COVID mania period from 2020 to 2022 created tons of abnormalities across the economy.

Ocean container shipping rates went through the roof…

Retailers sold out of goods as customers spent their stimulus checks on “stuff”…

The US housing market boomed thanks to ultra-low interest rates…

Capital markets activity roared as companies IPO’d and hundreds of SPACs went public…

On and on. The mania was broad-based.

Today, there’s one sector on my radar that also saw a major uptick during COVID mania. It now finds itself in a recession.

But one of the largest companies in the industry just made a huge forward-looking bet… and I like it as a way for us to capitalize.

|

Thompson Clark: Research shows that a year after a recession ends, small cap stocks outperform large caps on average by 88%. There have been 10 recessions since 1953 and every one of them proved that small caps are where you want your money to be when the market turns around. Click here for details and how to find out which of these small caps I think will lead us during the next bull market. |

One of the Purest Forms of Supply and Demand

I’m talking about the trucking industry.

The cost of moving goods via truck is quoted on a per-mile basis. And between 2020 and 2022, spot trucking rates soared to around $3 per mile.

Trucking is one of the purest forms of economic supply and demand out there. Higher spot rates attract more drivers. More drivers bring on additional capacity. And eventually, the capacity of trucks exceeds the demand for trucks.

Well, as you can probably imagine, the capacity of trucks today exceeds demand. As a result, trucking spot rates have collapsed. The current spot rate is around $1.50 per mile—a 50% haircut.

I mentioned a few weeks ago that the capital markets sector of the economy is in a depression, as transactions are down dramatically. It’s starting to come back to life, but it’s been a rough 18 months. The same is true with the cardboard box sector of the economy. It’s in the tank; the demand just isn’t there like it was during COVID.

Add trucking to the list—it, too, is in a recession.

Like what you're reading?

Get this free newsletter in your inbox every Monday! Read our privacy policy here.

As stated on the last two earnings calls, we are in a freight recession.

Trucking is a necessity. It’s not going away. It’s just going to take time for the industry to normalize.

Meanwhile, shrewd operators are capitalizing on this distress. And one of the shrewdest just made a huge bet…

The Knight Family

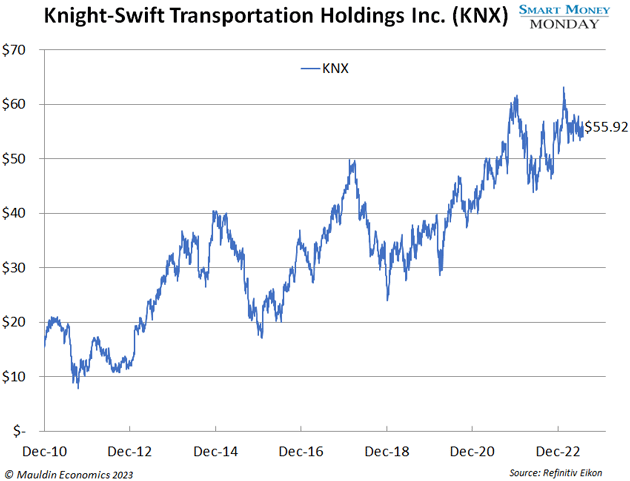

Knight-Swift Transportation Holdings Inc. (KNX) is one of the largest trucking companies in the United States. The company was founded in 1990 by Randy, Gary, Kevin, and Keith Knight.

Kevin and Gary are still on the board and own a little less than 3% of the company. That puts their stake in the $9 billion company at $250 million.

KNX generated $13 million in revenue in 1991. In 2022, it generated over $7.4 billion.

Knight-Swift understands trucking is a cyclical business. More than anyone else, it saw the recession coming. And just a few months ago, it capitalized on it through its announced acquisition of competitor US Xpress Enterprises (USX) for $800 million.

US Xpress has had a tough life as a public company. It just couldn’t get operations tightened up like Knight-Swift has been able to achieve. Its margins simply weren’t that impressive.

Knight-Swift’s view is that it can dramatically improve USX’s profitability—something to the tune of a four-fold increase. That’s an ambitious target, but it’s likely achievable. Knight-Swift did it before when it acquired Swift in 2017. Margins went from 7% to 20% in just a few years.

From my perspective, there’s a path to getting to $5 in earnings per share over the next few years. Valuing the company at 15 times this estimated future earnings per share, Knight-Swift shares would be worth $75 per share. That’s a 34% lift from today’s stock price of around $56.

That’s not a bad outcome.

And unlike Microsoft and Activision, the acquisition of US Xpress has already closed. So, no deal risk there.

Knight-Swift Transportation Holdings Inc. (KNX) seems like an interesting bet here to capitalize on the trucking freight recession.

Thanks for reading,

—Thompson Clark

Editor, Smart Money Monday

Thompson Clark

Thompson Clark