Victory Lap: Microsoft-Activision Gets the Green Light

-

Thompson Clark

Thompson Clark

- |

- Smart Money Monday

- |

- July 17, 2023

Smart Money Monday isn’t a typical newsletter where I formally recommend when you should buy and sell.

But sometimes, I like to put these opportunities in front of readers. And in the case of Activision Blizzard Inc. (ATVI), it’s time to ring the register and lock in profits.

It looks like Microsoft’s (MSFT) acquisition of ATVI for $95 per share is set to close tomorrow, July 18.

There are a few small wrinkles left to complete the deal, but the market is saying it’s nearly guaranteed. As such, from here, look to sell ATVI anywhere above $90 per share.

We’re two for two on merger arbitrage situations. The first was our bet that Elon Musk would have to buy Twitter (TWTR). That worked.

And now, we’re taking a victory lap on Microsoft’s all-cash acquisition of Activision.

|

Thompson Clark: Research shows that a year after a recession ends, small cap stocks outperform large caps on average by 88%. There have been 10 recessions since 1953 and every one of them proved that small caps are where you want your money to be when the market turns around. Click here for details and how to find out which of these small caps I think will lead us during the next bull market. |

Merger Arb

A quick refresher…

Merger arbitrage is making a bet that an event—in this case, a merger—will go through.

Microsoft announced in January 2022 that it was buying video game maker Activision for $95 per share in cash.

The day of the announcement, Activision’s stock didn’t rise immediately to $95. Rather, it rose to around $80 per share.

The first reason it didn’t immediately go to $95 is the time value of money. It’s July 2023, and the transaction still hasn’t closed (although I believe it will). Buying ATVI at $95 in January 2022 would generate a worse return than risk-free Treasury bills.

The second reason is deal risk. Can the company actually come up with the money? In the case of Microsoft, yes—no problem there.

And then, as an added deal risk: Will a government (the US government in this case) block the transaction on anticompetitive grounds?

Deal Risk

For this deal, that’s exactly what happened. In December 2022, the FTC announced it was seeking to block the transaction on anticompetitive grounds. The UK Competition and Markets Authority piled on around the same time.

Like what you're reading?

Get this free newsletter in your inbox every Monday! Read our privacy policy here.

That was one of the final steps in eliminating the deal risk to the transaction.

Ring the Register

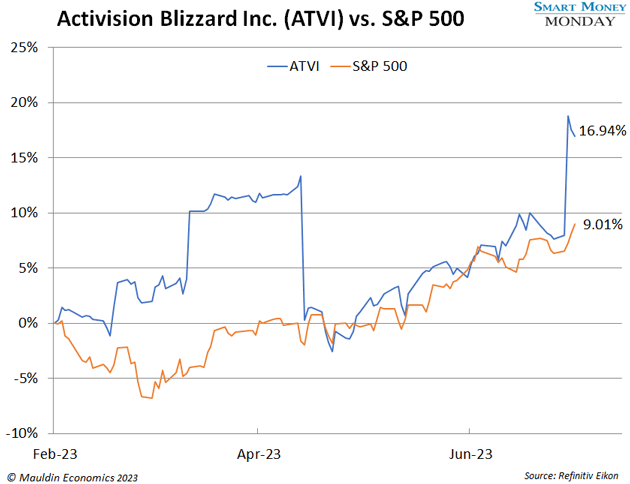

Since buying Activision in February 2023, we’ve pocketed a nice 17% return. That’s about double the S&P 500, which is up 9% over that time frame.

Honestly, I had my suspicions that the transaction would close.

Microsoft and Activision can easily afford the world’s most expensive, prestigious, and connected attorneys. The companies did their due diligence prior to even announcing the transaction. They wouldn’t have signed the deal if they didn’t think it had a high probability of closing, and getting it wrong would have cost Microsoft a whopping $3 billion that it would have to pay Activision.

So, while I wasn’t 100% sure it would happen, I knew our downside was protected. Along with that hypothetical $3 billion in cash from Microsoft, Activision is a high-quality business. The business is highly profitable. It wasn’t going to evaporate if Microsoft couldn’t acquire it.

Plus, it wasn’t terribly expensive, even on a deal break. Even at $90 per share, Activision (ex the cash from Microsoft) would be trading at less than 20 times forward earnings. That’s not expensive for a high-quality growth company.

So, again, it’s time to ring the register. Both companies have agreed to a close date of July 18… tomorrow. Go ahead and sell.

Congrats if you owned this one through the ups and downs. Did you make money here? I’d love to hear about it. Send me a note at subscribers@mauldineconomics.com.

Thanks for reading, and have a great week,

—Thompson Clark

Editor, Smart Money Monday

Thompson Clark

Thompson Clark