This Indicator Predicted the COVID-19 Recession… Now It’s Predicting an Economic Boom

- Robert Ross

- |

- The Weekly Profit

- |

- March 17, 2021

The markets are in the middle of a once-in-a-decade event.

And it says a lot about what you should do with your money right now.

I’m talking about a critical indicator called the yield curve.

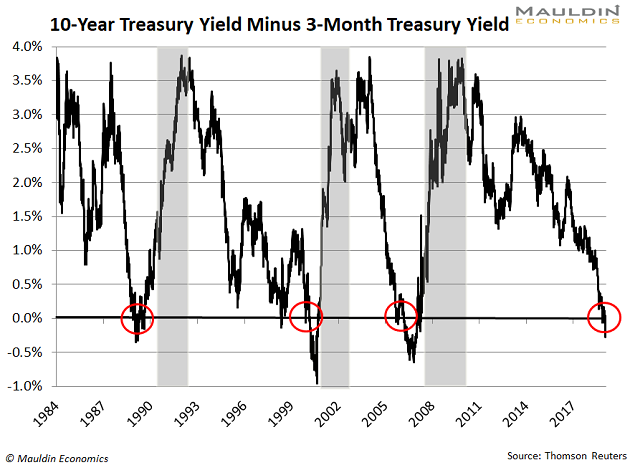

Longtime readers will remember spring 2019, when the yield curve inverted. Back then, I had asked you to pay attention to this economic warning sign because it had preceded every recession in the last 50 years.

Now the opposite is happening: The yield curve is steepening. This has historically preceded every major economic boom in the last 50 years.

I'm confident that not only is this boom already underway, but it will be unlike anything we've seen before. That's because the yield curve is…

The Market’s Most Reliable Recession/Expansion Indicator

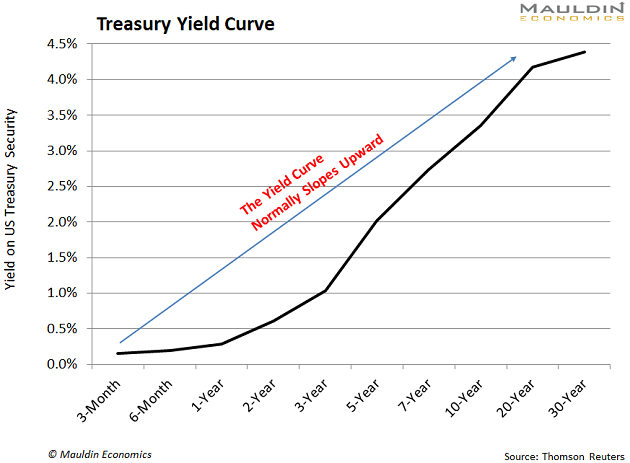

As you likely know, US Treasuries are bonds issued by the US government—the safest lender on the planet. That means they’re as close to “risk free” as possible.

The US Treasury issues these bonds for different lengths of time, ranging from three months to 30 years. This period is called the bond’s “maturity.”

Normally, investors demand higher yields for longer-term bonds.

That's because it’s harder to predict economic changes or major world events 30 years out. So, we demand higher yields to compensate for the greater uncertainty.

In other words, the longer the maturity, the higher—or steeper—the yield.

The chart above shows Treasury yields forming their usual, upward-sloping curve.

The opposite happens when the yield curve inverts, as we saw in April 2019:

As has happened every time in the last 50 years, the economy peaked within 18 months of the yield curve inversion.

Right on cue, the stock market stumbled as well:

With the warning that stocks were set to head lower, I recommended selling lower-conviction positions and loading up on portfolio insurance in the form of bond ETFs and gold.

Now that the yield curve is steepening, it's time for a strategy change.

A Steepening Yield Curve Is a Great Sign for Stocks

Just like an inverted yield curve portends a slowing of the economy, a steepening yield curve portends an acceleration in the economy.

Right now, the gap between 2- and 10-year yield is the widest it’s been since 2017. This suggests that the economic foot is waiting to tap the gas pedal. And when it does, it will send stocks cruising higher.

All Treasury yields reflect future interest rate expectations and inflation risk. But it is long-term yields that are more sensitive to economic growth and inflation.

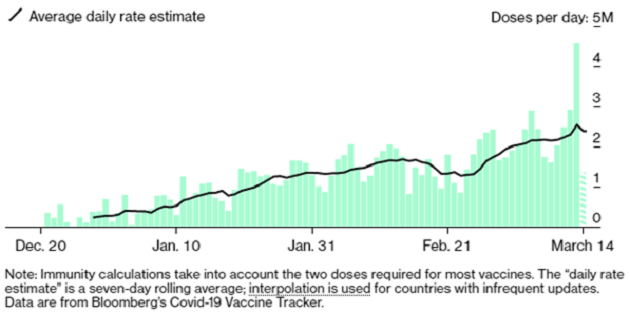

With vaccine distribution ramping up… the economy reopening… a third round of government stimulus putting cash in people’s pockets… and financial giants saying it's time to buy stocks… investors are factoring in higher economic growth and inflation expectations.

Source: Noah Smith

The latter is the key here.

Yes, it’s true that rising inflation may force the Federal Reserve’s hand in raising interest rates. But with the central bank stating it intends to keep rates low until 2023, I expect it to let inflation rise even above the 2% target rate until unemployment is back near pre-pandemic levels.

That means you want to add some inflation-sensitive stocks to your portfolio.

These 3 Stocks Will Ride Inflation Expectations Higher

Inflation expectations are currently the highest they’ve been in 10 years. It’s one reason we’ve seen bond yields surge over the last six months.

But there are some sectors—particularly energy, financials, and industrials—that directly benefit from higher inflation.

Magellan Midstream Partners (MMP), which operates pipelines in the central and eastern United States, should be a big beneficiary.

Income investors can benefit big, too, thanks to MMP's safe 9.9% dividend yield.

How do I know MMP's dividend is safe? My Dividend Sustainability Index (DSI), which tests whether a company can maintain its payout, gives MMP a respectable 84/100 score.

Mastercard (MA), the world’s third-largest payments company, is also poised to ride inflation higher.

Mastercard processed $4.8 trillion worth of transactions in 2019. And that number keeps growing in our increasingly cashless world.

While the company offers a mere 0.5% dividend yield, the long-term growth for the firm—and the stock—more than makes up for this small-but-steady income.

Whirlpool (WHR) tops my list of industrial companies. The company is one of the largest home appliance companies in the world, making everything from washing machines to freezers.

Even better is the company’s dividend yield. WHR pays a rock-solid 2.4% yield on a low payout ratio. When you add in solid free cash flow and low debt, WHR earned a 96/100 on the DSI.

That not only puts Whirlpool on the top of my industrial list, but if you are looking to buy any of these three inflationary plays, this is the one to start with.

I have another idea to play this trend that I'm going to send my Yield Shark subscribers' way a little over a week from today. To make sure you are on the list to receive it, visit this page and tell me where I can send this brand-new trade idea.

Robert Ross