Seismic Wave

-

Jared Dillian

Jared Dillian

- |

- November 10, 2016

- |

- Comments

Liberals in ruins, just absolutely shattered. After eight years of smug condescension, I will allow myself four years of schadenfreude.

The conventional wisdom on the election (I just heard Chuck Todd say it on NBC News) is that the election was primarily about economic issues—our manufacturing base being hollowed out, jobs lost overseas, which stoked nativist sentiment, stuff like that.

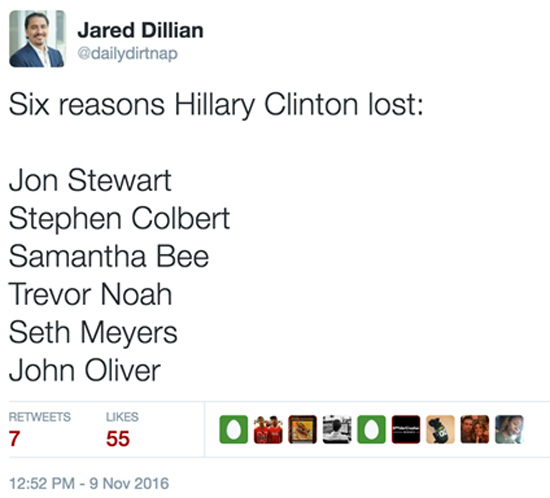

But I don’t think it was that at all. I think we owe these election results to a cultural phenomenon. People don’t like being called rednecks, racists, hicks, slow, homophobic, transphobic, dumb, unsophisticated, Cracker Barrel patrons—even if it’s true. If you really want to know why Hillary Clinton lost the election, look no further:

Night after night of this superiority and disdain led us to President Donald Trump. I’ll be the first to argue with flyover country over the merits of free trade, but I’ll do it in a respectful fashion. You take a giant dump on people night after night, this is what happens.

That is neither here nor there, though. This being a financial newsletter, let’s talk about how to make money off a Trump administration.

It is so easy, a caveman could do it.

Luckily, we have already talked about it. Please read this before you go any further. It’s something I wrote back in April.

Interest rates shot up yesterday. Some thoughts:

- We discussed this months ago. There are a lot of bond bulls out there. What do they say now?

- This is the first time in forever that the bond market has actually been afraid of supply. Possibly the first time since 1994.

- The curve steepened massively. Trump did what the Fed has been trying to do for years.

- Speaking of the Fed, given the price action yesterday, the chance of a rate hike in December has to be close to 100%.

- Fed funds futures sold off yesterday. The market is believing in rate hikes.

As you can see from the stock market reaction, the market went from worrying about global thermonuclear war to getting hopeful about Trump’s plan for growth. Tariffs aren’t really a plan for growth, but let me tell you what is:

- Cutting marginal income tax rates

- Cutting corporate tax rates

- Repatriating overseas earnings

- Rolling back regulations (Obamacare, Dodd-Frank)

- Energy policy

That is assuming Trump is going to do what he said he is going to do. Which is a stretch, because Trump probably isn’t going to build a wall, and he isn’t going to send Hillary to prison. There are a lot of promises he won’t follow through on. So I’ll believe the tax cuts when I see them.

But the market has hope.

Other Trade Ideas

I’d be a fool not to save the good stuff for Street Freak and The Daily Dirtnap, but I will say up front that, on a sector basis, a Trump presidency is bullish for:

- Financials

- Health Care

- Energy

Basically, the most-regulated sectors of the economy.

I would short:

- Technology

The least-regulated sector of the economy, and also the sector that was most vocally anti-Trump. Big tech likes to shake hands with the government—the relationship between Google and the Obama administration is especially cozy—so what if that comes to a halt?

Too Late?

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

Interest rates go from 15% to 1.3%, and then they go to 2%, and you think you missed it?

These are trends that are going to continue for months, weeks, years. Nobody missed anything. The hardest thing to do is to buy a chart that is up against the upper right corner of the screen. It is usually profitable.

subscribers@mauldineconomics.com

Jared Dillian

Jared Dillian