The Future’s So Dark, I Gotta Take My Shades Off

-

Jared Dillian

Jared Dillian

- |

- February 16, 2017

- |

- Comments

But Interstellar had a pretty bleak vision for Earth’s future: oxygen disappears from the atmosphere, causing blight among several different crops and plant species to go extinct. The only thing left is corn, which is pretty much all people eat. Hence, Matthew McConaughey travels across the universe to find a new planet.

Source: Prezi.com

My number three favorite movie of all time: 12 Monkeys.

Bruce Willis travels back in time from a post-apocalyptic future to figure out how the virus got loose that killed off most of humanity. The picture below is of Philadelphia in the future, though it’s telling that all they had to do to get the post-apocalyptic look right was to film Philadelphia in the present, in 1995. Also starring Brad Pitt, and the terrific Madeleine Stowe.

Source: movie-tourist.blogspot.com

Speaking of Brad Pitt (and this isn’t a sci-fi movie), how about Seven, a movie about a bizarre series of killings in dirty, dangerous New York? People thought that crime like that was going to continue forever, that the city was so dangerous, you couldn’t even walk down the street.

Source: fogsmoviereviews.files.wordpress.com

Or how about Looper, where people are reduced to transacting in silver and gold; Gattaca, where eugenics is employed across the population; Children of Men, where people stop reproducing; Blade Runner, where killer androids have escaped; and Rollerball, where corporations have taken over the globe?

Has any of this stuff ever happened?

No, it has not.

Here’s how people predict the future. They look at the past and present, and extrapolate. Interstellar doesn’t explicitly say that global warming caused crops to perish, but you can put two and two together. People believe that temperatures rose in the past, so they will rise in the future.

When Seven was made in 1995, crime had already peaked and was dropping, but people took the past (huge amounts of crime) and extrapolated it into the future (even more crime). That is what happens with all of these movies—they take the greatest fear in the public consciousness at the time—and create a vision for the future where it comes true.

Two points make a line, and then you just extend the line out into the future.

That makes for pretty bad forecasting, especially when it comes to economics.

I thought of this the other day as I was writing The Daily Dirtnap. I was thinking back to one of my favorite childhood books: Noonan.

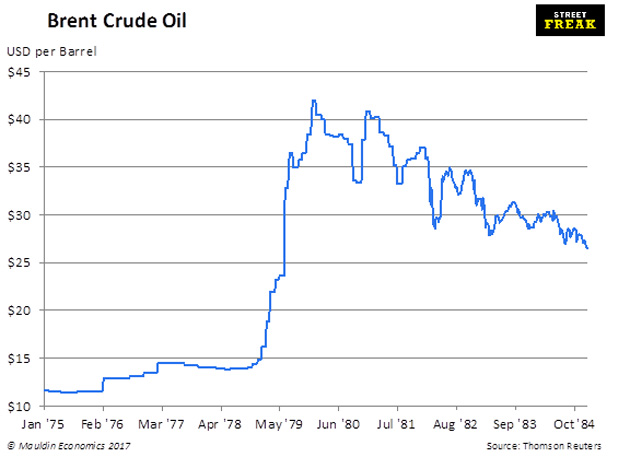

Noonan was written in 1978, about a pitcher with psychokinesis. There is also some time travel involved. Much of the book takes place in 1996, where there are riots about oil prices!

Remember, the book was written in 1978. What was going on in 1978?

Exactly.

A Couple of Points Here

- Humans are a very pessimistic species. If you’re my age, you probably think that optimism is the norm, but I think it’s the exception rather than the rule, especially outside of the US. People are just now starting to think that the future is going to be worse for their children than it was for them. They will probably be wrong.

Things will probably be great!

- It’s not just economic trends. When any big trend takes hold in the public consciousness, it probably means that it’s close to the end. That includes not just economics, but climate, culture, politics, sports, anything.

Climate?

I remember watching NBC Nightly News two years ago at the dinner table with my wife, watching the devastating drought in California on a daily basis. People were talking openly about the possibility that California would someday be a desert, that agriculture would disappear. Now?

Source: sfgate.com

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

- Political polarization. It is worse than it has ever been. People think it will keep getting worse.

- Right-wing populism. Peaking, or just getting started?

- Unions. Membership at all-time lows. A thing of the past?

- Drug overdoses. It gets worse and worse—does it ever stop?

- Health care costs. They never stop going up.

- Higher education costs. They never stop going up.

- Obesity. The population just keeps getting fatter.

You get the picture. All of these trends are square in the public consciousness. If you asked the man on the street—sure, drug addiction is going to get worse. Sure, health care will just keep getting more expensive. Sure, there are going to be more Trumps and Le Pens. It makes sense, because you take two points, draw a line, and…

None of these things ever play out, because economics, politics, and culture are all self-correcting. The cure for high prices is high prices. What happened when oil spent years at $100/barrel? People figured out new places to drill for it. And then we had more oil, and prices came down.

And just at the moment you think the trend can’t get any worse, is the moment that the trend is at the front of public consciousness—which inevitably marks the end of the trend.

If you want the best contrary indicator to markets, to culture, to life, look no further than science fiction movies. They take a fear about the future, extrapolate it, and magnify it. And it never comes true.

Except for Minority Report. Everything in Minority Report came true.

Quick reminder: all 10th Man subscribers are invited for a night of really, really, really good music.

Nexus Lounge on the corner of 1st and 1st, next Thursday, February 23, 8pm–12pm. Would love to see you there.

subscribers@mauldineconomics.com

Jared Dillian

Jared Dillian