Rely on Patterns and Steady Income for Wealth in 2023

-

Kelly Green

Kelly Green

- |

- December 21, 2022

- |

- Comments

There are just seven trading days left in the year.

And a relaxed holiday period is the perfect time to decompress and reflect.

What happened last week doesn’t guarantee it will repeat next week, but it does reveal patterns. And patterns are the takeaways I look for.

-

2022 was all about investor sentiment… and it was all over the place.

The markets were sensitive to anything and everything this year.

Any glimmer of hope and stocks had an up week. Anything unpredicted gave us a down week.

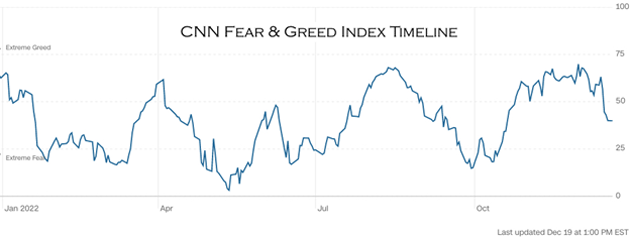

For a quick gauge of investor sentiment, I use the CNN Fear & Greed Index. The index measures seven areas of stock market behavior. The result is expressed as a number between 0 (maximum fear) and 100 (maximum greed).

Throughout this year, as soon as the next piece of economic data came out, investors were off in a new direction.

Source: CNN Business

Inflation and recession fears have kept investor emotions running high—and share prices moving. Never mind that nothing had changed with the companies being sold and bought.

-

We will see more of the same in 2023—edgy investors and edgier markets.

Interest rates are the highest they’ve been since 2007 and are likely headed higher.

And talk of recession has ratcheted higher across the entire media landscape.

We know that recessions and bear markets are an unavoidable part of long-term investing. Although both are temporary, their start and length are still unknown.

You don’t need a crystal ball to see why markets will remain choppy into next year.

I think the choppiness all comes back to investor sentiment, and not the facts and fundamentals about companies and their businesses.

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

Make Your Money Moves Based on Facts

I’ve been preaching dividends for over a decade.

And I’ll continue beating my dividend drum because the numbers don’t lie.

-

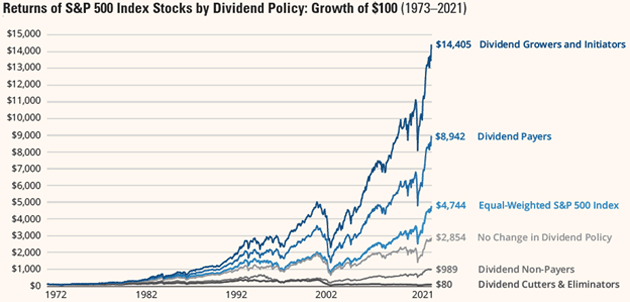

For over 50 years, dividends have been the boring secret to amassing long-haul wealth.

Source: Hartford Funds

As you can see in the chart above, dividend stocks outperformed the S&P 500 and non-dividend payers. And dividend growers outperformed them all!

The market has seen it all over the past 50 years—recessions, housing bubbles, financial meltdowns, and wars.

But no matter what happens or when it happens, you will continue to collect your dividends through it all.

Dividend payouts have been much less volatile than stock prices throughout history. Studies show that the market’s 12-month change in price was at least twice as volatile as the change in dividends.

Why?

-

Companies that pay dividends are usually big, “boring” stable companies.

Many dividend payers are in industries that are considered defensive such as utilities, energy, consumer staples, and healthcare. No matter how bad the economy gets, people still need these essential goods and services.

These tend to be companies with decades and even centuries of experience. They’ve survived a market downturn or two and have a plan to keep on trucking no matter what the market does.

But don’t be fooled into thinking there’s only a few percent yield you can squeeze out of solid dividend payers.

In times of market turmoil, rising recession fears, and growing concerns about the global economy, your dividends will help defend your portfolio.

That’s not the only benefit.

By holding a variety of dividend payers, you can outpace inflation and benefit from macro trends.

Our Unique System Creates the Perfect Combination

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

This is obvious.

Some companies will be able to withstand economic changes and maintain their dividends. Others will not.

Because of that risk, I separate dividend stocks into two groups: Bedrock Income and Current Income.

-

Bedrock Income stocks are solid dividend payers that you could hold for years or decades… possibly forever.

Just as bedrock is the layer that supports the earth’s crust, these dividend payers are the bedrock foundation of any dividend portfolio.

This group includes dividend aristocrats, consumer staples, and other dividend payers with a long history of raising their dividend payments.

Many Bedrock Income stocks pay a dividend yield in the 3%–5% range. These are the wealth-preservation members of your dividend portfolio.

-

Current Yield stocks are those you want to collect income from right now.

Although they might carry a little more risk, these are stocks paying dividends that should be sustainable over at least the short term.

You might hold these for years or only a few payments. These could be special situation companies that will profit from a hot macro trend. They include pass-through entities like BDCs, REITs, and MLPs.

Current Yield stocks will usually pay a dividend yield in a range between 6%–9%. But the current market downtrend has lowered share prices for a chunk of these stocks sending their yields to double digits!

This part of the portfolio adds a two-fold benefit.

First, higher yields help protect the purchasing power of your money from evaporating away during periods of high inflation.

Second, Current Yield stocks offer more opportunities to profit from macro trends and collect capital gains from rising share prices.

When combined, the result is a solid dividend portfolio that will keep your money working for you in any environment.

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

For this week only, I’ve prepared a special holiday offer to join us for up to 50% off. Click here now to get the full details.

For more income, now and in the future,

Kelly Green

Kelly Green

Kelly Green