Savvy Income or High Yield Trap: Mailbag Edition

-

Kelly Green

Kelly Green

- |

- March 15, 2023

- |

- Comments

As inflation hangs around like a freeloader house guest, the search for income becomes more pressing.

Some people pick up a second job. Others go big-game hunting in the income markets—and this can get you in trouble.

For both seasoned and newbie income investors, it can be very tempting to “chase yield.” That is, buying something based solely on its eye-popping current income.

That’s where the trouble starts. Paying a big yield last quarter is one thing. Paying it every quarter is another thing altogether.

You have to know if the yield really is sustainable.

Today, I look at two “high-yield” income opportunities readers have asked about recently. Both have had a bit of mainstream news traction, so you might be wondering about them as well.

Double-Digit Yield Floating Out at Sea?

I was asked to investigate the double-digit yielding Royal Caribbean (RCL) bonds.

I’ll start by noting that Royal Caribbean has a very low credit rating. All of its issuances would be considered junk bonds.

The coupon—or annual interest rate—for the different RCL bonds also had a very wide range from 3.7% to 11.625%. The two issuances with over 11% yield have garnered the attention of both investors and the news over the past months.

This coupon rate is based on the $1,000 face value (or par value) of the bond and is paid for the life of the bond. This could be until maturity or until the bond is called early by the issuer.

For RCL bonds, the lower coupon offerings are trading below face value, and the higher coupon offerings are trading above face value. This is called “trading at a discount” or “premium.”

-

If you pay more for a bond than its face value, the yield you collect drops.

For the 11.5% and 11.625% Royal Caribbean bonds, you’d have to pay $1,062.50 and $1,050.00, respectively. Meaning that investors are willing to pay above face value for these issuances.

Are they worth it?

For the full-year 2022, RCL had a net loss of $2.2 billion, or $8.45 per share.

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

Will Royal Caribbean go bankrupt tomorrow? Probably not. Could they? It’s not out of the realm of possibilities.

When I look for opportunities in junk bonds, I want to get a discount on the face value and a high yield. Plus, I want to see evidence that economic conditions for the company will improve to offset the risk I’m assuming.

Personally, I’d skip these RCL bonds.

High Yield from the S&P 500?

As I mentioned last week, the 50-year average yield of the S&P 500 is just 2.8%. So, any promise of high yield from the S&P 500, and I want to know the crazy scheme behind it.

JPMorgan Equity Premium ETF (JEPI) seeks to deliver higher monthly income with less volatility. The fund’s trailing 12-month dividend yield is 11.45%.

Ok, you’ve got my attention.

Now, let’s look at the 132 individual holdings behind that big yield.

There are a lot of familiar, large-cap dividend names that I know well. Some, like LyondellBasell (LYB) and AbbVie (ABBV), I even recommend holding.

However, a lot of its holdings are companies I routinely reject when doing research for my Yield Shark letter. Many, simply because they do not pay a dividend worthy of our time.

Only seven of JEPI’s holdings have a current yield above 5%, and none offer a double-digit yield. This is based on recent prices. Since JEPI started in May 2020, its yields have been slightly higher.

But how does the fund pay a double-digit dividend?

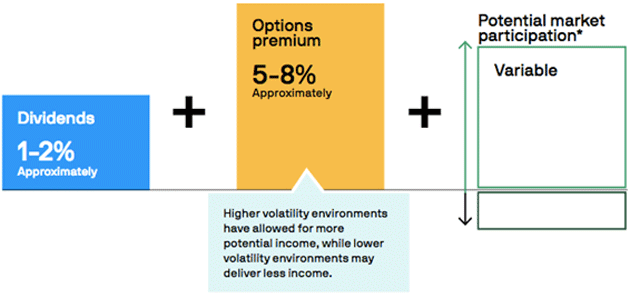

Its stock holdings are 80% of the portfolio. The other 20% are “options-based, equity-linked notes.” I poked around and found this graphic that shows what this means in practice.

Source: JPMorgan

The bulk of JEPI’s distributed income is from an options strategy based on the S&P 500 Index.

-

When markets are more volatile, options premiums are higher. But the opposite is also true.

The graphic implies we should expect the fund to yield 6%–10%.

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

The fund’s latest monthly dividend was 41 cents—its lowest in 13 months—and equals an annualized yield of 9.4%.

Don’t get me wrong, using covered calls to generate higher income can be a winning strategy. But I don’t think owning JEPI is a good way to maximize the potential return on the dollars invested.

Any number of unfavorable market conditions could cause JEPI to underperform.

-

On the surface, the double-digit yields on RCL bonds and JEPI make them look attractive. But there is nothing stable about them.

There is a better way to collect high-yield income and outperform the S&P 500.

I have three positions in the Yield Shark portfolio with double-digit payouts right now.

My subscribers just sold Eagle Bulk Shipping (EGLE) for a 49% profit that included a dividend yield that peaked at 19.3%.

If you want your money to really outpace inflation, I recommend trying the 2023 Second Income Challenge. Click here to get started. You won’t be disappointed. Last year, we outperformed the S&P 500.

For more income, now and in the future,

Kelly Green

Kelly Green

Kelly Green