Should We Worry About Dividend Cuts in 2024?

-

Kelly Green

Kelly Green

- |

- January 17, 2024

- |

- Comments

Before we get into today’s issue, I want to give you one last reminder about my MoneyShow presentation this morning at 11:15 EST. You still have time to claim your free ticket and log in to join me here.

Did you see that Walgreens (WBA) cut its dividend nearly 50% earlier this month? And just like that, the Dividend Aristocrat’s 47-year streak of annual dividend increases came crashing down. It was just three years shy of earning the title Dividend King.

This wasn’t the only “royalty” cut we saw over the past 12 months. VF Corp. (VFC) was just one year shy of King status when it cut its dividend last year. Shareholders were hit with a second cut a few months later.

Neither of these cuts was unexpected. But if you’re counting on dividends to fund your lifestyle, cuts from dividend giants will make you shift in your seat a bit.

The Dividend Aristocrat title is awarded after 25 consecutive years of dividend increases. The Dividend King crown after 50 years. These dividend stalwarts are great candidates for the “set it and forget it” part of your portfolio. I label them Bedrock Income stocks in my Yield Shark portfolio.

Should we worry about more dividend cuts in 2024?

We should always be on the lookout for warnings signs of a possible dividend cut. Luckily, the number of large, stable companies that cut their dividends in any given year is generally very low.

Warnings Signs to Keep on Your Radar

Dividend policy is crafted by a company’s management. Even if the same policy has been in place for years, you could be blindsided by a change.

Here are some things to watch for to avoid being stung by a slashed dividend.

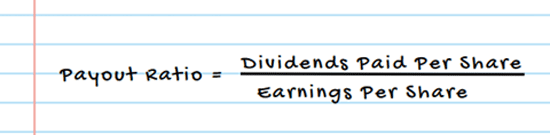

First, monitor a company’s payout ratio. It compares the amount of dividends paid to the amount of earnings per share. It tells us what portion of earnings is being distributed as a dividend.

The formula above is how the payout ratio is calculated. The result will be a decimal. You can multiply the result by 100 to change to a percent.

If the math results in a number higher than 1 it tells you more than 100% of earnings are being paid as a dividend. This often means that debt is being used to fund the payout. This can be justified in the short term, but becomes concerning in the long term. There are other ratios used to measure dividend coverage, but the payout ratio is one of the simplest and quickest to find.

You should always be wary of slowing dividend growth. A company with a long history of steady dividend growth that suddenly slows that growth might be signaling a longer-term problem. Look at management’s explanation for the stalled dividend hikes. If it’s due to a restructuring or a short-term transition, that might be fine. If not, a dividend pause or cut could be coming.

Finally, watch for slowing earnings growth. You should question falling earnings growth just as you did for slowed dividend growth. If there is a reasonable explanation that seems temporary, then don’t panic. If it seems like a lingering problem—or worse, a problem that’s not being successfully managed—your dividend could be at risk.

A Dividend Cut Isn’t Always Bad for Long-Term Investors

A great recent example of this was the 80% dividend cut from Camping World (CWH) last year. The cut wasn’t made because the company couldn’t pay the dividend. Rather, it “elected to modify its quarterly dividend to reflect the prioritization of capital allocation towards RV dealership acquisitions.”

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

-

Reinvest it back into the business—R&D, marketing, pay down debt, etc.

-

Keep it as cash—save it for a rainy day

-

Distribute it to the owners, aka, the shareholders

Camping World saw the opportunity to grow through acquisitions. Money was diverted from shareholders to expanding its business. This benefits shareholders in the long run if done successfully.

The companies we own in Yield Shark are considered long-term investments—even our potentially “shorter term” Current Yield holdings. The goal is to strike a balance between investing for the future and earning income needed today. I might recommend a dividend that’s not as safe in order to lock in more income right now. At the end of the day, it’s important to note this. And always be on the lookout for anything that might put our future plans at risk.

For more income, now and in the future,

Kelly Green

P.S. If you want to join me at the MoneyShow TradersExpo in Las Vegas next month, I just received a link for my loyal readers to get a discount of $100. You can get your three-day pass for just $99 by registering here.

Kelly Green

Kelly Green