Special Dividends—Easy Money or Tempting Trap?

-

Kelly Green

Kelly Green

- |

- December 14, 2022

- |

- Comments

special (adj): distinguished by some unusual quality.

—Merriam-Webster

The announcement of a special dividend can feel like a second Christmas.

That’s a fitting likeness as special dividends are usually a one-time “gift” from a company’s management to shareholders. Special dividends are simply a non-recurring distribution.

They can be paid in addition to a company’s regular dividends. Or they can be declared by a company that doesn’t pay a regular dividend.

Either way, who doesn’t love an unexpected gift?

Especially when special dividends are often much larger than regular dividends. It’s found money that will boost your portfolio’s yield.

But there’s a bigger question…

-

Should you buy a stock just because it announced a hefty special dividend?

In the 1940s, over 60% of NYSE companies that paid a regular dividend also paid at least one special dividend every year.

Today, special dividends are far less common.

And that rarity adds to the hype!

So, let’s take a closer look at whether or not a special dividend is a green light to buy a stock.

A 200% Dividend Increase

After the market closed on November 30, Sturm, Ruger & Co. (RGR) announced a $5 special dividend. It was big news, as the special dividend was more than double the regular annual dividend of $2.42.

Shareholders would see their dividend income triple for the year!

It was great news if you already owned RGR.

But you might want to think twice before buying the stock just to grab the special dividend.

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

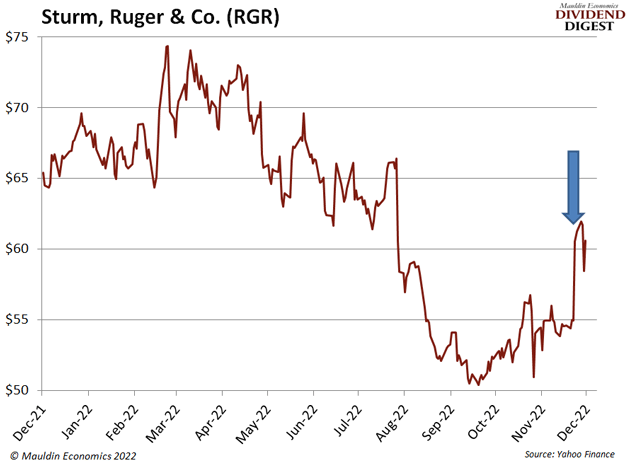

As soon as the market heard the news, RGR shares rallied toward a four-month high.

Shares shot up $5.64 the day after the announcement.

-

The market quickly prices in a special dividend.

This $5 “premium” will continue to be priced in until the ex-dividend date. That’s the first day shares trade where buyers don’t qualify to collect the special dividend. That day is today.

A company’s stock price will automatically fall by the special dividend amount on the ex-dividend date. This happens with regular dividends, too. Since special dividends are usually much higher, the share price movement is a lot more obvious.

-

Once a special dividend is announced, you’re too late.

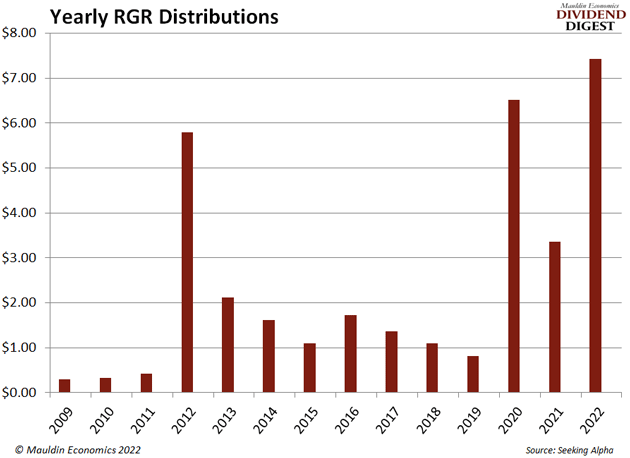

That’s especially true for a stock like RGR whose quarterly dividends are all over the place.

Those big payout years in 2012, 2020, and 2022 were all juiced by special dividends.

And even though RGR has paid them multiple times in the past, don’t buy the stock banking on them again in the future.

Keep All Dividends in Perspective Before You Buy

Am I saying RGR is a bad investment? Not necessarily.

But it does not have the stable dividend history I look for when adding positions to the Yield Shark portfolio.

-

A special dividend does not make a stock a good investment, even for income investors.

Always investigate a special dividend before using it as a reason to buy. Make sure you understand why the company is paying one.

These irregular payments can happen for many reasons:

-

Unexpected cash on hand

-

Asset sales as part of a corporate restructuring

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

-

Strong, non-recurring capital gains or cyclical earnings

-

Hybrid dividend payout strategy

The first three are conditions that may never happen again. You can’t count on them.

However, a hybrid dividend payout strategy could result in reoccurring special dividends. This is an intentional strategy by management where a company pays a regular dividend plus an annual special dividend.

The special dividend is usually paid around the same time every year. And although the amount is variable, management sets guidelines that determine the payment. It’s not a surprise, it’s planned.

This strategy is used mostly by REITs and cyclical businesses.

-

What’s the lesson here? Don’t chase yield!

Don’t be tempted by special dividend dollar signs dancing in your head. By the time it’s public knowledge it’s too late. And once the shares go ex-dividend, you’re bound to lose the special dividend amount in a lower share price.

Special dividends do very little to benefit a company in the long run.

Instead, look for stocks with a long history of paying regular dividends that grow year after year.

For more income, now and in the future,

Kelly Green

Kelly Green

Kelly Green