A Transformational Acquisition for This Proven Utilities Winner

-

Thompson Clark

Thompson Clark

- |

- Smart Money Monday

- |

- March 13, 2023

It’s been two years since Winter Storm Uri wreaked havoc on the Texas power grid.

The Texas utility market is unique and, because it’s unregulated, has more of a free-market, free-wheeling approach to power.

Power is generated by the plants, sold wholesale to distributors, who then sell it to end customers.

It’s a lot different than, say, North Carolina, where utility company Duke Power is fully regulated and has set prices (more or less) for power.

During Winter Storm Uri, power prices in Texas went parabolic. Many customers ended up with exorbitant power bills, and many power companies went bankrupt.

Then there’s Vistra Corp. (VST), which was whacked but not mortally wounded. The company survived the crisis and has emerged a much stronger company. It has executed well and repurchased gobs of stock—all smart capital allocation decisions.

Last week, Vistra announced a major change in its prospects. Since Uri, it has played defense. Now, with a transformational acquisition, it’s playing offense.

|

The 2023 Second Income Challenge: With inflation still running hot and volatility in the markets, Entrepreneur Magazine calls this “a good time to lean on the stability of [this income-generating strategy].” Click here to discover how you can add a second income today. |

Nuclear

As far as I’m concerned, nuclear is the obvious solution to producing reliable, green energy.

Fortunately, the recently passed Inflation Reduction Act acknowledges this, as it’s full of green energy subsidies and programs. One of the big programs in the bill relates specifically to nuclear energy.

It’s a bit complex, but essentially it provides a tax credit to nuclear power companies if nuclear prices fall below a certain floor. This incentivizes the company to continue to produce and sell power even if it’s not as profitable.

Vistra was quick to recognize this subsidy. And it acted.

Last week, Vistra announced the acquisition of Energy Harbor, a pure-play nuclear power company with locations in Ohio and Pennsylvania.

Valuation

Vistra, assuming the deal closes, which seems likely, is cheap. Very cheap.

Two large nuclear power players in the market are Constellation Energy Corp. (CEG) and Public Service Enterprise Group, Inc. (PEG). Both stocks trade well north of 10X their EBITDA.

Like what you're reading?

Get this free newsletter in your inbox every Monday! Read our privacy policy here.

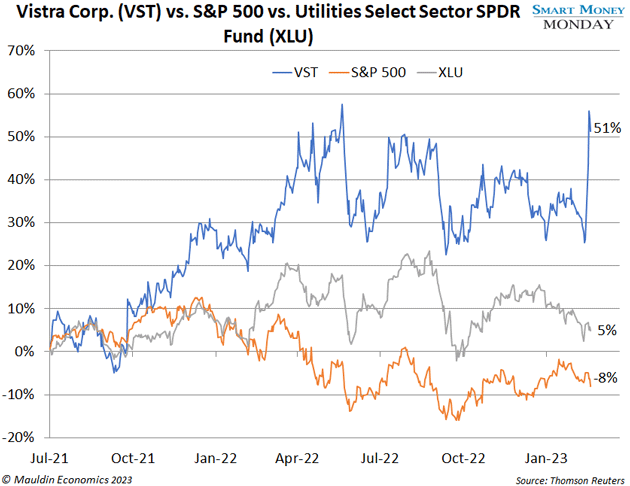

I’ve owned Vistra since writing it up in 2021—you can read that article here. It has crushed the S&P 500 and the Utilities Select Sector SPDR Fund (XLU) over that time frame:

And because of the valuation discrepancy, I still like it today.

Were Vistra to trade closer to its pure-play nuclear peers, that would imply a share price of between $50 and $75 per share. That’s a 100%–200% move from here.

It’s wild to think a utility company stock can put up returns like that, but it’s just math. And it’s a distinct possibility.

The new company will continue to allocate a substantial portion of free cash flow to share repurchases. Again, it’s bought back 20% of the shares outstanding in the past two years. And I expect it will continue to do that in the future.

Vistra is worth owning here. I own it and really like the prospects.

Thanks for reading,

—Thompson Clark

Editor, Smart Money Monday

Thompson Clark

Thompson Clark