Good Jockeys, Bad Horses—Avoid These “Disruptors”

-

Thompson Clark

Thompson Clark

- |

- Smart Money Monday

- |

- February 6, 2023

As a concept, WeWork Inc. (WE) has a lot going for it. At least the company’s tenants—who get perks such as free-flowing kombucha, networking happy hours, and a flexible lease—may see it that way.

For its shareholders, however, kombucha on tap isn’t exactly cutting it…

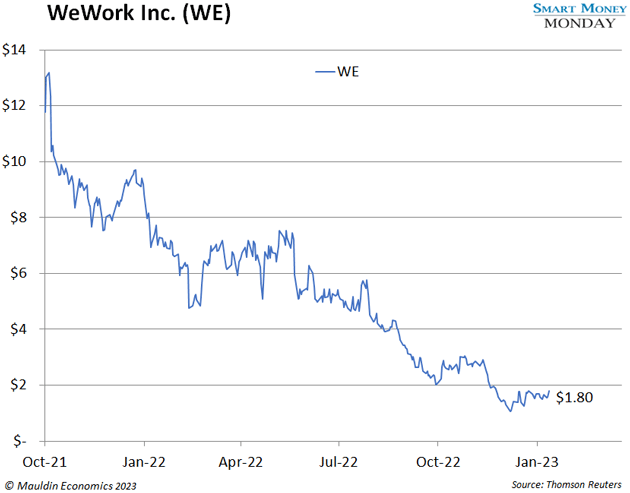

To recap, the office disruptor made its long-anticipated debut on the New York Stock Exchange in October 2021 at the peak of COVID mania. It wasn’t via a traditional IPO—rather, its listing was the result of a merger with special purpose acquisition company BowX Acquisition Corp.

WeWork’s stock jumped 13.49% on its first day of trading, closing at $11.78 per share. But that feels like a lifetime ago, as the stock has fizzled out since then. (It’s down over 80%!)

Sure, WeWork has climbed roughly 60% year to date, but the stock is still down 57.7% since I first warned against it in August 2022.

Nothing has changed. It’s still a pass despite the competence of CEO Sandeep Mathrani, a proven moneymaker in real estate. He helped turn around General Growth Properties during a difficult time for the economy and the company, which ended up getting sold to private equity behemoth Brookfield Property Partners in 2018.

In WeWork’s case, you’ve got a proven and talented CEO at the helm of a business with questionable economics and—worse—a bad balance sheet.

WeWork’s debt load has continued to increase, and the company continues to lose money.

|

Inflation like we’re seeing now hasn’t burned its way through the American lifestyle in over 40 years... but smart investors are using this approach to outpace inflation and safeguard their money. |

Bad Horses

A great investment requires a strong CEO and a quality business model. WeWork, unfortunately, looks like a bad horse with a good jockey.

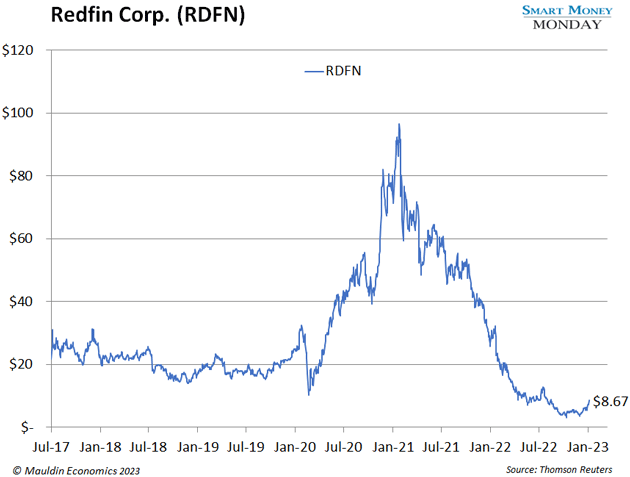

“Disruptor” Redfin Corp. (RDFN), once coined the “Amazon of real estate” by CEO Glenn Kelman, looks similar.

For context, Redfin went public before COVID mania in 2017. The stock debuted at around $20 per share. Six years later, Redfin’s shares have been sliced in half. It currently trades for under $10.

Over time, Redfin has become a player in the residential real estate market in the US. Its pitch is that it’s basically a cheaper form of your plain-vanilla real estate broker.

The “old” structure means a real estate broker takes 5%–6% of the transaction value for getting the deal done. Redfin steps in and offers to do it for less. The industry listing fee is 2.5%–3% (paid by the seller). Redfin’s fee is just 1%–1.5%, which is a big difference.

This has been the company’s strategy all along. And yet, it’s just not working.

Redfin has a little less than 1% of the total US market share based on units sold. So, in theory, it has lots of runway. As I see it, the problem is that people just don’t care. They’ll pay that extra fee for the extra service from a real estate agent.

Like what you're reading?

Get this free newsletter in your inbox every Monday! Read our privacy policy here.

Numbers Don’t Lie

Since 2015, Redfin hasn’t generated a single dollar of GAAP (generally accepted accounting principles) operating income.

Revenue has grown from $187 million in 2015 to over $2 billion on a trailing 12-month basis. Not bad.

And yet, Redfin isn’t making any profits.

As mentioned, the CEO in charge of Redfin is Glenn Kelman. He was placed there by venture capitalists in 2005. Prior to Redfin, Glenn co-founded a software company. My study of Kelman indicates that he’s a strong operator. He can probably run any quality business in the world… and run it at a high level.

Unfortunately, in this case, Redfin is just not the right business. It’s another bad horse.

Going back to the numbers, Redfin is in the same situation as WeWork. It’s losing money and has debt.

Redfin did take advantage of COVID mania, though, and issued billions of dollars of convertible debt. Fortunately for the company, this debt is at a low interest rate. However, there’s over $1.2 billion of it currently outstanding.

Above the common shareholders, there’s also a tranche of convertible preferred stock.

Just like the financials, the capital structure at Redfin is a total mess.

Finding Easier Ideas

Like WeWork, Redfin requires near 100% perfect execution—plus, a bit of luck—for the stock to work from here.

Both companies appear to have poor unit economics. They also have bad balance sheets. Revenue growth won’t overcome poor unit economics.

The CEOs in charge have respectable track records and, yes, are competent operators. But they’ve been dealt a bad hand. Bad horses, good jockeys.

There are easier names out there to own, which I’ve covered in recent issues of Smart Money Monday. And I will continue to find them, so stay tuned for new ideas in the weeks ahead.

Thanks for reading,

Like what you're reading?

Get this free newsletter in your inbox every Monday! Read our privacy policy here.

Editor, Smart Money Monday

P.S. If you’re not receiving the quick daily insights from Mauldin Economics friend Keith Fitz-Gerald, you’re missing out.

Keith is a popular financial analyst and educator and an entertaining writer. He has over 40 years of market experience and a list of media appearances a mile long. In his daily e-letter, Morning! 5 with Fitz, he cuts through the noise with actionable investing and trading ideas.

If you’re interested, you can begin receiving his e-letter by clicking here and entering your preferred email.

Lastly, you should know that we have a marketing relationship with Keith and his team. If you buy a product from Keith Fitz-Gerald Research, we may earn a commission. That said, we enter marketing relationships with very few publishers and only when we are comfortable with their management team and research.

Thompson Clark

Thompson Clark