My Top Smart Money Monday Pick for 2023

-

Thompson Clark

Thompson Clark

- |

- Smart Money Monday

- |

- February 27, 2023

As a bargain-hunting stock picker, seeing a stock you like hit an all-time high usually means it’s time to sell.

Or, at the very least, you don’t add to the position.

It’s rare, but there are times when a stock is a buy even after hitting all-time highs. My top pick in Smart Money Monday for 2023 is one of those rare instances.

Again, I like to buy things on sale. A typical rule of thumb is to look for stocks hitting a new low. That tells me it’s almost certainly hated and, therefore, potentially cheap.

Today’s idea doesn’t fit that rule of thumb. Despite hitting all-time highs, it’s actually cheaper and more compelling here than at any time in the past few years.

|

Ed D’Agostino’s One-on-One with Keith Fitz-Gerald: In the exclusive interview, Keith answered as many reader questions as he could in the time available. Here’s a brief rundown of the topics and names Keith covered:

It was a wide-ranging conversation and not one to miss. Click here to stream for free, while it’s still available. |

Berkshire of Canada

Admittedly, it’s a bit cliché to call a company the “Berkshire Hathaway of Fill in the Blank” or “The Next Berkshire Hathaway.”

And as we’ve seen, it’s downright disastrous to call someone the next Warren Buffett. Fortune magazine applied that label to accused crypto fraudster Sam Bankman-Fried. It did the same for SPAC king and VC promoter Chamath Palihapitiya. Many of his SPACs are down 90% or more.

But before Warren Buffett and Berkshire Hathaway were household names, there was one guy in Canada following his playbook: Prem Watsa.

Watsa is the CEO, founder, and largest shareholder of Canadian insurance conglomerate Fairfax Financial Holdings Ltd. (FRFHF).

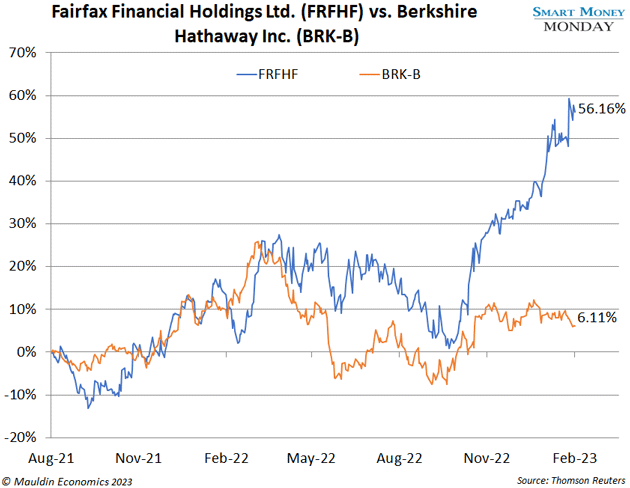

I first wrote about it here, and it’s up 56% over that time frame. It’s beaten Berkshire Hathaway over that same time frame as well.

Dodging the Bond Bubble

Prem Watsa is a tried-and-true value investor. For him, “cheap” is based on current in-place numbers. He doesn’t buy story stocks or stocks that will be profitable “someday.”

He’s also avoided bonds, one of the world’s largest asset classes—and for good reason. The yields on bonds, or fixed income, have been low for over a decade… 1% or 2% returns for long-duration bonds just wasn’t attractive.

Instead, Watsa kept investable funds in cash or extremely low-duration bonds that matured in less than two years.

Like what you're reading?

Get this free newsletter in your inbox every Monday! Read our privacy policy here.

In short, Watsa refused to chase yield. And now, that decision is paying off. Higher interest rates work in Fairfax’s favor here. It’s printing money on low-risk bonds.

Its fixed income book today is $38 billion dollars. Over the next two years, it should earn $1.5 billion per year in interest income.

Big Picture

Fairfax doesn’t just make money on interest income. It also makes money in insurance, with insurance operations generating around $1 billion per year in operating income.

Then, there are other equity investments and wholly owned businesses inside of Fairfax. That bucket should generate another $1 billion in operating income or investment gains.

Backing out the interest expense, taxes, and corporate overhead, you can easily get to $100 per share in earnings from Fairfax over the next two years and beyond.

$100 in earnings per share… that’s easily worth 10–15 times earnings, right? Insurance giant Chubb, which I mentioned above, trades for 16 times earnings.

Fairfax, however, isn’t even close. On today’s $664 share price, it’s trading at less than 7X earnings.

That’s much too cheap.

There’s a lot more going on inside Fairfax. But right now, the market appears to like simple, easy-to-follow stories. And at less than 7X earnings, it’s easy to see that Fairfax is a very cheap stock.

Thanks for reading,

—Thompson Clark

Editor, Smart Money Monday

Thompson Clark

Thompson Clark