Don’t Buy into Kellogg’s Dividend Trap

- Robert Ross

- |

- The Weekly Profit

- |

- December 11, 2019

When’s the last time you bought Kraft Mac & Cheese?

I imagine it’s been a while.

Thirty years ago, every cupboard in America had a box. But consumer trends have shifted. People don’t want hyper-processed foods like Kraft Mac & Cheese anymore.

Warren Buffett, one of the greatest investors of all time, must have overlooked this when he bought a 27% stake in Kraft Heinz (KHC) in 2015.

Not long after, Kraft’s sales flatlined. Earnings rose slightly, but this came from cutting costs, not growing sales.

Nevertheless, Kraft kept raising its dividend—until it couldn’t.

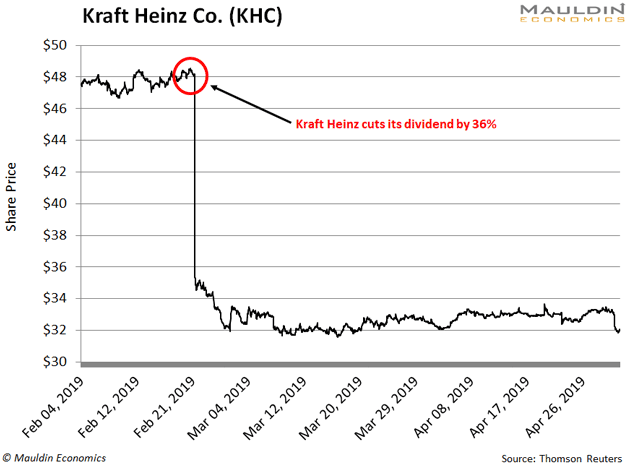

In February, the company slashed its dividend 36%. The news pushed Kraft off a cliff. Shares plummeted 30% in a single afternoon.

Dividend Cuts Trigger Big Losses

Dividend cuts like Kraft’s are the quickest way to lose money in the stock market.

Here’s how it works…

When companies have cash leftover after factoring in expenses, they often return cash to shareholders as dividends. When a company regularly raises its dividend, it signals that management is confident about the business.

The opposite is also true: When a company cuts its dividend, it means management is worried.

Even worse, a dividend cut will often trigger a steep drop in the company’s stock price, just like we saw with Kraft Heinz.

Now Kellogg Co. (K) is barreling toward the same fate.

|

How to Avoid At-Risk Dividends

Kellogg Co. (K) is the multinational food company behind Corn Flakes, Pop-Tarts, Eggo waffles, and other ‘80s kid favorites.

I ran Kellogg through the Dividend Sustainability Index (DSI), my proprietary tool for gauging dividend safety. The results? Kellogg’s dividend is headed for the chopping block.

Longtime readers know the DSI uses three key factors to measure dividend safety.

The most important factor is a company’s payout ratio. This is the percentage of net income a company pays its shareholders as dividends. The lower the payout ratio, the safer the dividend payment.

The second factor is the company’s debt-to-equity ratio. The more debt a company has, the harder it is to run a business. This includes paying a dividend.

The third factor is free cash flow. This is the cash leftover after expenses.

When any of these factors flashes red, it means a company’s dividend is in trouble.

For Kraft Heinz, the DSI flashed red for a solid year before the company slashed its dividend. Most critically, its payout ratio had been rising for three years, averaging 94% over that period.

In other words, the company was using almost every dollar it made to pay dividends.

Again, this is a major red flag. And I see the same troubles over at Kellogg…

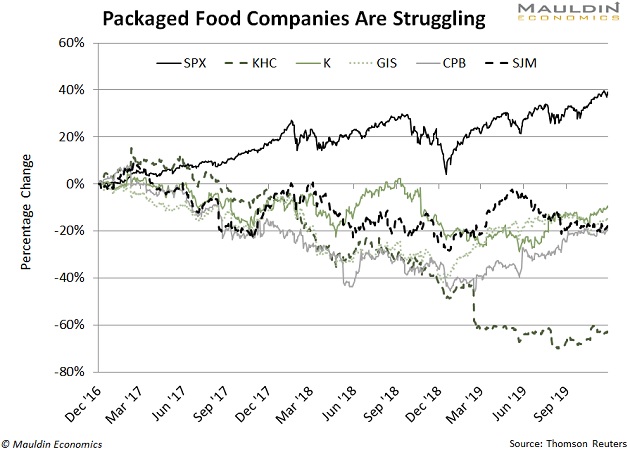

The Whole Packaged Food Industry Is Struggling

Like I mentioned earlier, consumer preferences are shifting away from processed foods. This is straining the entire packaged food industry.

Over the last three years, major packaged food companies have all severely underperformed the S&P 500. Kraft Heinz (KHC), Kellogg Co. (K), General Mills (GIS), Campbell’s Soup (CPB), and JM Smucker Co. (SJM) have returned an average of -23% over this period.

That’s terrible, especially compared to the S&P 500’s 40.9% return.

Of all these companies, Kellogg’s dividend is the most at-risk. Let’s take a closer look…

Sell Kellogg Today

First off, Kellogg’s payout ratio is 105%. That’s bad. It means the company pays $1.05 in dividends for every $1 in profits.

Even worse, this is “normal” for the company. Its average payout ratio for the last five years is 107%.

Meanwhile, Kellogg is drowning in debt. Its debt-to-equity ratio is 295%. And its free cash flow has sunk an average of 6% per year over the last five years.

Plug all this into the DSI, and you get the lowest score possible.

Now, regular readers know me as the safe income guy. Avoiding stocks with at-risk dividends is a critical part of safeguarding your investment income.

Kellogg is one of those stocks. If you own shares of Kellogg, sell before the company falls off the same cliff as Kraft Heinz.

That said, let’s switch to some good news.

We’re kicking off our exclusive VIP offer today. Once a year, for a short time, Mauldin’s elite annual service opens its doors to new members. VIP gives you the true “full spectrum investing” experience: For one year (or two), you’ll receive all of our premium publications—including the highly profitable In the Money and Yield Shark services.

It’s a perfect way to diversify, protect, and grow your portfolio without all the hard work that typically comes with it. Even better, you’ll get the whole spectrum of research services at up to 75% off. If you’re already a Mauldin Economics subscriber, you can save even more. It’s pretty neat. Click here to get all the details.

Robert Ross