These 3 Double-Digit Energy Dividend Payers Are Starting to Surge

- Robert Ross

- |

- The Weekly Profit

- |

- November 18, 2020

The Dow Industrials notched a new all-time closing high at 29,950.44 on Monday.

The last time it set a new high was nine months earlier, on February 12. The action in between those dates has been nothing short of incredible.

After coming into 2020 during the longest bull market in US history, the COVID-19 pandemic sent stocks 36% lower this spring.

But in true 2020 form, that wasn’t even the shocking part.

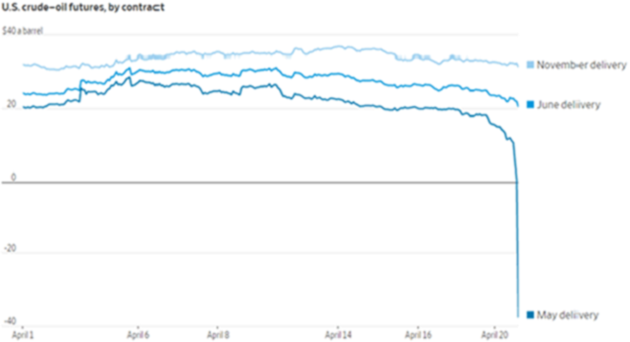

The biggest shock came in April when oil prices went negative for the first time in history.

The price action was a surprise, but the reason wasn't…

Source: The Wall Street Journal

With much of the country confined to their homes during lockdown, nobody was on the roads, on the rails, at sea, or in the air. Plus, there was a price war between OPEC and Russia.

You couldn’t even give oil away. Traders were paying people to take it off their hands!

But that may be about to change.

Modern Medicine to the Rescue

We’re seeing a major uptick in COVID-19 cases all over the world right now. In the US, we had 166,000 new cases on Monday. That’s the highest figure since the pandemic began. But thankfully, it looks like there’s a light at the end of the tunnel.

Pfizer (PFE) and Moderna (MRNA) now have vaccines that are over 90% effective. While vaccine approvals and distribution will take time, the end of COVID-19 is finally in sight.

And that means demand for energy may be coming back sooner rather than later.

For income investors, there are few better opportunities than in the pipeline market.

Let’s Follow the Smart Money Into Energy

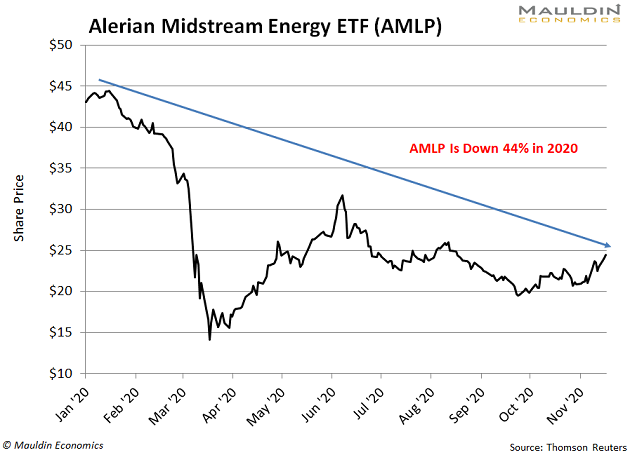

The oil market has rallied since bottoming below the zero line in April. But energy pipelines have continued to struggle.

For instance, take a look at the Alerian Midstream Energy ETF (AMLP), which holds a basket of energy pipeline companies:

While the broad markets are making all-time highs again, AMLP is down a whopping 44% this year. But with a vaccine coming soon, it might be a good idea for income investors to investigate this space.

Warren Buffett’s first post-pandemic deal was in energy. His Berkshire Hathaway (BRK) bought Dominion Energy’s (D) pipeline assets back in July for $10 billion.

Buffett may have been attracted to the sector because of its massive dividends.

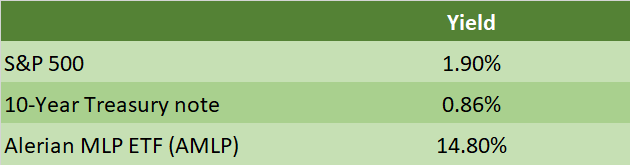

For instance, AMLP pays a dividend yield six times higher than the S&P 500:

Wait, you may say—AMLP pays a whopping 12.7% yield. But we know all too well here at The Weekly Profit that a high dividend yield doesn’t matter if it’s not reliable.

Lucky for you, I have the tools to tell you whether a dividend is safe or not.

Make Sure Your Energy Dividend Is Safe

I use something called the Dividend Sustainability Index (DSI) to gauge whether a dividend is safe. It looks at a handful of dividend-related metrics to test whether a company can maintain its payout.

For instance, one of the most important data points is the payout ratio. This is the ratio of a company’s dividend paid to earnings.

So if a company pays $1 in dividend per year and earns $2 in profit, it has a payout ratio of 50% ($1 in dividends / $2 in profit).

These three energy names offer even more than that…

3 Pipelines With Huge (and Safe) Dividends

Near the top of my buy list is Magellan Midstream Partners (MMP). The company operates pipelines in the central and eastern United States.

What puts MMP over the top is its 10% dividend yield.

And while the three-year average payout ratio is a little high at 85%, the company’s solid free cash flow growth and balance sheet help bolster the case for the payout. It’s also a key reason why MMP scored a respectable 84/100 on my DSI.

Next on my list is Phillips 66 Partners LP (PSXP). As the name implies, the company is the pipeline subsidiary of oil and gas giant Phillips 66. But unlike the parent company, PSXP pays an eye-popping 14% dividend yield.

And according to my DSI, this yield looks safe. Free cash flow has been rocky, but the three-year average payout ratio of 78% and strong balance sheet earned the company a DSI score of 88/100.

Last, we have Keyera Corp. (KEYUF). The Canadian midstream company currently sports a 10% dividend yield. And with a three-year average payout ratio of 79%, the payout looks safe and reliable. My DSI agrees, as it gave the company a score of 85/100.

Any of these three names are good buys now, and even better buys on pullbacks.

If you're doing this on your own, keep your position sizes manageable and consider keeping mental or actual stop-losses in place. Those will help you ride out any volatility with some added peace of mind.

Robert Ross