Don’t Miss Out on This Golden Opportunity

-

Kelly Green

Kelly Green

- |

- December 13, 2023

- |

- Comments

Have you seen the price of gold lately?

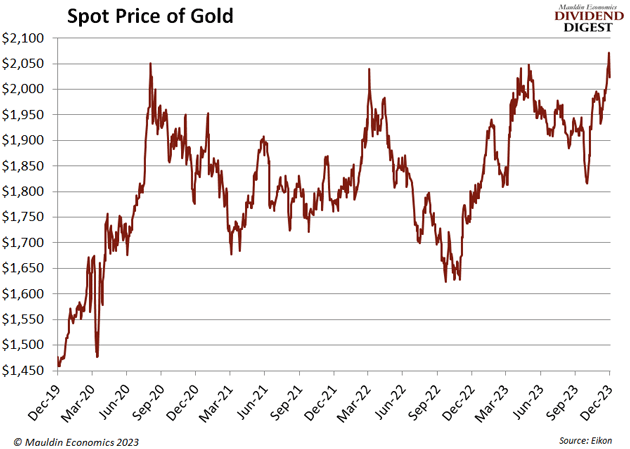

If you haven’t, here’s a chart for the past four years.

Last Monday, the yellow metal jumped 3% to hit a new all-time high of $2,135 per ounce. That bested the previous record high of $2,072 back in August 2020. More important, in my opinion, is the support or floor price this move suggests for gold.

We’ve seen gold pass $2,000 several times, but each time it has failed to hold above that price. Over the past year, $1,800 has acted as support and stopped gold from sliding lower. Now, let’s see if gold can stay above $2,000. I’m not 100% convinced gold will be able to stay at those levels… but I do think that support will move up towards $1,950.

So, should we be acting on gold’s new record highs?

Are You Suffering from Gold FOMO?

I know, why are we talking about gold when this is a dividend newsletter?

Stocks and gold have historically had an inverse relationship—when one rises the other falls, and vice versa. Now, both are steadily chugging towards new highs. Last Friday, the S&P 500 hit a 2023 high of 4,608.91—just 188 points shy of its all-time high.

Investors own gold as an inflation hedge or for asset diversification. It’s also considered the ultimate store of value, which isn’t useful to us as we are trying to put extra income in our pocket.

But it’s easy to feel left out as you watch gold soar higher.

There are several ways you can add gold exposure to your portfolio.

The most obvious way is to buy physical gold bullion/bars, coins, or jewelry. This has its own challenges as you have to buy from a dealer instead of your brokerage account. Then you have to decide where to keep it—at home (one day I will tell you about my silver coins being stolen) or pay for storage. Selling will require extra effort as well.

Instead, there is a much easier alternative: We can look towards mining stocks, and this is one of the few times I look at funds.

My Gold Dividend Watchlist

Yes, I said watchlist. I’m not 100% convinced it’s time to buy either of these gold plays, but let’s take a look.

-

A miner to keep an eye on.

Newmont Corp. (NEM) is the world’s leading gold company and also produces copper, silver, zinc, and lead. It has 102 years of experience and operations in Africa, Australia, Latin America, North America, and Papua New Guinea.

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

Newmont pays a quarterly dividend of $0.40 for a current yield of 4%. That’s not high enough for me, and the dividend was cut from last year’s 55 cents. At a minimum, I want to see NEM start raising the dividend and get closer to a 4.5‒5% yield.

-

A fund I’ve been following for a decade.

GAMCO Global Gold, Natural Resources & Income Trust (GGN) is a closed-ended mutual fund managed by Gabelli Funds. It invests 80% of its assets in equities and uses a covered call strategy. But, as its name suggests, this is not a pure gold play. There are other resource companies included as well.

GGN’s top holdings include Exxon (XOM) and Chevron (CVX), gold royalty company Franco-Nevada (FNV), and miners Wheaton (WPM), Newmont (NEM), and Freeport-McMoRan (FCX). You can see there’s some oil exposure in the fund.

The dividend has been declining since 2012 and is now just $0.03 per share paid monthly. However, shares are just $3.68, handing investors a 9.7% yield. One of the reasons I don’t like funds is because they hold a basket of stocks. I also don’t like to see two oil companies and a big chunk of cash in the top holdings. But, 9.7% isn’t nothing.

I’m not making an official recommendation on a gold pick. But if you have FOMO as gold continues to soar higher, these are two companies that you should take a look at.

For more income, now and in the future,

Kelly Green

Kelly Green

Kelly Green