The Best and Worst Piece of Investing Advice I’ve Ever Received

-

Kelly Green

Kelly Green

- |

- June 14, 2023

- |

- Comments

One of my favorite pieces of investing advice became the reason for many of my successes… but when followed too literally, it also fueled some of my biggest losses.

“Invest in companies that your mother could love, or at least understand.”

This had nothing to do with my actual mother. You could insert anyone who might not have an investing background. This is another way to say that you should know what the company does.

What good or service does the company provide? Is there consistent demand for that good or service? And how much of that demand does the company fulfill?

You might invest in a pharmaceutical company and not understand all the science behind it. But you should have an idea of the drugs it provides (and for which ailments) and the demand behind them.

We don’t know the secret recipe to Coca-Cola (KO), but more than 1.9 billion servings of the company’s drinks are consumed every day—or over 19,000 beverages every second!

This Is a Must for Bedrock Companies

By utilizing this simple concept, I’ve identified many companies that Yield Shark readers and I have been able to use to form the bedrock portion of our income portfolio.

These are companies that we can hold for years, even decades. They have a product that is used day after day.

Remember that when you buy a stock, you’re buying more than the three letters on the exchange. You are buying a piece of the company. That’s why earnings per share (EPS) is an important metric. It allows shareholders to see the piece of the earnings that belongs to one of their shares.

You wouldn’t go out and buy a physical business without understanding what it does. So, why would you buy a stock that you don’t understand in the same way?

This isn’t saying that you need to be an expert, but if you can’t explain what a company does to your mom in a few sentences, then it might not be a company worth your long-term investment.

|

The largest 500 American companies handed out a combined $561 billion last year in the form of dividends. Even better, this income keeps coming in no matter how their stocks are performing. Click here for instructions on how you can start collecting your own |

There’s More to a Good Investment

Now, “invest in companies that your mother could understand” becomes bad advice when you just stop at that. I’ll give you an example from my personal portfolio—a 96.8% loss.

It starts with a gluten-free pizza I found at Sam’s Club by Tattooed Chef (even the people without an allergy in my house thought it was pretty good).

Source: Sam's Club

Because of my allergy, we don’t do “convenience foods” often. However, we’d had a few different things from this brand and enjoyed them. There’s demand in the market for tasty gluten-free and plant-based offerings, especially ones the whole family will eat.

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

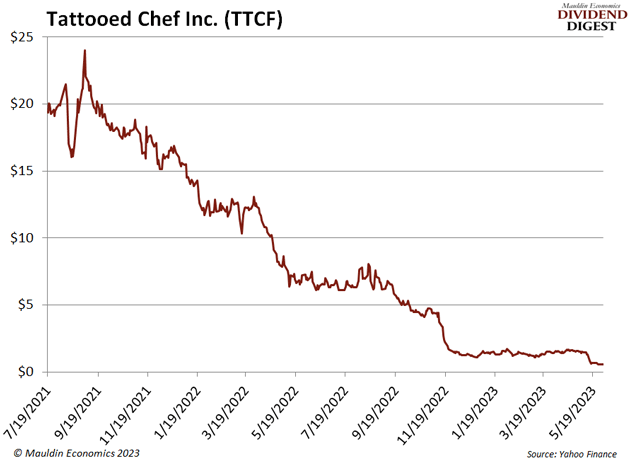

Here’s what has happened to the share price of Tattooed Chef Inc. (TTCF) since I bought in on July 19, 2021:

It’s not looking good for the 100 bucks or so that I initially invested. My brand loyalty got in the way—I twisted one of my favorite pieces of advice to justify holding these shares.

I still stand behind this piece of advice. But remember, any singular piece of advice is just a piece of the puzzle. Without solid financials and a competent management team, even a good product with loyal consumers won’t result in a strong investment.

Kelly Green

Tags

Suggested Reading...

|

|

Kelly Green

Kelly Green