The Great Tech Pivot of 2023

-

Kelly Green

Kelly Green

- |

- March 29, 2023

- |

- Comments

There are many reasons why I turn to income investing.

I like to see my Current Yield stocks pay me streams of income.

And I like to watch my Bedrock Income holdings grow exponentially as I reinvest the dividends.

But, maybe my favorite part of income investing is that I get to own companies found across all sectors of the economy.

Sure, certain types of companies lend themselves to dividend investing more than others.

Consumer staples companies are an obvious example. These companies sell products that people buy no matter what the economy is doing. And brand loyalty keeps them buying the names they know and trust despite inflation and house brand competitors.

Brands like Clorox (CLX), Procter & Gamble (PG), and Kimberly-Clark (KMB) all have massive portfolios. And although they spend money on advertising and R&D, they still earn sufficient profits to pay a decent dividend.

That’s not usually the case for tech companies.

Make Sure Your Tech Watchlist Is Up to Date

In tech, survival means staying ahead of the competition. And that requires continual innovation and money… lots of money. Instead of paying dividends, tech companies reinvest their profits back into the business.

The alternative is stale and outdated products. In a scenario like that, a company will be forced to cut its dividend and funnel more money into its business. As I mentioned a few weeks ago, that’s the situation Intel Corp. (INTC) faces right now. It cut its dividend 66% last month.

That being said, I’ll keep INTC on my watchlist. Despite its falling off the Dividend Aristocrat list, I want to see what its transformation will bring.

-

2023 will be an important year for tech.

It’s been a roller coaster for many tech companies since 2019. As I plowed through 2022 earnings calls, it was obvious that most are still adapting to a post-COVID new normal that does not yet exist.

This year, however, I think we’re finally going to see earnings numbers that better reflect the results of this transformation.

A solid dividend-paying tech company is not easy to find, so we have to keep our watchlist updated and be ready to act.

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

Semiconductor Stocks Are Integral to the Tech-Driven Future

If you look around your home, it might be easier to name the things that don’t contain a semiconductor component rather than those that do.

The supply and demand picture of this industry has been all over the place since the pandemic. Although the long-term outlook for semiconductors remains strong, there’s the potential for continued struggles throughout the year.

Knowing that, I’d love to have Taiwan Semiconductor (TSM), Texas Instruments Inc. (TXN), or NVIDIA Corp. (NVDA) in my portfolio if they paid a higher dividend yield. Their yields are currently 1.9%, 2.7%, and 0.06%, respectively.

Keep in mind that dividend yields can rise if stock prices drop. Keeping tech on my watchlist means I can watch for dividend increases or price drops that might put a company in my desired dividend rage.

Metals Make the Tech World Go Round

Lithium and copper might be two of the most important metals as the world moves into the era of decarbonization. Again, it might be easier to name the items in your house that aren’t impacted by these two metals.

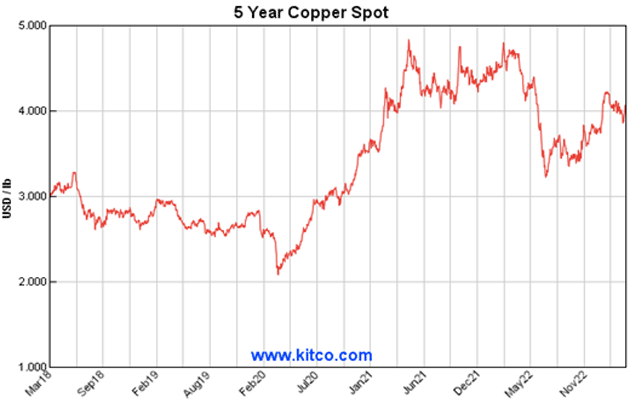

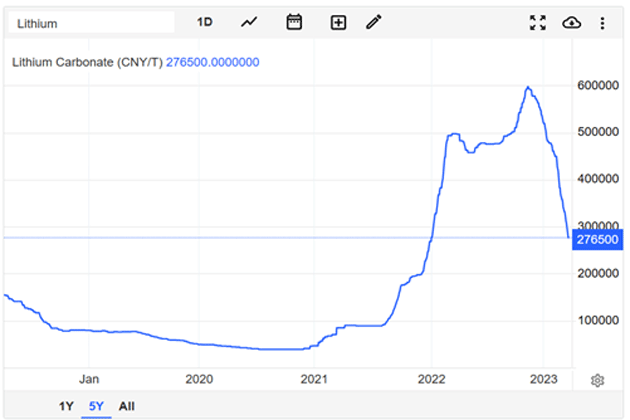

This will be an important year for both lithium and copper due to their wild price swings since 2019.

Copper started climbing from its March 2020 bottom to new highs in 2021. After it slid lower in 2022, I think we’ll start to see a “new normal” for copper prices this year, which I suspect will be between $3.50 and $4.

Source: Kitco

Lithium hit its price peak at the end of last year. Prices have plummeted 50% since then.

Source: Trading Economics

Price swings like those have a big impact on the profits of the companies that mine these metals. So when I add a miner to my watchlist, I look at what it costs them to mine each unit of metal versus the market price of that unit. Higher metals prices are always better, but we need to know the outlook for prices to better gauge future company profitability—and the dependability of its dividend.

In my Yield Shark portfolio, I add tech companies when there is the opportunity.

Right now, I have some copper-based dividends, a more speculative semiconductor play, and a tech giant that just emerged from a true transformational period.

I added that last one to the portfolio just yesterday.

It’s my favorite tech company right now because it’s focused on two of the biggest trends in 2023: AI and the hybrid cloud. What’s even better is this Current Yield play has the potential to pay out rising dividends for years… if not decades to come.

If you haven’t checked out my premium service Yield Shark, you can try it today with a 30-day, 100% money-back guarantee. All you have to do is click here to sign up.

For more income, now and in the future,

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

Kelly Green

Kelly Green

Kelly Green