The Motivating Power of Dividend Investing

-

Kelly Green

Kelly Green

- |

- April 19, 2023

- |

- Comments

Last Thursday, I woke up early and braved the flooding in Ft. Lauderdale, Florida. I was grateful to have a pickup truck as I drove through a foot of water near the Broward County Convention Center.

Over the course of the day, I got to see a variety of speakers, including Bethenny Frankel and the “Wolf of Wall Street,” Jordan Belfort. But the original reason I bought a ticket was to hear Marcus Lemonis.

If you’re not familiar with Marcus, he’s an entrepreneur and television personality. He’s also the CEO of Camping World Holdings, Inc. (CWH). This dividend-paying stock is currently on my watch list, but I do think we will see a dividend cut in 2023. But that’s a longer story for a different day.

One of the things that set Marcus apart from his fellow speakers was that he didn’t ever get on stage. Instead, he walked among the audience, creating an interactive experience based on two main themes:

-

We’re all motivated by something. It’s important to know why we get out of bed every morning and do the things that we do.

-

Sharing creates a strong bond between people.

So, today, I’d like to take a quick moment and explain my motivation for investing in dividends and, more important, my motivation for writing to you each week.

In exchange, I’d like to hear about your motivation for investing, for reading Dividend Digest or Yield Shark, or even just why you get out of bed every morning and do the things that you do.

Feel free to contact me through our customer service team at subscribers@mauldineconomics.com. Or reach out directly on Twitter, LinkedIn, or even Instagram.

Dividend Investing Immediately Hooked Me

After graduating with a degree in economics, I got recruited by a large insurance and investing firm. I passed my Series 7 and 66 licenses at the naïve age of 20 and was ready to go out and help people achieve their investing goals.

I quickly discovered that the insurance products and funds I was supposed to be peddling didn’t sit right with me. I wouldn’t understand exactly why until a handful of years later.

So, I handed in my resignation and took a long-term substitute position at the local high school teaching algebra. Fast-forward eight months and a temp agency asked me to complete a writing sample about any dividend-paying stock.

I picked Caterpillar Inc. (CAT) based on a suggestion by my dad who worked at a local branch. This still cracks me up to this day because I would need to see its current yield double to ever take another look at the company.

Anyway, I had no idea that this writing sample would change my life.

Over the next year, I progressed from temp to associate editor to co-editor of an income-investing newsletter at one of the biggest financial publishers at the time.

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

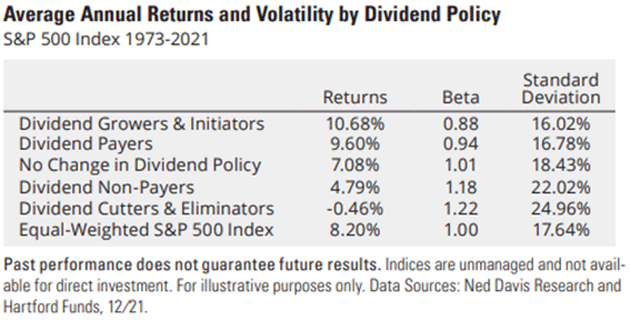

Source: Hartford Funds

I saw real-life examples of the power of compounding. And I read testimonials of readers taking our advice and making real money. That was the key motivator for what would turn into my career.

Don’t Sacrifice Your Wealth

A study last year, published in the Journal of Financial Economics, showed that the percentage of US equity mutual funds that have outperformed the S&P 500 over the last 30 years has decreased substantially over time.

It looked at the returns of more than 7,800 US stock mutual funds from 1991–2020. And it measured those returns against a market-matching ETF and the total US stock market.

On average, only 46% of funds outperformed over monthly horizons. Over a yearly period, only 38% beat the market, and just 34% outperformed over decades-long horizons. A mere 24% of funds beat the market for their full history.

Two reasons for this are:

-

The typical fund charges a bit over 1% and returns an average of just 7.7% annually over three decades.

-

The nature of funds is “buy high and sell low.” Fund managers tend to be inundated with cash when stocks have already risen and are forced to sell stocks after a decline.

This resulted in investors sacrificing $1.02 trillion in wealth by investing in funds instead of tracking the S&P 500 Index.

We know that dividend investing outperforms the S&P 500 Index. And since most brokers have gone commission-free, we don’t have the issue of fees eating at those returns.

Controlling Your Money Is a Powerful Thing

Since 2011, I’ve been in this industry in a variety of roles: editor, researcher, analyst, writer…

My motivation for getting up every day and working in financial publishing has always been the reader. This medium allows me to educate and help you in a way that I couldn’t in previous roles.

I’m able to control my money through dividend investing, and I’m grateful to be able to share that power with you.

Again, I’d like to hear about your motivation for investing and why you read Dividend Digest or Yield Shark. So, drop me an email or contact me through your favorite platform: Twitter, LinkedIn, or Instagram.

For more income now and in the future,

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

Kelly Green

Kelly Green