The Secret to Amassing Long-Haul Wealth

-

Kelly Green

Kelly Green

- |

- April 12, 2023

- |

- Comments

There are a finite number of things you can do with your money.

If you want to earn yield on your money, there are even fewer options, such as dividend stocks, bonds, and certificates of deposit (CDs).

When interest rates hovered around zero, many safe bonds, savings accounts, and even CDs didn’t have interest rates worth a second look. Dividends were really the only choice for yields worth your time and money.

However, the Fed’s aggressive rate hikes have changed everything. There are now more viable options.

Treasuries and Different Maturities

One example is Treasury securities. Since they are backed by the US government, they’re considered one of the safest places to put your money. But unless the yield is at least 3.5%, they can’t compete with safe dividend stocks.

If you’re unfamiliar with Treasuries, they come in three different types based on maturity:

-

Treasury bills come in maturities that are one year or less.

-

Treasury notes have maturities of two, three, five, six, seven, or 10 years.

-

Treasury bonds are the longest-term and mature in 20 or 30 years.

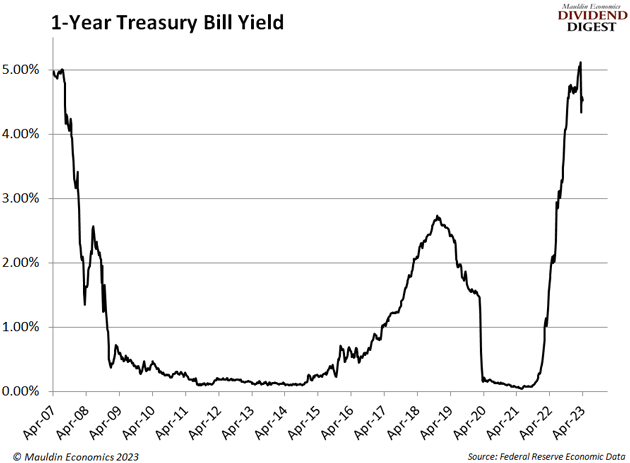

I’ve been hearing the most about Treasury bills because a Treasury bill with a one-year maturity currently yields 4.6%.

That’s the highest yield since 2007! And unlike a CD, your money is only tied up for one year.

Comparing that 4.6% to the 1.6% dividend yield of the S&P 500 makes it look like a no-brainer.

But should you move some of your “earmarked” income money over to a Treasury bill? I’m still not convinced.

Stick with the World’s Richest

American industrialist John D. Rockefeller could have bought anything he wanted. And what he valued most were his stock dividends.

Think about that: Even the richest American ever enjoyed ripping open an envelope to find a fat dividend check.

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

Even the father of modern investing, Benjamin Graham, advised investors to concentrate on the dividends that companies paid.

I know one thing: If my net worth reaches even a fraction of Rockefeller’s, Buffett’s, or Graham’s, I’ll be doing just fine.

But there’s more to it than the current yield…

All three businessmen didn’t just value dividends; they also valued longer-term holdings and used the power of compounding.

You can’t do this easily with Treasury securities. With a stock, it’s a simple checkbox in your brokerage account. With Treasuries, we can almost guarantee that our yield won’t continue to rise for decades or even years.

13 Stocks Marked “Buy” That Pay Over 5%

There are over 45 companies that have achieved the title of Dividend King, which means they have increased their dividend for each of the past 50 consecutive years.

These could continue to increase for our entire lifetimes. The Fed funds rate, however, cannot.

Remember, since 1980, 84% of the total return of the S&P 500 Index came from reinvested dividends and the power of compounding. They are the “boring” secret to amassing long-haul wealth.

If that’s your goal, find solid dividend-paying stocks. Then set it, forget it, and let compounding do the rest.

If you have some short-term savings that you want to park somewhere for a few weeks or months, make sure you’re looking at Treasury bills. The minimum to buy is just $100, and your money will be tied up for a shorter period than a CD.

It’s all going to depend on your goals. My goal for Yield Shark is all about income. These are opportunities that will pay for at least the next few years… some of them for the next few decades.

There are currently 13 stocks marked “buy” in the Yield Shark portfolio that pay over 5%. So, if you want your money to outpace inflation, I recommend trying the 2023 Second Income Challenge.

Click here to get started… because now is the time to lean on stability and income.

For more income now and in the future,

Like what you're reading?

Get this free newsletter in your inbox every Wednesday! Read our privacy policy here.

Kelly Green

Kelly Green