0% in 30 Years?! This Shocking Statistic Reaffirms Our Approach

-

Thompson Clark

Thompson Clark

- |

- Smart Money Monday

- |

- November 7, 2022

I recently learned a shocking statistic…

I didn’t believe it at first.

But sure enough, after looking into the data, it’s true.

Investors in the largest Chinese ETF have seen no positive return in 30 years.

The MSCI China Index was formed by index provider MSCI in 1995. The index includes back-tested data going back to 1992.

And since 1992, the total return for investors today is a whopping 0%.

Source: Twitter

Zero percent. In 30 years! That’s insane, especially when you compare it to China’s economic growth as defined by gross domestic product (GDP).

China’s GDP has climbed from $420 billion to $17.7 trillion over that time frame—a 4,000% increase, or 13% per year for 30 years.

Now, as I wrote last week, even the greatest business in the world will make for a poor investment if you overpay.

The same goes for themes. And the China theme is one of the greatest in a century: a massive population of people rising out of poverty into the middle class.

Yet many investors dramatically overpaid for exposure to it, resulting in poor returns.

|

Your chance to escape the recession is HERE... |

The Other Problem with China

The China theme—massive GDP growth, a huge population, and industrialization of an economy—is a good one. But it also poses a serious risk that developed market investors are not used to…

Property rights.

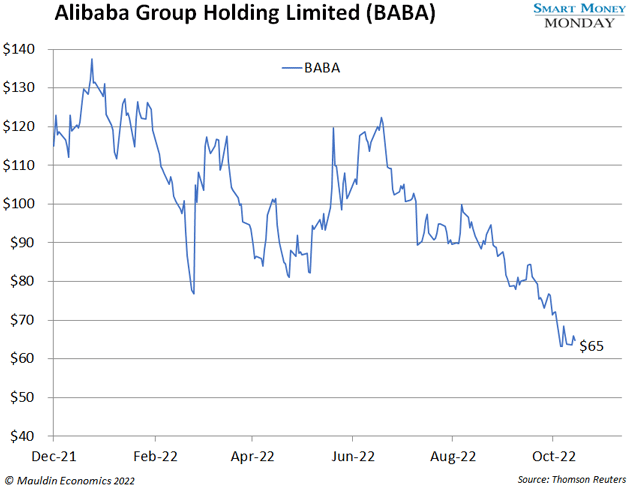

I warned about this issue last year when I passed on Alibaba (BABA). At the time, the stock had fallen 50% and was trading around $120 per share.

Like what you're reading?

Get this free newsletter in your inbox every Monday! Read our privacy policy here.

BABA has continued to fall since then. It’s now down another 50% to $66 per share since I warned about it.

The problem hasn’t gone away, as no one really owns anything in China. If you think you do, the government can take it away at a moment’s notice.

Turning Our Spotlight Elsewhere

China remains a pass. Property rights and stable economic conditions matter. Again, it’s something Western investors take for granted.

But the demographic and development theme is still an interesting one that I’d rather play through another massive country: India.

I wrote about India last August, which you can revisit here.

India’s prime minister, Narendra Modi, has done all the right things to drive growth in India:

-

He cut the corporate tax rate.

-

He privatized government-owned companies.

-

He has a general pro-business stance.

For India exposure, my recommendation remains the same—and that’s through buying Fairfax Financial Holdings (FRFHF).

Fairfax is a Canadian insurance conglomerate run by Prem Watsa, the Warren Buffett of Canada.

Fairfax owns interesting assets in India. It also owns a large stake in Fairfax India Holdings (FFXDF), which is its own publicly listed company full of quality Indian companies.

Since its inception in 1994, the MSCI India Index is up 400%. It likely still has room to run.

Thanks for reading,

Like what you're reading?

Get this free newsletter in your inbox every Monday! Read our privacy policy here.

Editor, Smart Money Monday

Thompson Clark

Thompson Clark