America’s Top CEO Calls This Emerging Market a “No-Brainer”

-

Thompson Clark

Thompson Clark

- |

- Smart Money Monday

- |

- September 12, 2022

When Jamie Dimon speaks, it pays to listen.

Dimon is the billionaire CEO of JPMorgan Chase & Co. (JPM), the largest US bank. Many credit him with more or less inventing the “megabank.” And he’s made a fortune for himself and his clients in the process.

Now he’s setting his sights on… Mexico.

Here’s Dimon on a recent client call:

I think Mexico is going to be a great set up. I bought a Mexican ETF. Did you know their labor is cheaper in Mexico than in China? And it is a secured supply chain. If you are a manufacturer, it is a no-brainer.

-

For decades, the US has relied on China for cheap goods.

There’s a good chance a Chinese manufacturer made the cell phone in your pocket, or the new bike you bought your kid, or the chair you’re sitting on. Millions of Americans can buy, buy, buy because cheap labor in China keeps the costs of many products down.

Lately, though, that’s been a bit of a problem. When the pandemic hit, China’s zero-COVID policy made it impossible to move products out of the country in a timely, reliable fashion. Anyone who tried to buy a bike in 2020 could tell you that.

All those supply chain issues have pushed US companies to look elsewhere…

-

Now Mexico is emerging as a manufacturing hotspot.

Mexico’s labor costs are the main driver here. As Dimon mentioned, labor is now cheaper there than China.

A 2020 PricewaterhouseCoopers study showed that manufacturing in Mexico could lower a company’s operating costs by up to 25%. Meanwhile, market research firm Statista pegs manufacturing labor costs in China at $6.50 per hour. In Mexico, it’s $4.82.

Those are compelling discounts. And they become more compelling when you layer in the cheaper cost of moving goods to the US.

Getting anything here from China involves variable shipping costs and potential delays. Then, when the goods arrive at the Port of Long Beach, you still need to transport a lot of it thousands of miles across the country.

When you make something in Mexico, you just plunk it on a railcar and send it up the line.

-

Cheaper energy costs give Mexico another leg up.

Like what you're reading?

Get this free newsletter in your inbox every Monday! Read our privacy policy here.

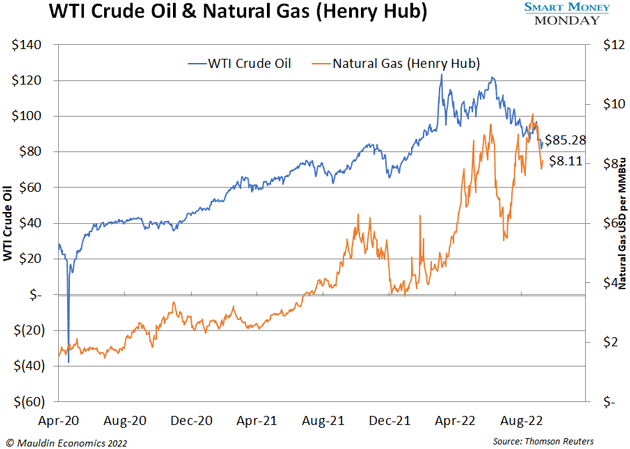

Regular readers know I expect energy prices to stay high. This puts Chinese manufacturing in a tough spot. Oil and gas are just more expensive there.

Most of China’s oil production comes from legacy oil fields that are expensive to maintain, according to the Energy Information Administration. Plus, natural gas can cost 50% to 170% more in China than it does in Mexico, according to Mexican advisory firm NAPS. That’s because Mexico is close to the US, one of the largest natural gas producers in the world.

In short, Mexico has a stable supply of lower-cost energy. That makes it an ideal place for cost-effective manufacturing.

|

Find out what’s really going on in the US and global economies, stock markets, and geopolitical landscape from the best and brightest in the business. Click here to read how to do just that for only $9.95 per month. |

-

Plus, Mexico isn’t going to force manufacturers into lockdowns.

In China, if one person gets COVID, an entire city could shut down.

That’s basically what happened earlier this year. The government locked down Shanghai for two months (long after most countries had moved to more nuanced COVID policies). The lockdown impacted almost all of Shanghai’s 25 million residents. And, since Shanghai boasts the world’s biggest port, it triggered supply chain disruptions that reverberated worldwide.

Mexico, on the other hand, has taken a different approach. President Andrés Manuel López Obrador has resisted any sort of lockdown since 2020. He’s also criticized strict policies in Europe, stating that politicians “have to guarantee freedom.”

And Obrador hasn’t wavered. Mexico has stayed open for business.

For manufacturers, that’s huge. They can hire workers and produce goods without the uncertainty and added costs of lockdowns.

-

One way to play the rise of Mexican manufacturing is to buy a Mexican ETF.

I’m a stock picker, so I normally avoid ETFs. But in this case, with Dimon leading the way, it’s worth a look.

The iShares MSCI Mexico ETF (EWW) seems like a strong bet. The fund owns nearly 50 Mexican companies, including Walmart de México y Centroamérica and Banorte, one of the largest banks in Mexico.

I’m adding EWW to my watchlist for now while I dig into other ways to play this theme.

Mexico is likely in the early stages of a manufacturing heyday. As this story progresses, the opportunities for us to invest in Mexico should as well.

Like what you're reading?

Get this free newsletter in your inbox every Monday! Read our privacy policy here.

—Thompson Clark

Editor, Smart Money Monday

Thompson Clark

Thompson Clark