An Inside Look at What Oil Execs Really Think

-

Thompson Clark

Thompson Clark

- |

- Smart Money Monday

- |

- August 1, 2022

Oil execs are walking on eggshells.

They’re being attacked for “price gouging” at the pump...

“Sitting on record profits”...

“Destroying the planet”...

The list goes on.

And all this backlash means oil execs have to be extremely careful about what they say and do in public.

They can’t be direct and blunt—it would give their detractors more ammunition!

Fortunately, we have an excellent, unfiltered source of information that reveals what these execs really think.

That’s important because not only are their thoughts very telling...

I believe it’s further proof that we’re still in the early innings of a multi-year rally in energy stocks.

Let me explain why... and share my top way to cash in.

|

Inflation is spiking to new 40-year highs, and the dollar’s purchasing power is being devastated. The good news? This one overlooked area of your portfolio could help you outpace inflation and safeguard your money. |

-

Here’s what top energy executives are saying...

Remember: You won’t get the full energy story by turning on CNBC...

But you will by turning to the Dallas Fed.

Like what you're reading?

Get this free newsletter in your inbox every Monday! Read our privacy policy here.

The survey’s anonymous...

Which means these execs can say how they truly feel, giving us a clear picture.

Here were some of the top quotes in the second-quarter 2022 survey:

“The government's anti-oil, anti-gas, and anti-pipeline stance has caused us to not pursue expansive projects.”

“The country’s energy policy is on the wrong path. Picking wind and solar and going faster in this direction is a mistake. The country should embrace domestic oil and gas.”

“Politics are affecting our business, with both sides pushing ridiculous agendas with no management or understanding at all.”

These executives are calling it like they see it.

And their views aren’t hard to grasp. It’s common sense. Unfortunately, common sense just isn’t that common these days.

-

Regular Smart Money Monday readers know I’ve been pounding the table on energy stocks since October.

There are two main reasons.

The first is government stupidity.

The consensus is that we don’t need fossil fuels anymore.

But that couldn’t be further from the truth.

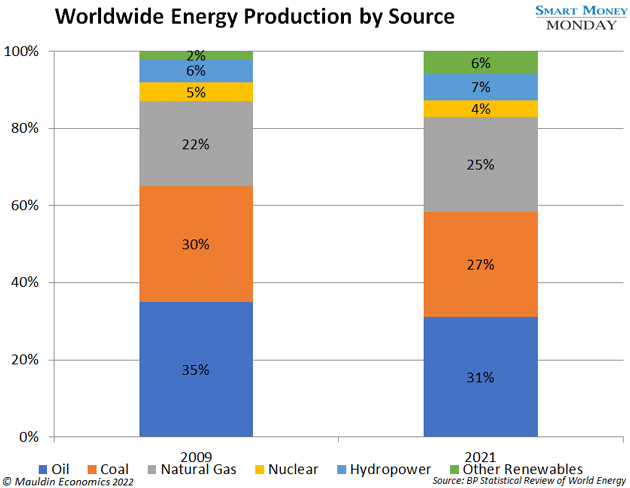

Today, 83% of the world’s energy supply still comes from oil, gas, and coal. That number has barely budged in over a decade.

This “green” future everyone talks about is still a long way away.

Just look at the US electric vehicle (EV) market. There are 1.5 million registered EVs compared to 289 million registered cars. Meaning EVs make up less than 1% of vehicles on the road.

Even if EVs grew to 5% of the market, it wouldn’t dampen oil demand by much. In fact, the International Energy Agency doesn’t expect global oil demand to peak until 2030.

Weeks after his inauguration, Biden took action against the energy industry... pushing a ban on new drilling leases for oil and gas on public lands and offshore waters.

Like what you're reading?

Get this free newsletter in your inbox every Monday! Read our privacy policy here.

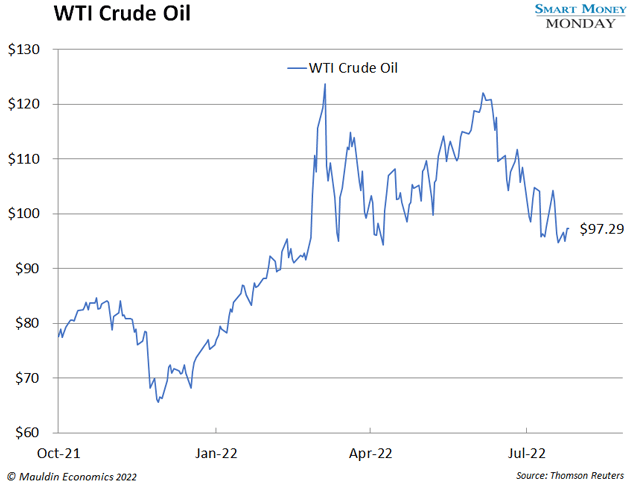

Since my essay in October, the price of oil has climbed 25%.

Next, I’m looking at what the energy management teams are doing.

During the last energy bear market, energy firms plowed money into exploration and production.

Investors, management teams, and banks all got burned. Many companies borrowed billions they couldn’t pay back... and ultimately went bankrupt.

But now, management teams have completely changed their spending habits.

They’re returning cash to shareholders through dividends and share buybacks.

Oil majors like BP (BP), ExxonMobil (XOM), and Chevron (CVX) plan to spend $38–$41 billion on buybacks this year, according to the Financial Times.

-

It’s not too late to profit off the energy boom...

In October, I recommended Chevron, ExxonMobil, Chesapeake Energy (CHK), and BP as smart ways to play this trend.

BP has been flat while the other three have risen 40‒50% each. Congrats on a nice call if you took advantage.

I believe this run is just getting started... And one of my favorite energy stocks today is Ovintiv (OVV), which I first recommended to Smart Money Monday readers in June. I own shares and continue to like what I see with the company. It’s profitable. It has a clean balance sheet. And it’s returning cash to shareholders.

It’s also extraordinarily cheap at 4 times 2023 earnings per share.

Lastly, I expect Ovintiv to be included in the S&P 500 soon, which should provide a nice boost to the stock.

Thanks for reading,

Like what you're reading?

Get this free newsletter in your inbox every Monday! Read our privacy policy here.

Editor, Smart Money Monday

Thompson Clark

Thompson Clark