These Cruise Ship Dividends Are Cruising for a Bruising

- Robert Ross

- |

- The Weekly Profit

- |

- April 8, 2020

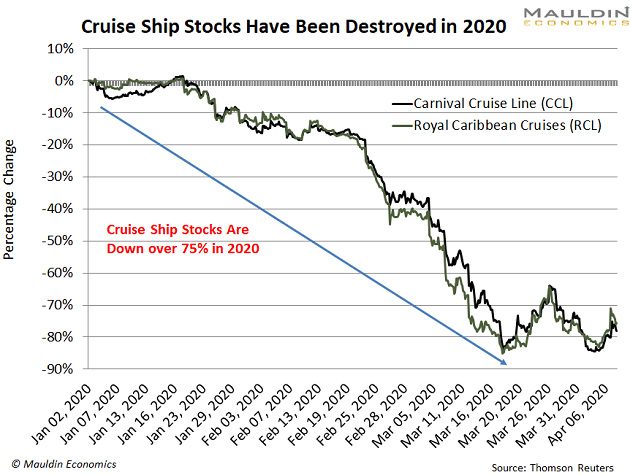

The S&P 500 Index is down 27% in 2020. Except for a handful of essential businesses, most stocks and sectors are deep in the red.

But no sector has fared worse than the cruise line industry, which has shut down until at least mid-April because of the coronavirus pandemic.

[Have you taken up my publisher Ed D'Agostino on his offer for a FREE three-month membership in our Healthy Returns investment advisory? Our biotech research team just released a bulletin about social distancing’s role in past pandemics. Next up, they are reviewing currently available coronavirus treatments PLUS the companies that could make medical history … and soon. You can only get this valuable information in Healthy Returns. Don’t miss out; click here now to activate your complimentary subscription.]

With passengers getting sick—and some dying—aboard these ships, it’s no wonder why cruise operators are having their worst year on record. And with the US Coast Guard directing passenger ships to remain at sea “indefinitely,” the bad press continues to mount for these companies.

To add insult to injury, cruise lines were excluded from the $2.2 trillion Coronavirus Aid, Relief, and Economic Security (CARES) Act.

So unlike airlines, which asked the government for a $50 billion bailout, the cruise industry is on its own.

This has crushed the stock prices across the entire industry. But it’s also sent bargain hunters on an expedition for low prices on the two largest cruise line stocks, Carnival Cruise Line (CCL) and Royal Caribbean Cruises (RCL).

The share prices for these two companies are down an average of 83% in 2020:

That’s more than triple the S&P 500 decline for the year.

But what’s interesting is the dividend yields for many of these companies have surged.

Can They Keep These Lofty Dividends Afloat?

When companies have cash left over after factoring in expenses, they often return a chunk of that cash to shareholders as cash payments, or dividends.

The dividend yield for a company is found by taking the annual dividend paid divided by the share price.

Let’s say Company A paid $2 in dividends in 2019. The stock trades for $100.

That means Company A has a dividend yield of 2% (i.e., $2 in dividends / $100 share price).

But now let’s assume Company A’s stock price falls 50%. Now the stock is worth $50.

Because the company paid a dividend of $2, the dividend yield is now 4%. ($2 in dividends / $50 share price.)

If the company can meet its dividend payment, that’s great news for dividend investors.

But more likely, companies will cut their dividends when the yield gets too high.

|

No Party Here: This Company Just Suspended Its 23.5% Dividend

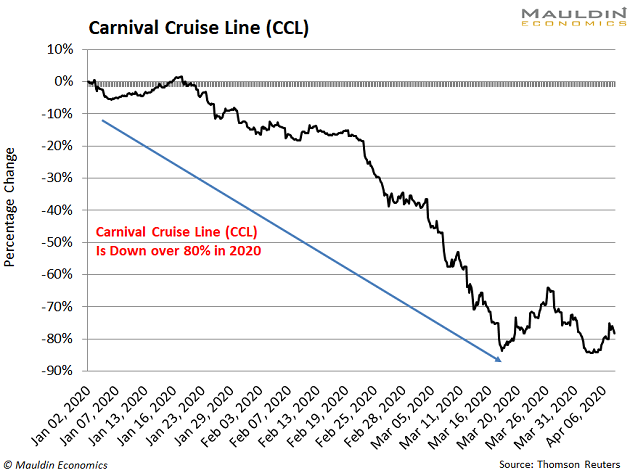

In the last 12 months, Carnival Cruise Line (CCL) had paid $2 per share in dividends.

This was a stable dividend a year ago. Back then, the company’s stock was trading at $50 per share. That means the dividend yield was 4%. (For reference, that’s about two times the S&P 500 dividend yield of 1.9%.)

But that all changed in 2020. The stock price is down over 80% this year.

With the stock trading at $8.50 per share, that means the company’s dividend yield ballooned to 23.5%!

That kind of payout is hard to maintain. No wonder Carnival’s management suspended their dividend last week.

Meanwhile, Royal Caribbean is still paying a double-digit dividend yield. For now, at least.

The Best Way to Tell if a Dividend Can Keep Cruising Along

Double-digit dividend yields are generally unsafe. But a 23.5% dividend yield like Carnival’s is always unsafe.

A tried-and-true way to tell if a dividend is safe is to look at a company’s payout ratio.

The payout ratio is the percentage of net income a company pays to shareholders as dividends. The lower the payout ratio, the safer the dividend payment.

When a company’s dividend rises faster than its earnings, the payout ratio rises.

As a rule of thumb, a payout ratio over 80% is usually not sustainable.

But in Carnival’s case, the payout ratio would be in the quadruple digits.

Royal Caribbean Is Next on the Dividend Chopping Block

In the last 12 months, the company has paid $2.96 in dividends. With a share price of $24, that means the company has a 12.8% dividend yield.

Since I expect cruise line earnings to fall 80% in 2020, that means the company will earn an estimated 2020 profit of $1.80 per share.

That would leave the company with a payout ratio of 164%.

Based on my 80% payout ratio rule, I’d be surprised if RCL does not cut its dividend in the next few months.

But just to make sure, I went one step further. I plugged RCL’s data into my Dividend Sustainability Index (DSI).

The DSI looks at payout ratio, debt levels, free cash flow, and a host of other factors to see if the dividend is safe.

Readers of my premium investing service Yield Shark are very familiar with the DSI. Every recommendation I make must pass this test. If it doesn’t, I won’t recommend it to my subscribers.

So far, not one has had its dividend cut in the five years I’ve served as analyst and editor.

And according to my index, the probability that RCL cuts their dividend is 95%.

If you’re a safe investor like me, you want to avoid RCL like the plague.

Even though cruise line dividends are completely unsafe, I have another company that’s a solid dividend payer. With a payout ratio of 40% and 32 years of increasing dividends, it doesn’t get much safer than this company.

But like all my best ideas, I have to save them for readers of my premium investing service In the Money. If you want to try In the Money risk-free for 30 days, click here.

Robert Ross