These Three Bond Funds (and Those Who Own Them) Are in for a Rude Awakening

- Robert Ross

- |

- The Weekly Profit

- |

- December 19, 2018

And this couldn’t come at a worse time.

Conventional investing wisdom says owning bonds will protect your portfolio when the market drops.

And the market has certainly been dropping. The S&P 500 is down 9% since October.

I would bet that many folks have shifted money out of stocks and into bonds over the last two months.

Much of that money has flowed into investment-grade corporate bonds.

These bonds are traditionally seen as some of the safest bonds investors can buy.

But investment-grade doesn’t mean what it used to.

Corporate Bond Quality Is Plunging

The quality of investment-grade corporate bonds has crumbled over the last decade.

These bonds are rated by credit agencies like Moody’s, S&P, and Fitch. A bond is considered investment-grade if it’s rated between AAA and BBB-.

The closer to triple-A, the safer the bond.

But according to Morgan Stanley, the US has been flooded with BBB-rated bonds.

In just the last 10 years, the triple-B bond market has exploded from $686 billion to $2.5 trillion—an all-time high.

To put that in perspective, 50% of the investment-grade bond market now sits on the lowest rung of the quality ladder.

And there’s a reason BBB-rated debt is so plentiful.

It All Comes Back to Incentives…

Companies have been binging on cheap credit for years.

Ultra-low interest rates have seduced companies to pile into the bond market.

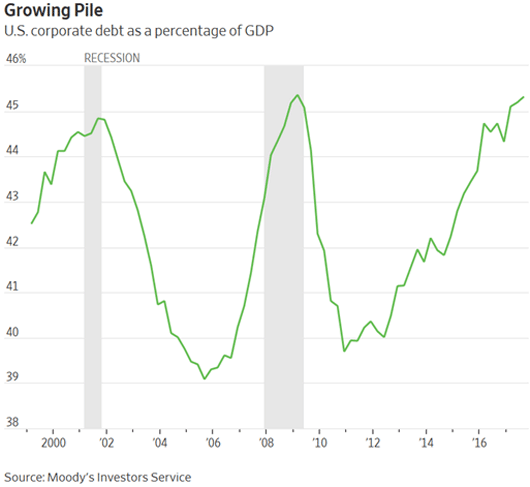

Corporate debt has surged to heights not seen since the Global Financial Crisis:

Source: Wall Street Journal

But as we’ve covered here in The Weekly Profit, interest rates are on the rise.

Higher interest rates make investment-grade corporate bonds less attractive. This is especially true for the lower tiers such as BBB-rated bonds.

That’s how the bond market works. Bonds sold today with a higher interest rate make yesterday’s lower-rate bonds lose value. So, higher-rate bonds are a better deal for investors.

And that’s bad news for the companies issuing these bonds.

BBB-Rated Bonds Have a Target on Their Backs…

In a recession, BBB-rated bonds are the most vulnerable of all investment-grade bonds.

According to Moody’s, 10% of BBB-rated corporate bonds become what’s known in the industry as “fallen angels” in a recession.

That’s a tactful way of saying they’ve been downgraded to “junk” status.

Since the number of BBB-rated bonds has exploded, we will see more fallen angels than ever before during the next recession.

And when that happens, investors that own a basket of bonds in an index fund are going to get hurt.

When Index Investing Goes Wrong…

When a bond’s rating is slashed from investment-grade to junk, it gets automatically kicked out of any investment-grade indexes.

That will cause the price of passively-managed investment-grade bond funds to tumble. See, these funds will be forced to sell these junk bonds after their prices have been slashed.

We’re about to see this happen with General Electric (GE). The struggling company is rated BBB+ by S&P—just two notches above junk status.

The stock keeps hitting new lows, and I expect to see General Electric get downgraded to junk in 2019.

If we see a wave of corporate downgrades, corporate bond funds holding near-junk-level bonds will get crushed as they’re forced to sell at bargain-basement prices.

Hit “Sell” if These ETFs Are in Your Portfolio…

My goal is to find the safest yields for my readers. Whether it’s dividend-paying stocks, business development companies, or even gold stocks, I want my readers buying the safest investments possible.

Today, investment-grade corporate bond ETFs are anything but safe.

Of the major investment-grade corporate bond funds, the Vanguard Intermediate-Term Corporate Bond ETF (VCIT) is the riskiest to own.

This $18-billion fund yields 3.6% but has a dangerous mix of assets.

VCIT has 65% of its assets in bonds rated BBB or lower. If we see a big spike in downgrades to investment-grade bonds, this fund will get hit hard.

Next in line is the Invesco BulletShares 2022 Corporate Bond ETF (BSCM).

This $1-billion fund yields a low 2.8% and 49% of its bonds are rated BBB.

Even worse, the fund holds three bonds of soon-to-be-junk General Electric.

Lastly, we have FlexShares Credit-Scored US Corporate Bond ETF (SKOR).

This small fund yields 2.9% and has $100 million in assets. But 64% of the ETF’s assets are in bonds rated BBB or lower.

As interest rates rise, I think we’ll see a wave of bond downgrades, and these funds will take the brunt of the downturn.

Now is the time to sell these funds before it’s too late.