Disruptor Stocks Are Dead

-

Thompson Clark

Thompson Clark

- |

- Smart Money Monday

- |

- May 16, 2022

Investors are in a pickle.

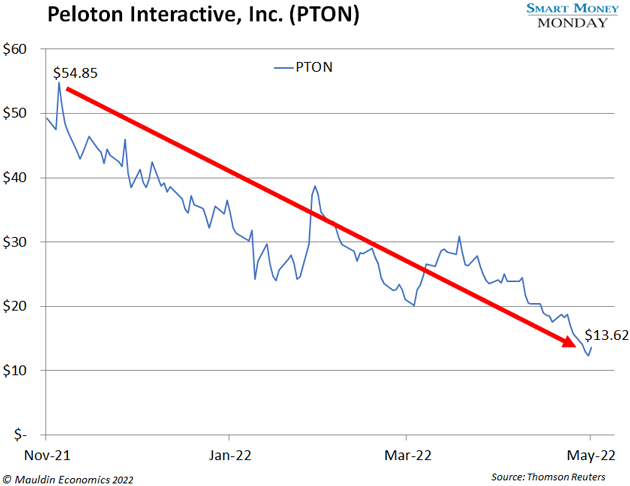

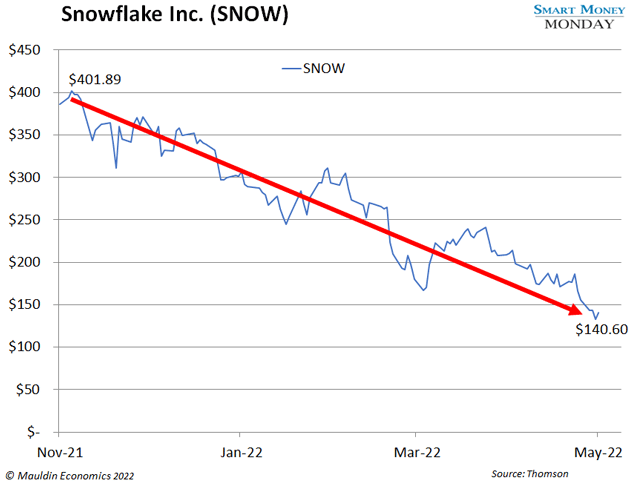

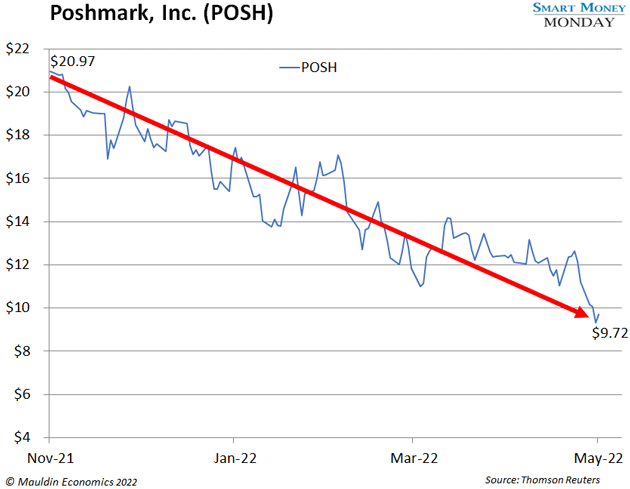

Say you loaded up on tech “disruptor” stocks in 2020 and early 2021. Stocks like Peloton (PTON), which was supposed to disrupt the way we exercise. Or cloud computing disruptor Snowflake (SNOW). Or ecommerce disruptor Poshmark (POSH).

For a while there, things were going great. From January 2020 to its peak, Peloton soared 463%.

|

[Video Exclusive] Years in the making. I'm releasing a list of 585 stocks that ran for more than 100% returns last year, and lifting the lid on the market’s most overlooked trend. |

Then it all came crashing down. In the past six months, the tech-heavy Nasdaq 100 has sunk 26%. And many tech disruptors have fared much worse.

Peloton has sunk 75%.

Snowflake has sunk 65%.

And Poshmark has sunk 54%.

If you still own these kinds of tech disruptors, it’s time to ask yourself…

-

“Do I sell now or hold on?”

There’s a simple way to answer that question. First, check if the company makes money. If it’s profitable, there’s a chance the stock might recover. If it’s not, you should consider selling.

I know—taking a loss feels terrible. People experience more pain over losses than pleasure from gains of the same size. Psychologists call this “loss aversion,” and it comes from being, well, human.

But if you keep some simple facts in mind, you can override your impulse to hold on, minimize your losses, and maximize your overall profits. Feel free to print this out or jot it down on a Post-It and slap it on your computer.

➤If you’re down 50%, you need the stock to double just to break even.

➤If you’re down 67%, you need the stock to triple to break even.

➤If you’re down 90%, you need the stock to soar 10X to break even.

In your experience, how often does that really happen with companies that don’t turn a profit?

-

The dot-com bust provides some telling examples…

Like what you're reading?

Get this free newsletter in your inbox every Monday! Read our privacy policy here.

Sure, others survived. Everyone points to Amazon (AMZN), which fell 80% during the dot-com bust and went on to skyrocket 35,722% from its 2001 low. But few companies will ever match Amazon.

It’s far more likely you’re sitting on a company like tech conglomerate Cisco Systems, Inc. (CSCO). It’s a good company. And yet, the stock is still trading 17% below its 2000 high of $80.06. If you bought at or near the top, 22 years later, you’re still underwater.

Do not make a similar mistake this go ’round.

-

The market is fundamentally shifting…

The speculative fever of 2020 and early 2021 is over. Companies are no longer going public at crazy valuations—no one wants to pour money into an oat milk maker or space travel company with big plans to make money 10 years down the road.

That said, the market is still in the “sell everything” phase of this paradigm shift. However, as the dust settles, you’re going to want to own companies that make money now—not companies with big plans to become profitable someday.

-

If you’re down 50%+ on an unprofitable company, consider selling it and buying a quality, profitable company that’s on sale instead.

Chevron (CVX) is a good example. It’s trading for a reasonable 15 times earnings. And, as I mentioned last week, billionaire Warren Buffett is buying shares hand over fist.

Or you could buy Starbucks (SBUX) at 20 times earnings. Founder Howard Schultz returned as CEO last month. This should serve as a positive catalyst for the stock. Starbucks is an incredible, high-quality business, and the stock is on sale.

Or you could buy my favorite bank stock, First Citizens (FCNCA). I first recommended it in February, and I own shares myself. This top 20 bank is still very cheap, and it has a lot of growth ahead as it digests its recent acquisition of CIT Group.

The market has taken the good down with the bad. But eventually, the good will recover. Now is your opportunity to get out of money-losing companies and redirect your capital into quality businesses.

The days of highflying, speculative tech is over. Investors want to own companies that make money now. As for those with plans to turn a profit in 5, 10, or 15 years, I don’t think they will bounce back to their previous highs.

—Thompson Clark

Editor, Smart Money Monday

Thompson Clark

Thompson Clark