Hedge Against Coronavirus Panic with These Safe 8%+ Yields

- Robert Ross

- |

- The Weekly Profit

- |

- February 26, 2020

Did your portfolio get crushed on Monday?

You’re not alone.

But I’m 100% sure you would’ve fared much better—and maybe even finished in the green—if you held something called alternative assets.

It’s a catch-all term for anything other than stocks, bonds, and cash.

We talk about some of the most common alternative assets, real estate and physical precious metals, quite a bit here. But there’s a high-yield alternative asset that you may have overlooked.

I’m talking about business development companies (BDCs).

BDCs are special entities that invest in small to medium-sized private businesses.

They trade just like stocks, so you can invest in BDCs the same way you’d invest in a publicly traded company like Walmart or Coca-Cola.

BDCs pay almost no corporate income taxes, which is part of what makes them unique. They’re also required to distribute at least 90% of their taxable income as dividends to shareholders.

So they pay huge dividend yields.

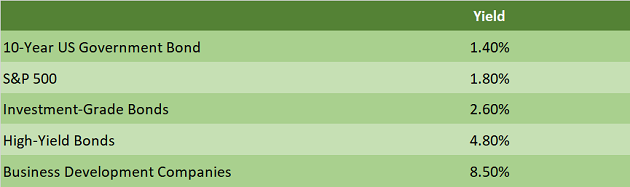

In fact, the average dividend yield for BDCs is four times that of the S&P 500:

BDCs Fill a Lending Void

Traditionally, small and mid-sized businesses turned to banks when they needed money to grow.

Problem is, the total number of US banks has shrunk 46% since 1998. And the banks left standing are less willing to make high-yield loans, which are often the only kind of loans smaller businesses can get.

Today, high-yield loans only make up 9% of bank loans. That figure has tumbled significantly in recent years, down from 71% in 1994.

That’s a massive shift. And it’s left a lending void for small and mid-sized businesses.

It’s also created a huge opportunity for BDCs.

See, BDCs are eager to loan money to smaller businesses. And smaller businesses are willing to pay handsomely for those loans. Interest usually runs in the 10% range—which is a big reason BDCs can pay such high dividends.

Despite the hefty costs, businesses are clamoring for BDC capital. In 2010, the entire BDC market was valued at $18 billion. Today, that figure has skyrocketed to $45 billion.

|

Low Interest Rates Boost BDC Investment

I expect income investors to pour into BDCs as the Federal Reserve continues to push interest rates lower.

See, income investors look to CDs, bonds, and dividend-paying stocks to generate income. As a general rule, CDs and bonds are less risky than dividend-paying stocks. But there’s a tradeoff… their yields are closely linked to interest rates set by the Fed.

When interest rates are low, CD and bond yields are also low. And vice versa. When interest rates are high, CD and bond yields are high.

That’s not the case with dividend-paying stocks, including BDCs. This can make them more attractive than CDs or bonds in a low-interest-rate environment like we’re in now. And the lower rates dip, the more attractive they get.

You might recall that the Federal Reserve cut rates three times last year. Today, the federal funds rate sits at 1.5-1.75%, which is well below the long-term average of 5.2%.

I expect the Fed to continue to cut rates this year. This would make BDCs—and their average dividend yield of 8.5%—even more attractive to income investors.

Safety Matters

You get it… BDCs’ huge dividend yields make them very appealing. But are those yields safe?

Frankly, for a lot of BDCs, the answer is “no.” So, I used the Dividend Sustainability Index (DSI), the proprietary index I developed to measure dividend safety, to sift through the rubble.

Longtime readers know that the DSI looks at a company’s payout ratio, debt-to-equity ratio, and free cash flow to measure the safety of its dividend. (You can read more about the DSI by clicking here).

Every stock I recommend in The Weekly Profit has passed the DSI with flying colors, including these three BDCs…

Three BDCs to Buy Now

Ares Capital Corp. (ARCC) is near the top of my list.

Ares mostly invests in business services and healthcare companies. It also pays a massive 8.6% dividend yield. And, with a 90% payout ratio and low debt, its high-yield dividend looks safe and reliable.

Saratoga Investment Corp. (SAR) is another great option. The company invests in recession-resistant private businesses—primarily healthcare and software—with at least $8 million in revenue.

Saratoga pays a giant 8.7% dividend yield. That’s almost five times the yield of the S&P 500.

And with a three-year average payout ratio of 75%, the dividend payments should keep rolling throughout 2020.

Solar Capital Ltd. (SLRC) rounds out our list.

Solar has over $1.5 billion invested in companies generating $50 million to $1 billion in sales per year. Nearly half of the company’s private investments are in the financial services, healthcare, and telecommunications industries.

Like the other BDCs I mentioned, Solar pays a massive 8% dividend yield. It also has low debt and a stable payout ratio, which makes it a great addition to any income investor’s portfolio.

There’s another BDC that I haven’t mentioned yet… it’s my #1 BDC pick right now, which is why I recommended it in my premium investing service Yield Shark some months back. That turned out to be a great move, since it’s nearly doubled the S&P 500 since—and it still has plenty of room to run.

You can get this BDC’s name and ticker—along with the 21 other premium BUY recommendations in the Yield Shark portfolio with a risk-free trial subscription. Click here to get started.

Robert Ross