My Top 3 Predictions for 2021

- Robert Ross

- |

- The Weekly Profit

- |

- December 30, 2020

I come from a big family with two siblings and dozens of cousins.

We typically huddle around my family’s big Christmas tree in Michigan this time of year. But like families everywhere, we had to go the digital route in 2020.

While the setting had changed, the questions (and cups of whiskey-spiked cider) did not.

All anybody wanted to ask me about was the stock market… if it will give us something to "cheers" to in 2021.

Let me put it this way…

We're Going from One "Year Like No Other" to Another

Most people are ready to leave this year behind. And in two days, we will.

If you're an investor, be sure to give 2020 a tip of the glass first.

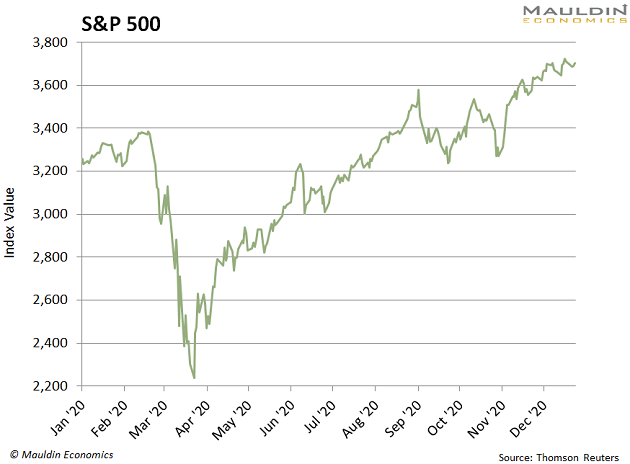

The market gave everyone a scare when it bottomed in March. But stocks have surged 66% since then...

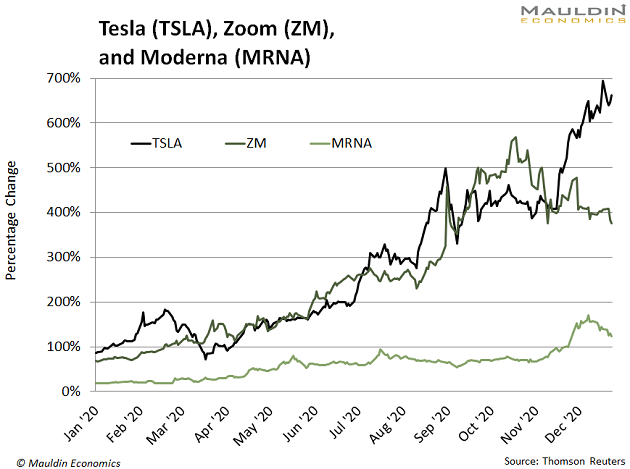

…while individual stocks like Tesla (TSLA), Zoom (ZM), and Moderna (MRNA) have surged triple-digits:

Back in the spring, it was my brother-in-law who wanted to know if he should buy the rally.

This time, the natural question came from my cousin: “Can this rally keep going next year?”

I'll tell you exactly what I told her…

Prediction No. 1:

The Bull Will Still Run in 2021

As 2020 has shown us, things outside your control—like a global pandemic—can render any prediction worthless.

But I have a lot of confidence in—and a lot of money riding on—this idea.

Why? Three reasons…

- We have every reason to expect the Federal Reserve will keep money flowing into stocks.

Their easy money policies help push people out of “safe” investments (i.e., money market funds and bonds) and into riskier assets (i.e., stocks). With the Fed pledging to keep interest rates low until 2023, bulls can look forward to a multiyear boost.

Here's something else investors can look forward to…

- Congressional gridlock isn't going anywhere.

We have two Georgia Senate runoff races still left to go. But those should be decided on or shortly after January 5.

Early polling and betting odds tell us we’ll have two years of political gridlock… at least. Gridlock is historically great for stocks… especially Walmart (WMT), Hewlett-Packard (HPE), and IBM (IBM).

As is this…

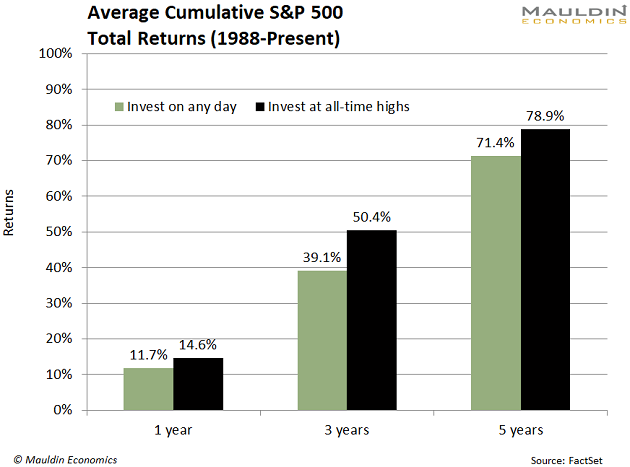

- Markets are at all-time highs… which typically lead to more all-time highs!

Since 1988, the S&P 500 returns were significantly higher on one-, three-, and five-year time horizons when the index was at all-time highs:

But while I expect the bulls to keep charging, some sectors are looking even better than others.

Prediction No. 2:

Tech Will Be 2021's Top-Performing Sector

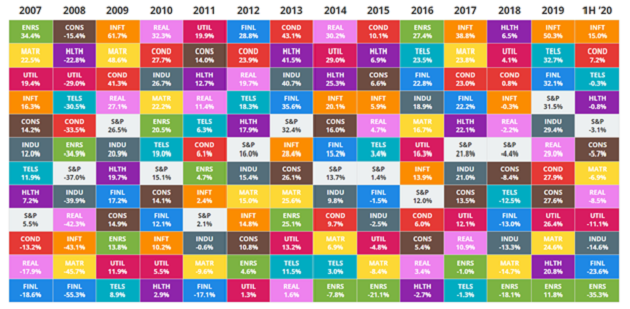

Technology stocks have been on an incredible run over the last five years. In fact, it has been the best-performing sector in three of the last four years.

Forget those nattering nabobs of negativity who say the tech run is just about done. Get ready to see more outperformance in 2021.

Source: Novel Investor

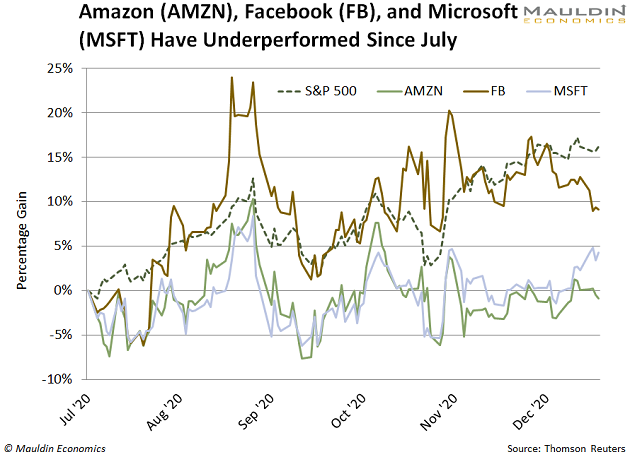

For one, while some tech names have had an incredible run in 2020, others have struggled... particularly in the second half of the year.

Household names like Amazon (AMZN), Facebook (FB), and Microsoft (MSFT) have well underperformed both the S&P 500 and Nasdaq since July. And smart investors will see this opportunity to buy great companies at a discount to their peers.

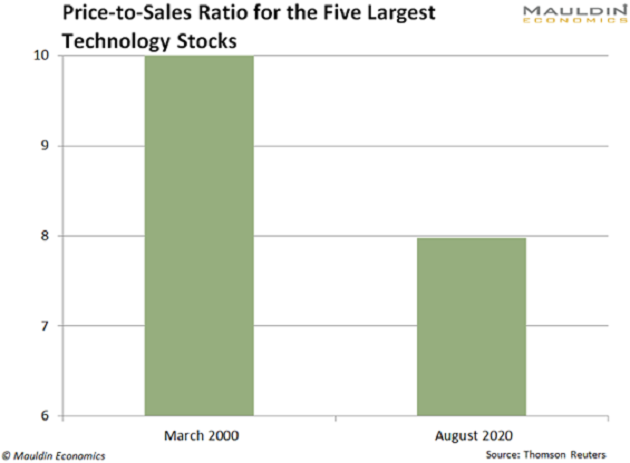

The other kicker is technology stocks are not expensive.

Compared to the dot-com bubble (when interest rates were 5X higher) the five largest US technology companies are relatively cheap:

Technology companies allowed many of us to keep working from home, and biotechnology companies will help us return to normal.

That means we'll see another big year from the companies that made—and will continue to make—this possible.

The worst of the COVID-19 pandemic will soon be behind us. The coronavirus vaccine will take effect, both physically and psychologically, and the global economy will find its footing again.

Some companies are already taking that side of the bet...

Prediction No. 3:

2021 Will Be the Best Year in a Decade for Dividend Hikes

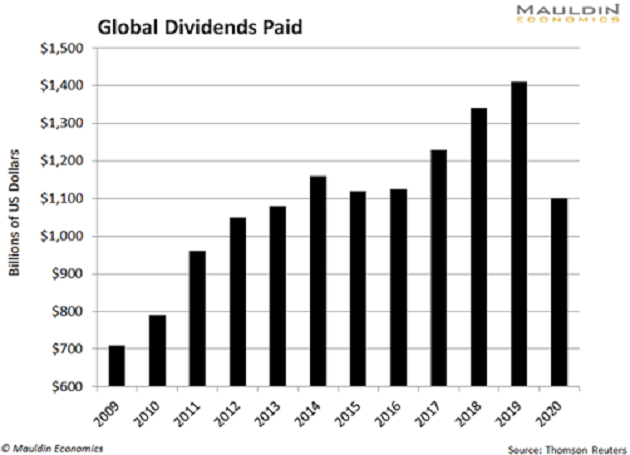

2020 was the worst year in a decade for dividend investors. In total, global companies cut their dividends by 22%.

That means 27% of all publicly traded companies slashed their dividends this year.

We stayed on top of these dividend cuts throughout the crisis. From cruise ships to casinos, we steered away from companies whose payouts my Dividend Sustainability Index (DSI) identified as being in danger.

But what goes down… must come up. At least when it comes to dividends.

We have already seen a few dividends return from the dead. Kohl's (KSS), TJX Companies (TJX), Marathon Oil (MRO), and Darden Restaurants (DRI) are among the first to reopen their purse strings.

Look for more where that came from… even among those that maintained and/or raised their payouts in 2020.

Why? We can use history as our guide.

In the two years after the 2008 financial crisis, we saw global dividend payouts increase 39%.

My Yield Shark subscribers are ready to take advantage. Are you?

With the Fed keeping the easy money flowing… techs and biotechs getting ready for another unbelievable year… and dividend income ready to be unleashed, there's never been a better time to be an investor.

This is my last article for 2020. Have a happy and safe new year, and I look forward to showing you how to profit from these three predictions in 2021 and beyond.

Robert Ross