Your Top 3 Ways to Buy “Gold on Steroids”

- Robert Ross

- |

- The Weekly Profit

- |

- January 22, 2020

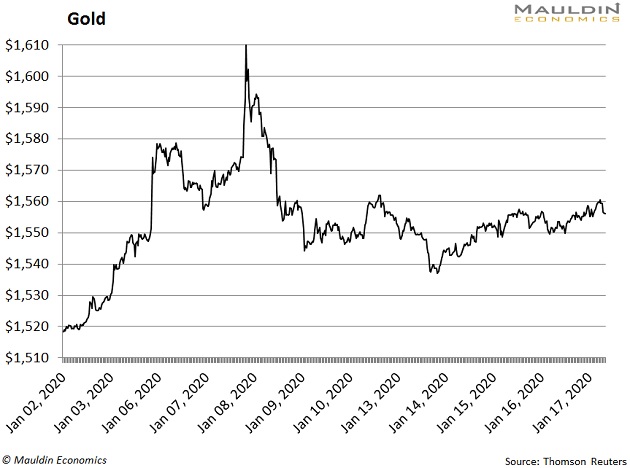

Gold is on an amazing run.

It’s climbed 25% since I wrote about it in December 2018, outperforming the S&P 500 over that period.

I wouldn’t classify myself as a gold bug. But gold sure has a lot to offer right now.

To start, it’s the classic safe haven asset—meaning investors buy gold when risk escalates.

This is a big reason they flocked into gold over the last week as Middle East conflicts continued to percolate:

Most investors buy SPDR Gold Shares (GLD) when they want to buy gold. That’s fine for novice investors. But there’s a special type of gold stock that’s even better for us.

They’re called gold royalty stocks. You can think of them as gold on steroids… something every income investor should have in his portfolio.

|

How Gold Royalty Companies Work

As you might imagine, operating a gold mine is very expensive. Even if there’s gold in the ground, it takes a lot of money to get it out.

That’s where royalty companies come in.

A royalty company makes an upfront payment to a mining company and becomes a silent partner. In return, it gets a fixed percentage of a mine’s future gold production, typically for as long as the mine is active.

So gold royalty companies enjoy all of the upside—but none of the hassle that comes from actually digging the gold out of the ground.

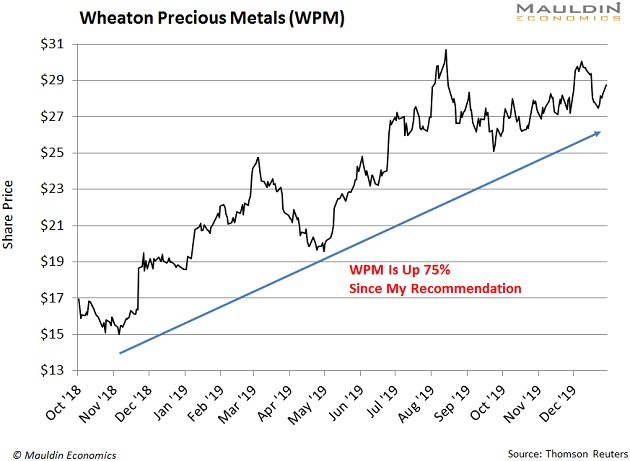

This is exactly what Wheaton Precious Metals (WPM) does.

I recommended Wheaton Precious Metals to subscribers of my premium investment service, Yield Shark, back in October 2018. It’s soared 75% since:

Even though the stock has nearly doubled, I still like the outlook for Wheaton… and two other companies we’ll cover in a moment.

But first, let’s take a closer look at why these companies are so profitable.

All of the Upside

The royalty model gives royalty companies like Wheaton Precious Metals unlimited upside.

Like I said earlier, these companies don’t mine a single rock. Instead, they lend money to gold miners to help them run their business.

When the miner sells its mined gold, the gold royalty company gets a piece of that sale.

The best part is that when gold prices rise, the royalty payments rise as well. So do the company’s profits and its share price.

The royalty company also benefits if the mine grows its gold production or the life of the mine is extended.

This all happens without investing any additional money.

And None of the Downside

There’s another reason to love royalty companies: limited downside.

See, after its initial investment, the royalty company isn’t on the hook for any additional costs.

For a gold investor, this is a major benefit over owning a gold miner. See, gold mining is one of the world’s worst businesses.

It’s a dangerous operation fraught with countless hazards and variable costs that miners can’t predict or control. Environmental activism, political risks, unions, and safety regulations… the list of potential problems goes on and on.

Royalty companies don’t have to worry about any of that. So they get the best of both worlds.

Three Gold Royalty Companies to Buy Right Now

I already told you about my top gold royalty company: Wheaton Precious Metals (WPM). But it’s not the only player in this niche industry.

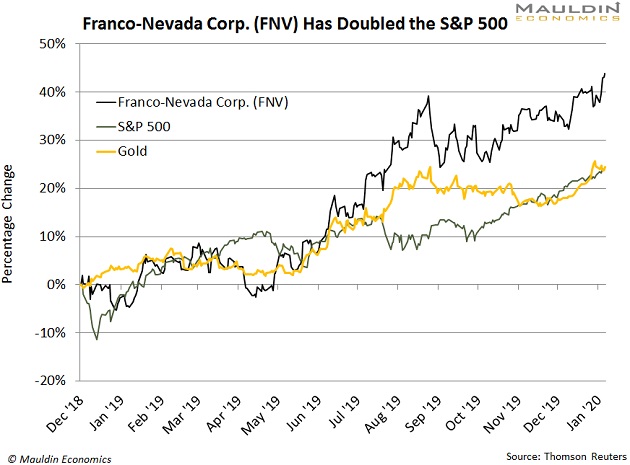

Franco-Nevada (FNV) is another solid choice. The company actually invented the gold royalty model back in 1986.

I told readers of The Weekly Profit about Franco-Nevada back in December 2018. The stock has climbed 45% since, more than doubling the S&P 500 over that period.

It’s also beat out the regular gold market, which is up 25%.

Franco-Nevada pays a stable 1.0% dividend yield. That’s smaller than what we normally look for, but I expect the share price to keep rising this year.

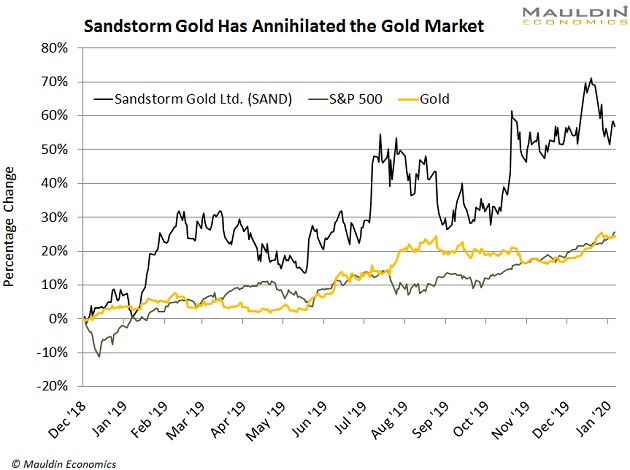

Finally, we have Sandstorm Gold (SAND), which I hope you bought when I mentioned it in December 2018.

Sandstorm has climbed 60% since, shredding both the gold market and the S&P 500.

Other than Wheaton, these two stocks have bested the rest of the gold royalty market as well. And they’re still the top options for adding gold exposure to your portfolio.

Before I go, I want to mention one more thing with unlimited upside and limited downside: becoming a member of the Mauldin Economics Alpha Society. You’ll get lifetime access to all our best research... and beyond, because your kids can inherit your membership. The savings over just a few years are enormous.

But this year, you’ll get something even more special: complimentary access to our most popular annual event, the Strategic Investment Conference (SIC), and to a brand-new, members-only event, the Wealth Preservation Symposium. Just remember, this offer expires on Jan. 23. Get the details here.

Robert Ross