Could You 3,700X Your IRA?

-

Thompson Clark

Thompson Clark

- |

- Smart Money Monday

- |

- August 2, 2021

Buy and hold. Surely, you’ve heard that guidance.

We’ve all seen charts of the big returns you can get simply by keeping your money in the market for 30+ years.

What you don’t hear very often is how to achieve truly astronomical returns, like Ted Weschler did. Over 35 years, he grew $70,000 in his IRA into a whopping $264 million.

Weschler’s name might not sound familiar, but I’m sure you’ve heard of his boss…

-

Ted Weschler is one of billionaire Warren Buffett’s stock picking protégés.

He’s managed investments at Buffett’s holding company, Berkshire Hathaway (BRK.A) for the past decade.

Earlier this summer, Weschler’s tax returns were leaked to ProPublica, presumably by someone at the IRS. We place a high value on financial privacy here—the leak was highly unethical. But the information is out there now, readily available on major news sites.

Weschler also released a statement about it. That’s where we found the critical information…

-

How did he do it?

From what I can gather, Weschler didn’t invest in obscure investment vehicles that would be inaccessible to most individual investors. He also didn’t load up on mutual funds or ETFs.

He picked stocks. And he likely owned only a few stocks. Maybe even just one—that of his former employer, American chemical company W.R. Grace (GRA).

Does that mean you should bet your retirement on one or two stocks?

No! The conventional wisdom about holding a diversified portfolio of stocks, bonds, and other assets still holds. But you won’t get a 370,000% return over 35 years by “owning the market.”

You need to actively invest if you want any chance at those kinds of results.

-

For most people, that means carving out 10–15% of your investment portfolio for “wealth accelerators.”

Like what you're reading?

Get this free newsletter in your inbox every Monday! Read our privacy policy here.

I’m not talking about day trading—Weschler wasn’t messing around with meme stocks or some other passing fad. He picked the right wealth accelerator stocks and held on.

For those of you reading Smart Money Monday for the first time, every Monday I share a profitable idea to jumpstart your week.

Today, you will read about a simple but powerful strategy for picking the best wealth accelerator stocks. Allocating a small portion of your portfolio to this strategy can speed up your retirement time frame, help make up for a late start, or simply afford you a better lifestyle down the road.

This is how it works…

-

Step #1—Buy what you know.

The best place to find wealth accelerators is in industries you understand. Maybe you even work for the company or know someone who does.

If you’re a nurse, for example, you’re in a better position to appreciate opportunities in pharmaceutical stocks. If you’re a programmer, you’ll have a better grasp of opportunities in tech (like the three we’re tracking in the NoCode space). If you’re a farmer, you might focus on commodity stocks.

Weschler spent 6 years working for W.R. Grace directly after college. So, he knew the company very well. He’s acknowledged owning the stock in past interviews.

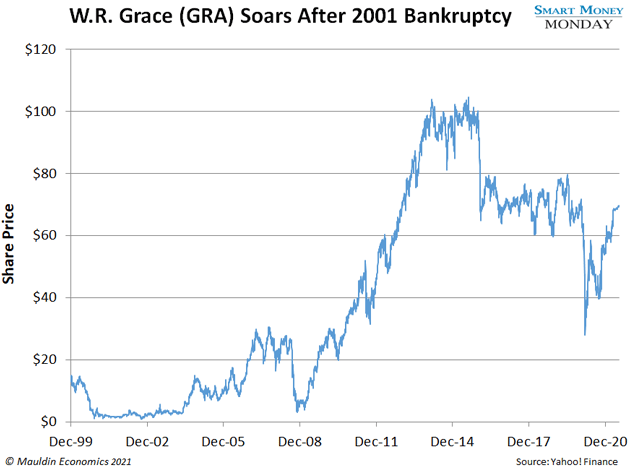

W.R. Grace went through a very tumultuous period in the early 2000s. The company even filed for bankruptcy in 2001 because of large asbestos liabilities.

But Weschler knew the company inside and out. And his fund, Peninsula Capital Partners, loaded up on the stock when it was hovering around $2 per share. It’s climbed 3,400% since and is now in the process of going private.

This stock likely played a key role in his IRA’s 370,000% returns.

Of course, you don’t need to limit your stock picks to the industry you work in. But if you can’t explain what a company does to your spouse over dinner, it’s a big red flag.

-

Step #2—Buy it cheap.

That means buying quality, undervalued stocks—stocks that are “on sale” for one reason or another.

Maybe the company is having a “Chipotle Moment.” That’s what I call it when a great company is trading at a discount because it’s facing an extremely rare, temporary problem. Like Vistra Corp. (VST), the beaten-down Texas utility I mentioned in Smart Money Monday a couple weeks back.

Like what you're reading?

Get this free newsletter in your inbox every Monday! Read our privacy policy here.

-

Step #3—Once you buy a wealth accelerator on the cheap, hang on!

Again, Weschler wasn’t day trading. He wasn’t trying to ride trends or follow charts. There were almost certainly down days. Maybe months or even years. But all signs indicate that he simply held on, and that’s what you should do, too.

Even better if you do this all in a Roth IRA, just like Weschler did. (He paid a $29 million tax bill and converted his traditional IRA into a Roth IRA in 2012.)

The beauty of a Roth IRA, as you probably know, is that you fund it with after-tax income. Then the money grows tax free. And you have no additional tax liability when you withdraw it at retirement.

-

This strategy sounds so simple…

Allocate 10–15% of your portfolio to handpicked wealth accelerators. Buy what you know. Buy it cheap. And hold on.

And yet, most people are terrible stock pickers. They don’t have the time, experience, or technical know-how to do the research. And they’re easily spooked into selling on the lows. Left alone, they basically have zero chance of beating the market.

That’s where your trusted analyst comes in—I’m here to do the research for you.

Last Monday I recommended buying shares of Cleveland-Cliffs (CLF), my favorite commodity stock headed up by rock star CEO Lourenco Goncalves. I hope you took a position—it’s already surged 14% since… and it’s only been a week.

I’ll share another great candidate to accelerate your wealth in the next issue of Smart Money Monday. Stay tuned.

Monday Mailbag

I always enjoy hearing from subscribers. If you have questions about picking the best wealth accelerator stocks, please write to me at subscribers@mauldineconomics.com.

I read every email that comes in, and sometimes I share a question or two here in the Monday Mailbag.

One subscriber recently asked about the ticker symbol for Franchise Group (FRG), which I recommended a couple weeks back.

Q. “Morningstar describes Franchise Group (FRG) as a tax preparation business. Am I looking at the right company you describe in the missive below?”

A. Morningstar’s description of Franchise Group (FRG) is out of date. CEO Brian Kahn has shifted the business away from Liberty Tax. It’s now a holding company for multiple franchise concepts. Liberty Tax was the company’s original franchise concept, but Kahn sold it off earlier this year for $249 million.

Like what you're reading?

Get this free newsletter in your inbox every Monday! Read our privacy policy here.

—Thompson Clark

Editor, Smart Money Monday

Thompson Clark

Thompson Clark