Epstein Killed Himself

-

Jared Dillian

Jared Dillian

- |

- November 7, 2019

- |

- Comments

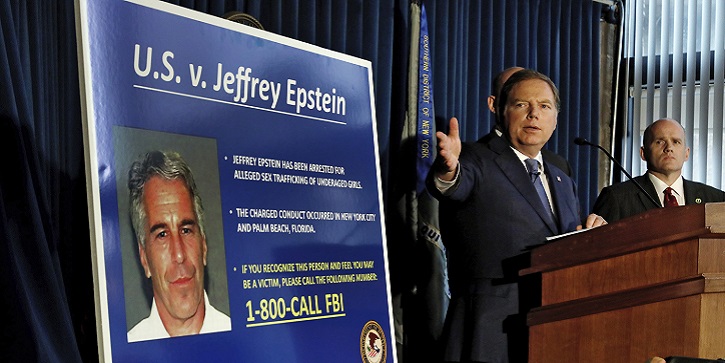

There is a burgeoning conspiracy theory that Jeffrey Epstein was murdered in his jail cell. Although it’s not really burgeoning, is it? Most people really believe this. I think once a majority of people believe a conspiracy theory, it becomes fact.

Out of all conspiracy theories, this one is certainly plausible—Epstein potentially had a lot of damaging information on a lot of rich, powerful people. But it is also plausible that Epstein lived a life of saturnalian excess and was not looking forward to the sparse and potentially brutal conditions in prison.

And it is also worth pointing out that corrections officers are not known for their empathy—or their grasp of social psychology and the broad political implications if Epstein was permitted to end his life. Never, ever bet against government incompetence.

I like that theory better than the theory where Spiderman parachutes into Epstein’s prison cell and gives him hemlock. That’s the thing with conspiracy theories—they assume there is a conspiracy, and conspiracies are difficult to hold together. Do rich and powerful people conspire? If they do, how do they keep it secret?

I don’t know, but I do know this—the people who believe that rich and powerful people conspire tend not to be very successful people, because they are always blaming others for their problems.

Insert Conspiracy Theory Here

One thing I have commented on in The Daily Dirtnap is the mainstreaming of conspiracy theories. I mean, even Trump himself tweets them out.

You would be surprised at how deeply conspiracy theories have been mainstreamed into the discourse of the financial industry. Like, lots of people believe that the government buys stocks. That there is this thing called the Plunge Protection Team where there is a guy sitting in a closet in the Treasury building buying e-minis on a Dell computer whenever the market goes down.

There is a theory that JP Morgan, the bank, is short literally all the silver in the world to suppress silver prices. And so on.

You don’t find these things in the corners of the dark web. They are right out in the open. The biggest financial media outlets give these people a platform to share their beliefs. The most disturbing thing about my industry, hands down, is that the vast majority of people working in the capital markets believe things that are simply not true.

On a micro level, there is no money to be made in conspiracy theories. If there really was a PPT (and yes, I know about the President’s Working Group on Financial Markets), then you should be able to make money off it in a systematic way. But you can’t, so it’s just somebody to blame when things don’t go your way when you’re short. If you’re long a bunch of silver and it won’t go up, blame someone else for your problems.

If It Feels Like the Country is Falling Apart…

On a macro level, belief in conspiracies is a direct result of loss of trust in institutions. In Epstein’s case, the corrections officers failed at their job, the judicial system failed at its job, and the media failed at its job. These are institutions, and the health of this country is based on the strength of its institutions. What makes extreme political beliefs possible anywhere in the world is a loss of trust in institutions.

The internet also tends to amplify fringe beliefs, which everyone knows by now.

I see Epstein memes in my own Facebook feed, from people who, up until this point, had been apolitical. Their first foray into politics is in the form of a conspiracy theory.

If I were a psychiatrist and I were presented with a patient who believed things that simply were not true, I would call that person delusional and I would prescribe an atypical antipsychotic. I take great interest in mental health—when the human mind malfunctions, what do you do? We have tools to deal with that.

What do you do when the country, collectively, believes things that aren’t true? Take a pill? Turn it off and turn it on again?

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

If it feels like the country is coming apart, it’s because it is.

Like I said, there is no money to be made in this stuff. The money is made by staying in the sane center—and profiting off of the craziness. Negative interest rates would be crazy. The S&P 500 at 5,000 would be crazy. The VIX at 8 (or 80) would be crazy.

If volatility increases in politics and social psychology, it stands to reason that it might increase in financial markets. I haven’t been too high on tail risk in the last several years, but I am starting to come around.

Your Turn

I’ve been writing in The Daily Dirtnap for some time about this mainstreaming of the fringe, about how political risk is seriously underpriced, and how all kinds of curveballs could be thrown in the election campaign next year.

Now I want to get a snapshot of where The 10th Man readers are on all of this, because this is a giant, complicated mess that is going to have far-reaching implications. Implications on a societal level, yes, but also implications for the markets and your portfolio.

So – could you do me a favor and take this survey on politics, investing, the media, and the general health of the US as a country?

Yes, it’s pretty wide-ranging but it shouldn’t take you too long to complete—there are plenty of multiple choice questions in there.

I’ll leave it up for a week, so if you could take a few minutes I’d really appreciate your time. Results coming soon to a 10th Man near you (but of course, all answers will remain anonymous). Thank you.

Jared Dillian

subscribers@mauldineconomics.com

Jared Dillian

Jared Dillian