How to Talk to Your Parents about Bonds

-

Jared Dillian

Jared Dillian

- |

- September 12, 2019

- |

- Comments

Baby boomers, man.

Before I begin, a good rule of thumb for anything I write: don’t take anything personally.

Baby Boomers are the worst investors in the world.

I have seen it with my own two eyes. They got gorked up on dot-com stocks in 1999, then got rinsed. They got gorked up on stocks again in 2007, then got rinsed.

They are gorked up on stocks again.

Have you ever tried talking to a Baby Boomer about their asset allocation?

Hey Dad… uh, you’re getting close to retirement. Don’t you think you should lighten up on stocks?

We all know how that conversation goes. Not well. Especially with cable news turned up to 11 in the background.

In the old days, they had this rule of thumb that your age should be your percentage allocation to bonds. So if you were 70 years old, you should have a 70% allocation to bonds.

The reason is simple. When you’re close to retirement, you don’t want to risk losing it all. You want something safe, that spits out some income.

In my travels, I would say that the average Baby Boomer has an 80%-90% allocation to stocks. When the sane, sober Generation Xers try to have a conversation about de-risking, they get told to beat it.

For whatever reason, Baby Boomers have an insane tolerance for risk. And it has not served them well. They are wealthy, but they could have been wealthier. They are credulous. If a bubble pops up, they believe in it, and dive in headfirst, whether it’s cannabis or dot com or security stocks. Not bitcoin—that posed a technological hurdle they could not overcome.

Ironically, the one bull market they have not been sucked into is bonds. Which is the one thing they should have been investing in all along.

Boomers and Bonds

Bonds are for old people—although not just for old people—and yet old people don’t want them.

A little louder, for the Tommy Bahama shirts in the back:

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

Pretend you have $2,000,000 saved for retirement. In 2008, the stock market went down nearly 60%.

If the stock market goes down 60% again, you will have $800,000, which will drastically reduce your standard of living in retirement.

Theoretically this would get your attention, but it probably doesn’t because you don’t think it’s possible that the stock market would go down 60 percent again.

You’re right. It might go down more than 60%. There is precedent for that, too.

This is why stocks are unsuitable for all different kinds of people—they make sense for people in their 20s and 30s, and also 40s, but as you get older you have to cut risk dramatically.

This used to be the conventional wisdom. Not anymore. What happened?

What happened was an 11-year bull market. There are lots of investors whose investing career has not spanned a full cycle. Only the first half of the cycle, which is less instructive than the second half.

Boomers have been through a bunch of cycles and, as a cohort, have learned precisely zero lessons from them.

RIP My Inbox

I will answer this question one more time.

“Why invest in bonds when interest rates are so low—when it’s clearly a bubble?”

- Stocks are a bubble, and yet you invest in those.

- Believe it or not, interest rates can go lower, and probably will.

But most of all…

- Bonds provide diversification.

Stocks may have gone down almost 60% from 2007-2009, but a 35/65 portfolio of stocks and bonds only went down 24%.

That fact remains relevant whether you believe bonds are “in a bubble” or not. I have a bit more to say on this, which I will send to you tomorrow.

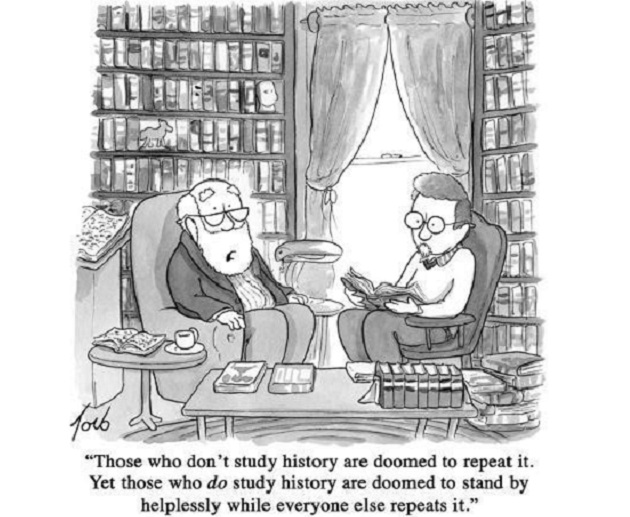

Here’s the thing—financial markets simply aren’t fair. They’re not fair to normal human beings with normal human emotions, people who get excited by high prices and demoralized by low prices.

A humblebrag: whether because of genetics or study or whatever, I have been blessed with the ability to do the opposite: I get excited by low prices and demoralized by high prices.

Source: New Yorker

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

Anyway, the worst-case scenario for these advisors is that you pull your account.

Most people don’t pull their accounts when they lose money—it is easy for the advisor to shift blame to the market. They pull their accounts when they don’t make as much money as everyone else.

If you went to your advisor and asked to shift your asset allocation to bonds, he or she is going to put up a massive fight. Because your expected return will drop, and you won’t make as much money as “everyone else.” If you’re all in stocks, and you lose money, well, so will everyone else.

That is a fight you might not win. If you told him about this guy on the internet yammering on about bonds, he would probably tell you that I am a crank.

Financial advisors are many things—relationship managers, mainly—but the majority of them are not market experts. His opinion is no better or worse than the person on CNBC.

I have a strong suspicion that very few Baby Boomers will take my advice. Because, you know, Baby Boomers.

It’s not about my giant ego. I try to prevent unnecessary misery. How am I doing?

I give myself a D+.

Jared Dillian

subscribers@mauldineconomics.com

Jared Dillian

Jared Dillian