I Think It’s Gonna Be Okay

-

Jared Dillian

Jared Dillian

- |

- June 29, 2023

- |

- Comments

A month or two ago, people were having a conniption about commercial real estate. An absolute meltdown.

All these office buildings were sitting unoccupied because people were working from home. The office REITs were trading at distressed levels. You saw the short interest in office REITs go way up.

And the derivative trade of this was that commercial real estate and associated securities were held on regional bank balance sheets, so regional banks were going to go down for the dirtnap.

Where’s the kaboom?

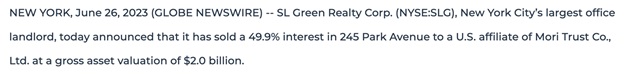

On Monday, this happened:

Source: GlobeNewswire

This shows that:

- The market for office real estate is liquid.

- Valuations remain high.

- Fears about working from home are overblown.

The thing I have said all along is that companies are simply not going to let employees work from home forever. They will make people come back to work. Quit if you want to—we can find someone to replace you. It’s taking some time, but give it a few years—in 2025–2026, everyone will be back in the office five days a week.

By the way, SL Green was up over 20% on the day, and it’s a holding in The Daily Dirtnap portfolio.

It’s Never as Bad as It Seems

2022 was a pretty terrible year, right? Stocks were down about 20%. That’s a plain-vanilla bear market.

There have been much bigger bear markets in the past. If you’re investing in stocks, you can expect to take a 20% drawdown semi-frequently.

What happened last year was that people lost all perspective. When the market was on its lows in October of last year, I saw lots of calls for the market to decline another 20% or 30%. People were losing their minds.

To get a drawdown of 50%, you really need a debt crisis, which wasn’t happening. It was simply a valuation contraction because of higher interest rates. If you could recognize it for what it was, then maybe you could have stayed invested and recouped some of your gains.

Sentiment always works. I actually just sat down with Mauldin Economics publisher Ed D’Agostino this week to discuss today’s market sentiment, whether we’re in a new bull market, and how you can “de-risk” your portfolio… among other topics.

You can watch it by clicking the “play” button below—we’re also extending a special offer to my Portfolio Suite, so check it out if you’re interested in learning more about how you can apply sentiment in your trading.

Anyway, back to commercial real estate…

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

Heard an Edward Jones guy in Myrtle Beach pitch me that idea. If the Edward Jones guy in Myrtle Beach knows about the idea, it’s not going to work.

Why the Market Is Going Up

I get accused of being a “permabull” sometimes. A permabull is a funny thing to call someone who is usually right. I can think of a couple of scenarios in which stocks could have another, perhaps bigger, bear market in 2024–2026. But nothing of the sort is on the horizon.

Want to know why the market is going up? Because people do what’s called modified dollar-cost averaging. They make those automatic contributions in bull markets but then chicken out in bear markets. Then, when the market rallies again, they turn on the machine again.

You might have noticed a change in the price action recently. It takes a lot to get the market to sell off. Also, it is summer, and there is nothing going on except for rogue Russian mercenaries threatening to destabilize a nuclear power. That didn’t have much of an effect on stocks, either.

What About AI?

Sentiment trading is about doing the opposite of what everyone else is doing, right? So, what about AI? Shouldn’t we be doing the opposite of what everyone else is doing and short these AI stocks?

Nope.

You have to distinguish between an extraordinarily popular delusion and an investable trend. AI is bigger than the invention of the internet. It is the invention of the wheel. That investment boom will easily be as big as the internet.

We just need some IPOs so people have stuff to trade. If OpenAI were to IPO tomorrow, I don’t know what the valuation would be, but it wouldn’t fit in a pocket.

The tragic thing about AI is that we simply don’t have much in the way of good stocks to buy, and the good ones (like Nvidia) already have it priced in. For Daily Dirtnap readers, the compromise has been to buy Microsoft, which has done passably well.

This isn’t optimism. Optimists are idiots. This is about the knowledge that a lot of bad things need to happen simultaneously for things to go wrong, and you only need one or two things to happen for things to go right.

Jared Dillian, MFA

subscribers@mauldineconomics.com

Jared Dillian

Jared Dillian