Most People Don’t Care About Stocks

-

Jared Dillian

Jared Dillian

- |

- August 3, 2023

- |

- Comments

I am a Wall Street guy, and, being a Wall Street guy, sometimes I forget that 99.9% of the planet has no clue what the stock market is doing on any given day. Or cares. It has zero bearing on their lives whatsoever.

That’s one of the great things about working in the Myrtle Beach area. Outside of a few financial advisors, there are no finance people here. And I’d argue that the financial advisors aren’t too plugged into what the market is doing, either.

Here are the times when people care about the stock market:

- When it’s crashing. But the stock market has to crash a lot for people to care. Stocks were down 20% last year, and it didn’t even show up on a lot of people’s radar. Also, people have been trained to ride out the downturns, and 20% doesn’t register as a downturn for most people. 50% is a different story.

- When it’s ripping. People cared a lot about stocks in 1999. And in 2021. Every once in a while, the market gets hot, and people think they can get rich trading stocks. I can tell you that if you see everyone around you quitting their jobs and becoming day traders, that is a pretty good time to short stocks. People become day traders when it’s easy, and it doesn’t stay easy very long.

- Meme stock mania. GameStop and AMC sucked a lot of people into the markets and destroyed a lot of wealth. You can put crypto in this category, too, but also any stock that captures the imagination of the investing public. Krispy Kreme Doughnuts did this at one point. Nvidia is doing it today. A stock goes up 5,000%, people notice, and then they buy it… after it’s gone up 5,000%.

Those are pretty much the only times when people care about the stock market. I hate to generalize about retail investors as a group because there are certainly some smart retail investors, but broadly speaking, when retail is piling in or out of stocks, that is usually a good contrary signal.

Nobody Really Cares About Stocks Now

My flagship newsletter, The Daily Dirtnap, is having a slow year this year. My renewal rate is high, but the people who are unsubscribing are generally saying one thing in common: “I’m not trading anymore.”

That’s kind of interesting. I’ve been a trader since 1999. There have been times when I trade less. There have been times when I trade more. But there hasn’t really been any time when I just stopped trading. People stop trading for two reasons: when it’s discouraging and when they run out of money. Running out of money is never a good thing, but let’s assume those people are in the minority. For everyone else, trading was easy and then became hard. That’s why they stopped trading. It became harder to make money.

I’m sympathetic… I guess? Trading is hard 98% of the time, and the 2% of the time it’s easy, you should sell everything and head for the hills. It’s especially hard this summer. Implied volatility is 13, realized vol is 8, options are too expensive to buy and too cheap to sell, bonds have been in a range since forever, and most people missed the rally in stocks. Don’t quit; get smarter.

I can tell you that after doing this for 24 years, I am constantly learning. The more mistakes I make, the smarter I get. So go out there and make a ton of mistakes. But be disciplined so you can limit the damage.

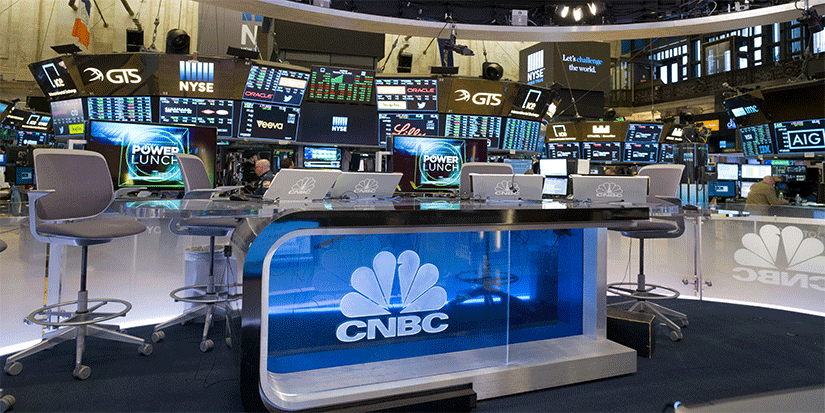

NBC Nightly News

Everyone has their signals. For me, it is NBC Nightly News.

I watch NBC Nightly News every night despite hating Lester Holt. He is a political hack. But that show is a great stock market indicator.

Most nights, Lester doesn’t report on the stock market. When he does, you know that we are in the vicinity of a turning point.

I also tell people that the best financial newspaper in the world is not The Wall Street Journal, the Financial Times, or Investor’s Business Daily. It is USA Today. Go to the green money section in USA Today, and you will get all kinds of great ideas. All newspapers get dumber over time, and USA Today is dumber than most. If someone sends me a USA Today article on the stock market, that is, hands down, one of the best sentiment indicators you can get.

It’s the summer. Volatility is low. But there is always, always stuff to do. There is always a bull (or bear) market somewhere. And don’t restrict yourself to just US stocks—there are financial instruments you can trade all over the world.

2023 may go down as a snoozer. But you shouldn’t sit it out because it got hard. You’re just not trying hard enough.

Jared Dillian, MFA

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

subscribers@mauldineconomics.com

Jared Dillian

Jared Dillian