The Long Right Tail

-

Jared Dillian

Jared Dillian

- |

- April 11, 2019

- |

- Comments

Portfolio strategies like Modern Portfolio Theory and others tend to assume that market returns follow a normal distribution.

Not really.

Certain securities have high kurtosis, which is where out-of-the ordinary returns (larger or smaller) occur more frequently than the normal distribution predicts.

Of course, nobody who is stable and balanced puts 100% of their assets into something which has the possibility of extreme returns.

But risk 90 cents for the possibility of making 10 bucks? All day long.

That’s why today we’re going to be talking about investing in… silver.

Nobody actually “invests” in silver. I am a silver investor and I wouldn’t say that I “invest” in it. I keep it around, for when something crazy happens.

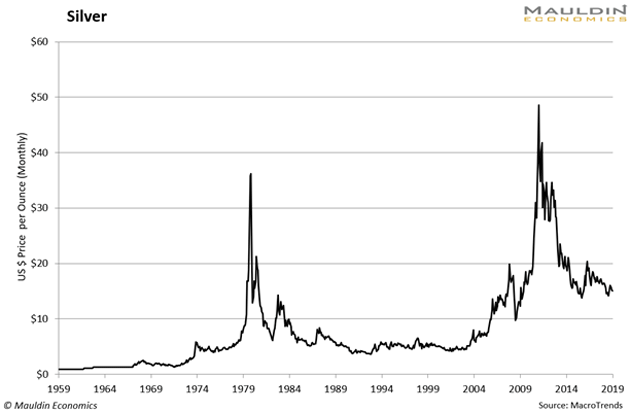

Here is a chart of silver going back a long time so you can see what I mean:

You can see “Silver Thursday” in March 1980, the result of Bunker Hunt attempting to corner the silver market. And you can see the freak-out in 2011.

So you might come to the conclusion that an asset that goes bananas every once in a while could be a good asset to hold.

Especially in light of what is going on in the world at the same time:

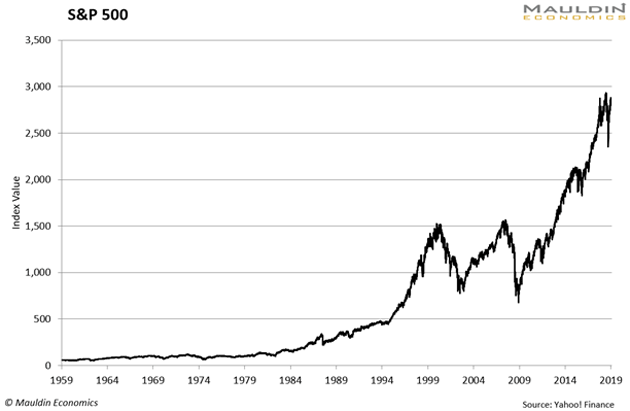

Two weeks ago, we talked about the 35/55/3/3/4 portfolio: 35 percent stocks, 55 percent bonds, 3 percent commodities, 3 percent gold, and 4 percent REITs (Real Estate Investment Trusts). That portfolio gives you almost the return of the 80 percent stocks/20 percent bonds portfolio with about half the risk.

I think if you threw 1 percent silver in there, the risk characteristics get even better.

Sadly, people get a little carried away with silver, like they did a few years back. They start ordering monster boxes of coins and getting it delivered to their front door by very unhappy FedEx guys. The mints were happy to oblige all the demand back in 2011, and I bet there are lots of coins of 2011 vintage floating around out there in estate sales.

That is usually what happens with physical precious metals. Even when the price goes up, people don’t sell them. An asset that you aren’t willing to ever sell is kind of pointless, and it ends up in the estate sale, where the coin and bullion dealers buy them back. Especially the private coins.

|

Silver Might Be Worth a Lot One Day

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

Still, you never know. Strange things can and do happen with precious metals. Palladium has gone nuts, and platinum is a fraction of what it once was. And as I said earlier, market returns don’t follow a normal distribution. Extremely positive (and negative) returns happen much more often than a normal distribution expects them to.

Subjectively speaking, silver looks cheap. It’s about where it was in 2010, when the breakout occurred. It has done the round trip. But that’s not why we own it, because of some subjective opinion of cheapness. We want to own it for what it does to your portfolio.

Some people like to trade silver in the futures market, which seems insane to me. Silver is notoriously difficult to trade in the short-term, earning the reputation of being the “rich man’s casino.” Pass.

Nobody should be trying to scalp a couple of percent out of a silver ETF. You buy it and hold it and wait for it to go 5x or 10x. And then—you actually have to sell it.

Silver miners are also a possibility. Since the bear market, many miners have become small cap stocks that are not very liquid. But they possess the same kind of periodic moonshot potential (kurtosis) that spot silver does. But you have to be careful with miners. Do your homework.

I’ve done my research, and I just added a miner to the Street Freak portfolio. It’s stable and profitable today, but with big upside potential should silver make a move. It gets almost half of its revenue from silver, and the remainder from gold, zinc, copper, and lead, so it’s diversified.

It kind of has the best of both worlds – the company has a low risk of hurting you, but still gives you exposure if silver lives up to its fat tail and delivers extreme returns. A relatively safe way to risk 90 cents to potentially get those 10 bucks.

This qualifies as an investment, and I like this investment a lot. I just released the write-up in Street Freak service, so it is still rated a “buy” recommendation. If you want to find out more (and save a big chunk of change for 3 days only), please click here. Given what is going on in the world, I think there’s a pretty strong chance you’ll regret it if you don’t.

One More Thing

I heard a great quote from Milton Friedman recently: “Only the government can take perfectly good paper and perfectly good ink and render the combination completely useless.”

That’s one of the reasons we’re buying a silver miner. Just in case.

subscribers@mauldineconomics.com

Jared Dillian

Jared Dillian