The Yield Curve Screams Recession

-

Jared Dillian

Jared Dillian

- |

- March 9, 2023

- |

- Comments

Federal Reserve Chairman Jerome Powell said the Fed could hike rates more and more often. This resulted in stocks being down a little, gold being down a lot, and the yield curve doing one of the most incredible permutations I’ve ever seen.

It was a massive flattening, which is to say that the inversion became even more inverted—at the time of writing, the yield curve, as measured by the spread between two-year and 10-year interest rates, is 102 basis points inverted. I’ve had a long (though not always illustrious) trading career, and I’ve never seen anything like this.

The bond market is screaming that there is going to be a recession, and now it seems certain that the Fed is overtightening. You see, this all started with last month’s payroll report showing that we added over 500,000 jobs in the month of January. A lot of people questioned the verisimilitude of that data, saying that the seasonality calculations might have been wonky, or it could have been due to warm weather.

Nonetheless, the headline number had a big psychological impact, and Fed officials—namely James Bullard—spent the next month talking up short-term rates. We’re going to get another payroll number tomorrow. Economists expect 224,000 jobs to be added. We’re also getting CPI next week.

If you’re Jay Powell, and you give that speech in front of Congress, and then you go back to your Bloomberg Terminal to see the yield curve freaking out, you might want to reconsider what you’re doing. The bond market talks. Everyone knows the yield curve predicts recessions. If we don’t have a recession after a 102 basis point–inversion, then I’m a monkey’s uncle.

This is weird, weird stuff.

And It Could Get Weirder

And things could get weirder still. Pretend we added another 500,000 jobs in February, and pretend CPI comes in hot next week. It may seem like I’m obsessively focusing on payrolls and CPI, but it’s for a reason—these numbers have political significance, and the Fed can’t be seen cutting rates as long as the unemployment rate is at 3.4% and CPI is over 6%.

The Fed doesn’t want you to question its resolve, but I think everyone is taking them seriously by this point. Let’s put it this way: T-bills at 6% are going to cause some incredible distortions in the markets. Like, why buy stocks ever again if you can get 6% risk-free? It’s actually a minor miracle that the stock market has held up as well as it has.

The last time we had 6% short-term rates was in 2000, if you recall. I recall. I looked at the stock market with a bunch of dot-com stocks with infinite P/Es, and I looked at prime money market funds with 6.6% yields, and I said no thanks to the stocks.

But the trouble with short-term interest rates is that they are short term—you can’t lock them in. You can buy a two-year note at 5%, but in two years, when that security matures, you may only be able to reinvest it at 2%, whereas you can lock in 10-year interest rates at 4% right now. Which do you think people will choose? Of course, people are lemmings and will go with the T-bills.

But we could be having this same conversation next week after a couple of hot numbers, and the yield curve is inverted by 120 basis points. Right now, the yield curve is twisting, and that contains some very valuable information. It’s telling the Fed that it’s out of its mind. It’s probably also causing a lot of pain to a lot of hedge fund guys who have been betting on a steepening yield curve for the last six months.

That’s pretty much an axiom of the capital markets—weird can get weirder.

Asymmetry

The one point I’ve been trying to drive home in The Daily Dirtnap is the asymmetry of economic data at this point. Stocks will go up a lot more on a soft number than they will go down on a hot number.

Pretend payrolls come in negative tomorrow. The stock market will jump 4%—at least. Now pretend CPI comes in with a five handle next week. Stocks will rise 4%—at least—whereas the downside is limited.

A lot of this is because of the whole “unknown unknown” thing. We have been dealing with tight financial conditions for a while. Everyone is mentally prepared for higher rates. What people are not mentally prepared for are a dovish Fed and easier financial conditions. Could happen.

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

Those Bastards

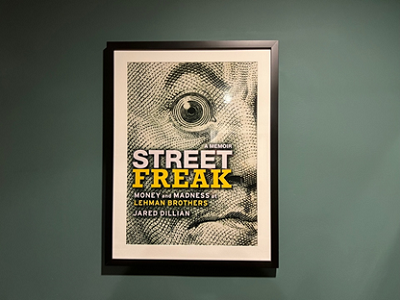

I got a great birthday present from my wife this week: a framed cover of Those Bastards, due out in about a month, to go with my other two framed book covers.

Source: Jared Dillian

You’ll be hearing me talk more about Those Bastards soon. All you need to know is that you need to buy 10 copies and hand them out to people. Or, if you can’t buy 10, buy five. Or buy two. But don’t buy just one.

This one makes a great gift, and people will love it.

Party

And finally, if you made it this far, come on out to my party at Doux Supper Club at 59 W 21st St in New York tomorrow from 7 pm–midnight. Buy tickets here or at the door.

Jared Dillian

subscribers@mauldineconomics.com

Jared Dillian

Jared Dillian