Another Way to Think About Interest

-

Jared Dillian

Jared Dillian

- |

- February 13, 2020

- |

- Comments

First, please enjoy the music I played at the InsideETFs opening reception a few weeks ago. Don’t worry, it’s pretty chilled-out—good music to work to.

Finance guys are too smart.

Interest rates are demonstrably low. People have no fear of debt when interest rates are low.

You should always have a healthy fear of debt, but that is another discussion altogether.

People spend a lot of time thinking about the interest rate when they should instead think about the number of dollars they spend in interest.

For example, mortgage rates are very low. Rates of 3.5% are not uncommon, which pretty much means they’re at all-time lows.

Even at 3.5%, you can end up paying a lot in interest over the course of 30 years.

If you borrow $400,000 at 3.5%, you will pay $247,000 in interest over the life of the loan, assuming you don’t make any prepayments.

$247,000 is a lot of money, and my guess is you could find a more productive use for that money rather than contributing to the bank’s profitability.

|

People pay a lot of money in interest. The average person has $11,000 in credit card debt. That means the average person pays $2,000 in credit card interest. If the average person makes about $50,000 a year, that means said average person is paying about 4% of their income in credit card interest.

Throw in car loan interest and mortgage interest, and the average consumer pays 10–20% of his income in interest.

My question: Does anybody get any benefit from paying all that interest? Is it enjoyable? Is it fun?

My guess is people would rather spend that $5,000–$10,000 on something else. Clothes, food, a vacation, whatever. Ideally, people would save that money, but I have no problem with people spending it as long as they aren’t paying it to the bank.

As I have grown older, I have come to view interest as unproductive, and I try to pay as little of it as possible.

In fact, the key to personal finance isn’t making pointless austerity choices like leaving your thermostat at 86 in the summer and giving up going to the movies. It’s just math. If you borrow $100,000 less on your mortgage, you pay $63,000 less in interest.

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

My best personal advice to people is to not be good customers of the bank. A good customer of the bank borrows as much money as they can, pays every dollar of interest, makes every payment on time, and just cruises around with this crushing debt load.

A bad customer of the bank doesn’t borrow money, or if he does, he pays it back as quickly as possible before interest accrues. OR—alternatively, a bad customer of the bank defaults on his loans—which is better than carrying around a crushing debt load and paying the interest every month.

I’m not anti-bank. Banks help people accomplish things they wouldn’t be able to otherwise accomplish. They extract a hefty toll. Paying this toll is largely optional.

Every dollar I spend in interest is a colossal waste. These days, I spend none.

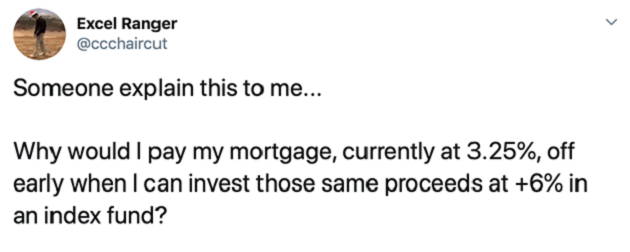

No.

Among other things, this is a pretty good sign of a stock market top.

You shouldn’t do this. For reasons that should be obvious, but I’ll explain anyway.

The returns on the stock market are uncertain. You can lose money. Then you would have debt and losses, which would suck. This happens at the top of every cycle—margin debt peaks, and people get hosed.

I have a friend who is obsessed with defeasing debt payments. For example, he talks about buying a Porsche, paid for by the income from a few rental properties.

Again, the rental income is uncertain. People might not pay, the apartments could go unfilled, or worse, the whole thing could burn down. What is certain is that you’ll have to continue to make payments on your Porsche.

But there is something else to think about: the size of your balance sheet. I try to keep my balance sheet as small as possible. No assets, no liabilities. The bigger the balance sheet, the greater chance for an asset/liability mismatch.

I know this because I worked at an investment bank in the 2000s. In fact, I worked at the one that got it wrong, with 35x leverage. It’s probably not a coincidence that the really successful businesses of the 2010s were all capital-light businesses.

Nonfinancial corporates have ballooned their balance sheets in recent years. I’ve also observed that the yield on BB corporate bonds got down to 3.47%. This seems like an opportunity, or the opposite of an opportunity.

If you want to get rich, the solution isn’t to shop for clothes at Walmart. The solution is to use debt as little as possible—or as judiciously as possible.

Sometimes I think about all the interest that I have paid in my adult life. It’s probably less than $200,000—and that’s with owning five houses. That’s still too much. I would love to have that money back.

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

Every year I go, I think I’ve heard it all by now. And every year, I’m proven wrong. Ask my wife: After I come back from the SIC, I keep talking about it for months.

This year, I’m especially looking forward to hearing from two of the headliners—keynote speaker Sam Zell and former Goldman Sachs partner Leon Cooperman. They’re both billionaires, and there’s a reason for that.

I suggest you get yourself a ticket soon because this year we’re limiting the seats to 450 instead of 700, and they’re selling out fast.

Jared Dillian

subscribers@mauldineconomics.com

Jared Dillian

Jared Dillian