Level 10 of the Videogame

-

Jared Dillian

Jared Dillian

- |

- February 20, 2020

- |

- Comments

The financial markets are a MMORPG.

That stands for Massively Multiplayer Online Role Playing Game.

And on Level 10 of the game, you get to answer the following question:

“If politics and society are so crazy, why is there no volatility in the markets?”

Hey, if you can answer that one, you can have my job.

This is the thing that I come into work every day and think about. This is the thing I get stuck on.

For starters, Trump was supposed to cause volatility with his chaos, and he didn’t. In fact, he crushed volatility.

Now we have commies winning primaries and the market just yawns. One interpretation would be that the commie doesn’t have a chance, but of course he does.

The best answer I can come up with is that the supply/demand dynamics of stocks and bonds are overriding everything.

|

The Great Depression

The Great Depression now lives in the realm of forgotten economic statistics. Here’s an economic statistic for you: The stock market went down 89% from 1929–1933.

Ever put any brainpower into what could cause a stock market to go down 89%?

It’s more than just corporate earnings.

It’s more than just the economy.

In 1933, stocks were pricing in… pretty much the end of capitalism.

A general rule of thumb is that whenever stocks go down 50% or more, anywhere in the world, people are very, very pessimistic about their economic system. It just happened in Argentina.

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

I have also observed that economic literacy has plummeted. I have been writing about this for the last ten years in The Daily Dirtnap, starting with 100% taxes on AIG bonuses and continuing out from there. It also kinda feels like we have a long way to go.

And yet stocks are at all-time highs.

Don’t misunderstand me—I don’t want a recession, because the next recession will almost certainly result in the end of capitalism. I don’t want that just so my puts can go in the money.

But this divergence that we’re experiencing between the stock market and radical politics can’t continue forever. It has to resolve itself somehow, and it probably won’t resolve itself with politics becoming less radical.

Anyone who was born in 1933 is now 87 years old. Anyone who was an adult in 1933 is now 105 years old. There aren’t too many people around who can talk to us about what made a stock market go down 89 percent. I suppose I could go to the library and read old newspapers, but I have never been good with the microfiche.

The Cost of Pessimism

A few weeks ago, we talked about the real, monetary cost of being pessimistic. There have been a lot of reasons to be bearish, especially since 2015. The market levitates.

There is a belief that persists in the financial community that bearish market pundits must be naked short and getting their faces ripped off all the time. That isn’t necessarily true. I suspect most of them are like me. They think that the stock market is dumb and have found other ways to make money that don’t involve stocks.

It hasn’t been easy. The S&P 500 is the only game in town, and there’s no volatility in anything else, either.

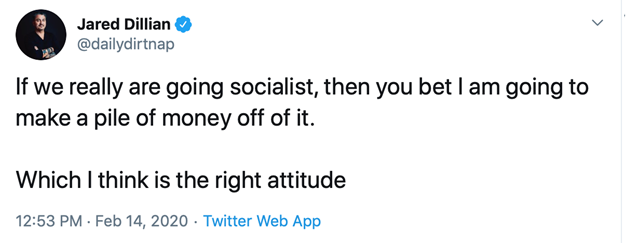

I wrote this recently:

If Bernie wins, there are going to be some trades to put on. Maybe I should sell these ideas, but they are pretty straightforward:

- Stocks down

- Dollar down

- Bonds up

- Gold up

- Oil up

Of course, this is what should happen, but what should happen hasn’t happened in a really long time, so the prognostication is pointless.

As I mentioned earlier in the piece, Argentina took a 50% digger on a Peronist government, but maybe EM and DM are different.

And I can think of a few scenarios where stocks would go up on a Bernie presidency, except for the fact that he would explicitly want them to go down.

In the old days, you didn’t have to overthink things. Socialist president, stocks go down, easy as pie. Everything is so hard now.

The conventional wisdom was blown out of the water in 2016. It will probably get blown out of the water again.

No Politics Allowed

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

Notice I didn’t say the candidate that will make markets go up. I’m sure you all know the difference between being pro-market and pro-business.

Slim pickings out there. I spend most of my time wondering if the uniforms will be chartreuse or butterscotch.

If you want to hear some more opinions on what awaits the stock market and economy if either Trump, Sanders, or Bloomberg win the election, you should consider attending the SIC 2020. Looking at the faculty, I’m pretty blown away (read all about the speakers here). There are some heavy hitters on the list, and you should definitely hear what they have to say.

You are in luck, you can still get priority pricing, but it won't last much longer! In my book, paying less for stuff you’d want to buy anyway is one of the most financially savvy things you can do. So register today and join me and the rest of the Mauldin Economics crew in Scottsdale!

Jared Dillian

subscribers@mauldineconomics.com

Jared Dillian

Jared Dillian