Dreams of a Soft Landing

-

Jared Dillian

Jared Dillian

- |

- March 30, 2023

- |

- Comments

We’re about a year into interest rate hikes, and things are going… not so well. 500 basis points is a lot to cram through the economy in a year, and stuff is starting to blow up.

Told you so.

The focus now is on commercial real estate and CRE loans, primarily held on small regional banks’ balance sheets. The rate hikes have already succeeded in causing a huge credit contraction—if they continue further, the Fed could blow up the banks themselves.

The solution here is to cut interest rates, but that risks restarting inflation in the second half of this year and watching it shoot back up to 9%—which absolutely could happen.

St. Lewis Fed President Jim Bullard says rates are appropriate for now, but he’s been agitating for more rate hikes later in the year. The weird thing about all of this is we haven’t had our recession yet, which has gotten some commentators (myself included) wondering if we ever will. Oh yes—we will get our recession. This is one of the reasons I am currently bearish on stocks, even though the prevailing sentiment is already bearish. I have said before that the stock market has already priced in a recession—and it has—but not a severe one.

|

Strategic Investment Conference (SIC) 2023 featuring Jared Dillian: A few years ago, it would’ve been unthinkable that we’d experience the rate hikes, inflation, and global unrest of the last year. Today, it seems the only way to truly be defensive in your portfolio and leverage new opportunities is to “think the unthinkable.” At this year’s Strategic Investment Conference, our faculty of world-renowned speakers will help us prepare for what comes next in 2023 and beyond—both the potential pitfalls and the hidden opportunities. |

Someone explained it to me this way: Benjamin Bernanke, Frederic Mishkin, and others were Depression-era economists who wanted to find the causes of the Great Depression and come up with a solution. This played out in real time in 2008. But this newer generation of economists in the Fed lived through the inflation of the 1970s. They’re looking at Paul Volcker as a model for how to deal with it. And for sure, their legacies are at stake, and they would rather history books remember them as a Paul Volcker—the guy who did too much—than Arthur Burns, the guy who did too little. This Fed will always err on the side of tighter policy.

The scary crazy thing is that after having watched Silicon Valley Bank blow up as a result of rate hikes, it doesn’t seem as if the Fed feels any contrition over their actions. On the contrary, it’s as if they expect even more banks to fail, and they find that to be an acceptable outcome in the pursuit of lower inflation. Of course, none of this would have been necessary had they started tightening monetary policy a year earlier, but nobody wants to talk about that. The inflation wasn’t transitory.

But What If It Is Transitory?

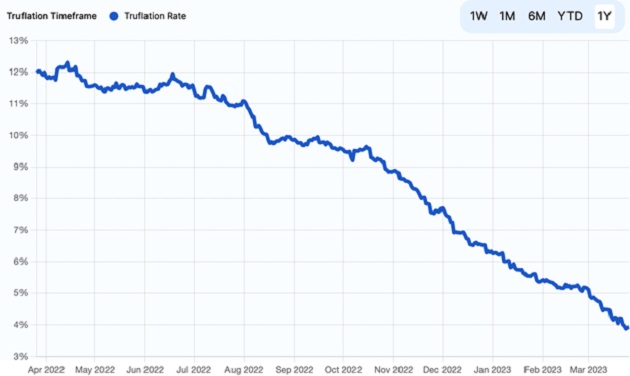

Truflation.com provides something close to a real-time measure of inflation. As you can see from the chart, inflation is down to 4%.

Source: Truflation

You can dig down into the components and see that in some sectors, inflation has actually gone negative. So, was the inflation transitory?

In a sense, yes—it’s the result of pumping a few trillion dollars of stimulus into the economy. But in a sense, no—the stimulus sparked off an inflationary psychology the Fed has yet to squash. Inflation will probably continue to fall, but to an extent, I actually agree with Bullard—not so much that inflation will go up later this year—because it won’t—but that the Fed must remain vigilant in case it ever ticks up.

There’s been some debate as to whether the Fed should capitulate and raise its inflation target to 3% or 4%. They’ve demurred, which I think is the right decision. We can achieve 2% inflation. We can achieve 0% inflation if we really try. The CPI numbers will lag, but eventually, CPI will fall below 4%. Keep an eye on Truflation.com—that tells you all you need to know.

The Sad Thing

The thing that bums me out sometimes is that prices are probably never going down. It used to be that I could go out to dinner with my wife on Wednesday nights for $50, including the tip. Now, it’s $70. In some parts of the country, it is a lot more than that. Four years ago, I bought a cat scale for $35 from Amazon. Now, it’s $58. Multiply that by every good and service in the economy, and you get an idea of the scale of the problem.

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

Two More Things

Thing number one: my book Those Bastards: 69 Essays on Life, Creativity, and Meaning will be released next week. I will respectfully request that you buy a boatload of copies and hand them out to all your friends. It’s the most thoughtful, poignant essay anthology you will ever read.

Thing number two: I had my semiannual party in NYC a few weeks ago and recorded the set. You can find it here. It’s the typically outstanding progressive house you’re used to hearing from me. The crowd loved it. Enjoy it here.

Jared Dillian

subscribers@mauldineconomics.com

Jared Dillian

Jared Dillian