How Low Will We Go?

-

Jared Dillian

Jared Dillian

- |

- January 27, 2022

- |

- Comments

A correction in the stock market is underway.

I have seen several of these. First of all, it doesn’t have to be as bad as we think it will be. For example, the European debt crisis in 2011 felt pretty terrible, but then, the market only dropped about 20%. But some people thought it would blow up the planet.

I get the feeling this time might be a bit worse, as we unwind over a decade of easy money policies in order to fight inflation. There is a lot of discussion about how much political will the Fed has to do this. Some people think it’ll hike once or twice and stop, some people think they might hike five or six times, and some people think it will do 50bp rate hikes. The answer is we don’t know what the Fed’s reaction function will be. There is talk of a Fed put—if stocks go down far enough, the Fed will pause the tightening. I am not so sure. But like I said, I don’t know.

Really what this is, is a big style box unwind—growth stocks had outperformed value for over 10 years, and over the last month or two, we have seen that running in reverse. I have less conviction about the overall direction of the stock market here than the continued style box unwind. Though I will say I have a tough time buying energy and financials here, given the massive run-up.

Unfortunately, I think the analog here is the 2000 dot-com bubble, which was really the same phenomenon—unprofitable tech was taken to the woodshed. The last time this happened, the rotation lasted 2.5 years and resulted in the S&P 500 falling 50% and the NASDAQ 100 falling 80%. At the end of it, Exxon Mobil (XOM) was the largest company by market capitalization. I suspect something similar will happen this time.

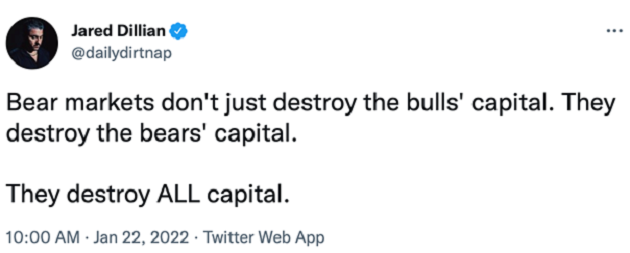

I said this last week:

Well, couldn’t you just buy puts on the highs, watch the market crash, and walk off a hero? Not really. It’s very difficult to get the timing on such things right, and then you’re dealing with monster short squeezes (we will get one soon, if we haven’t already), and the stocks that you are long become strangely correlated to the overall market. I’m more adept at trading bear markets than the average investor, but all that means is I end up losing less money. It takes a lot of courage to just be naked short.

Speaking of the squeezes, I got my first taste of this in January of 2000. I was 25 years old, and had a tiny account at Ameritrade, but I had enough money to short a handful of some of the dumbest dot-com stocks out there. They went down immediately, and I was feeling pretty smart, until the Fed cut rates, and those stocks went up an uncomfortable orifice. I was forced to cover. Ultimately, they all went to zero.

Bear markets destroy ALL capital.

Nudity

The tide goes out, and you get to see who is swimming naked, etc.

The SPAC situation is very sad. Having said that, a small minority of those de-spaced SPACs are actually pretty good companies. At end of this, whatever “this” is, there will be some very good opportunities. There were some dot-com stocks that plummeted 99% in 2002, then went on to become 50 or 100-baggers. But it is too soon to think about that.

If you’re wondering how long “this” could continue, it could be a while. It has only been a month or two. I’m talking sub-$1 share prices. The excesses of the upside will turn into excesses on the downside.

Another way to look at this is not as a bear market or as a growth/value rotation, but an unwind of the pandemic bull market. Every work-from-home stock, like Peloton (PTON), is going to do the round trip. Peloton already has—it went below the IPO price.

The omicron variant is the best thing that could have happened—highly contagious, everyone gets immunity, with a minimum amount of lethality. That, combined with the vaccinations, will get us to herd immunity. I’ll make a call: We won’t be talking about the pandemic much in six months. It will have disappeared. And the pandemic stocks will have, too.

The fiscal and monetary response to the pandemic was a huge overreaction. Of course, that is obvious in hindsight—we didn’t know it at the time. But it created giant distortions in the economy and the stock market that will last for a decade or more. We are in the process of undoing some of those distortions. But I am comfortable saying that Peloton, Zoom (ZM), and others, will never reclaim the highs.

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

Drop Dead Gorgeous

Over the holiday break, I recorded a beautiful chillout mix—it’s called Drop Dead Gorgeous. Because that’s what this music is. Check it out, and please follow me on SoundCloud.

Jared Dillian

subscribers@mauldineconomics.com

Jared Dillian

Jared Dillian