I Suck at Trading Stocks

-

Jared Dillian

Jared Dillian

- |

- June 2, 2022

- |

- Comments

No, really, I do. Well, maybe I don’t suck. But I’m no Mark Minervini. I find stocks confounding. I do much better in other asset classes: rates, commodities, and currencies.

Stocks are hard because they are so efficient.

Before we go any further, I understand The 10th Man has some new readers. Welcome. This is a newsletter about nothing in particular. Yes, it is about finance, but it is not strictly about picking stocks because picking stocks is not too interesting. Nonetheless, we will talk about it this week. Because money won is sweeter than money earned. This article is intended to help you get better at trading stocks, if you have the stomach for it.

One thing I have always said is that prisoners at Guantanamo Bay must be made to trade S&P 500 futures. Give them a trading terminal, and a limited amount of capital, and if they get a margin call, zap ‘em with a stun gun. I could not devise a better and more sophisticated form of torture. Trading stocks is absolute hell.

Trading commodities is easier. Pull up some charts of copper, oil, and soybeans. What do you see? Trends. And not just trends—trends without much in the way of pullbacks for long periods of time. This is what a market looks like without a lot of retail participation. You might ask: Who is on the other side of these losing trades? Hedgers. There is always a natural short to trade against: copper miners, oil producers, and soybean farmers who need to hedge their exposure.

|

[Exclusive] Jared Dillian has just released his 7 essential wartime trades to make right now. We're allowing a small group of select members the opportunity to test drive this new Wartime Portfolio. |

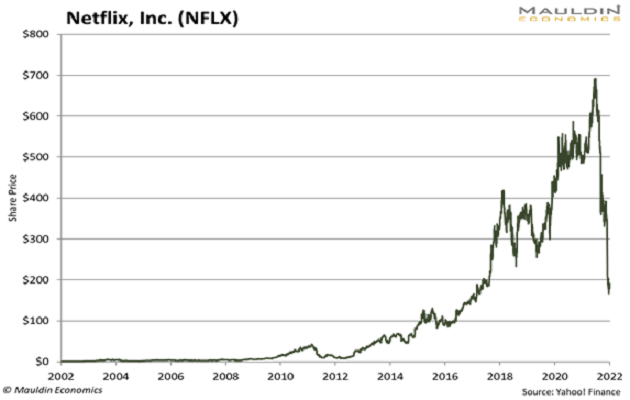

In the stock market, it is pure speculation, with the longs on one side and the shorts on the other. There are trends in stocks, sure, some really long ones, but also some big reversions along the way. Pull up a long-term chart of Netflix (NFLX) and see if you could survive that many 70% drawdowns.

Short version: Trading stocks is very hard. And the irony is that when individual investors trade, they almost exclusively trade stocks. This is mostly due to the vagaries of the futures market, with its institutional-sized contracts, though the exchanges have listed some micro-sized contracts on the S&P 500—but notably, not on corn. The futures markets are very well-behaved. The stock market is not.

Information Disadvantage

Individual investors are constantly searching for new sources of information about the stock market. They love tips, they love reading Barron’s, they are always looking for an edge. Sometimes I have conversations with these investors, and I’ll ask them what their thesis is on a trade: “You bought Amazon (AMZN)? Why?” “Well,” they say, “because the holidays are coming up and sales are going to increase.”

Now, before you laugh, that is a real thesis I heard from someone. If you’re experienced, you know there is a lot of seasonality in Amazon’s earnings. Revenues are very lumpy around the holidays, and crucially, this is already priced in. Everyone already knows this. In fact, if you have a thesis for buying a stock, there is a 99% chance everyone already knows it.

Part of the game in trading stocks is getting as close as you possibly can to inside information without going over the line. One of the craziest things I’ve heard was hedge funds using satellite imagery to look at retailer parking lots. So, let’s just establish something here: You know nothing. You are at a massive information disadvantage.

But that isn’t always a bad thing. You can have a thesis that makes sense, as long as it is simple and can be expressed in one sentence. I have a thesis about my favorite stock, Airbnb (ABNB). Disclosure: I own it. Here is my thesis: Airbnb will steal lots of market share from hotels over a 5- to 10-year time frame. That is a thesis you can invest on, and it requires no information advantage. What it is, is an investable trend. Airbnb has been stealing market share from hotels. It has happened in the past, and I’m betting it will happen in the future.

All the really good trades in the last 20 years have had a clear, simple thesis. Apple (AAPL), Amazon, all of them. The challenge is managing the risk.

Managing the Risk

Here is the problem with investing in stocks: You take big drawdowns, it causes an emotional response, and so you make bad decisions.

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

- Involve a third party. Give your account to a financial advisor, and every time you see him, he will tell you to never sell your stocks. And you won’t.

- Don’t look at your account. Don’t open the app—not on good days, not on bad days, never. This is very hard to do.

- Have the highest level of conviction. You must be absolutely 100% sure this stock is going to go up. And nobody is ever that sure.

- Use sophisticated hedging techniques. This is out of reach for most people.

There are no easy answers. I’m still looking for the answer myself. But I’m terrible at trading stocks, and I know it, which is why no single stock position is ever greater than 5% of my portfolio. I simply do not have the conviction, because I am too experienced, and I know too much. I know how things can go wrong. The average investor does not.

Global Dance Collective

I was very privileged to be on legendary DJ Adam Silver’s radio show last week, the Global Dance Collective, which played live in the US on Data Transmission Radio. It’s a two-hour show, and my set is in the second hour. Check it out!

Jared Dillian

subscribers@mauldineconomics.com

Jared Dillian

Jared Dillian