In Praise of Moderation

-

Jared Dillian

Jared Dillian

- |

- March 24, 2016

- |

- Comments

I’m going to roll back the clock to 1986, 30 years ago, when American politics was completely different. Remember? We used to complain that Democrats and Republicans were essentially indistinguishable. After all, they used to cross the aisle frequently to vote in favor of the other party’s legislation. I would characterize both parties in 1986 as fairly centrist.

I am a little bit nostalgic for those days.

The cool thing about the Internet is that you get to find out that most people are basically out of their minds. Spend much time on Facebook? You get political opinions on Facebook, for sure—extreme right and extreme left. The vast majority of my Facebook friends are either closet communists or nativist Trumpkins. Nobody, and I mean absolutely nobody in between.

When I was in my twenties, I thought being in between meant that you were a sellout, that if you really had any principles you would occupy an extreme position. For a period in my life, you could have called me a pretty extreme libertarian. I’ve come to view political polarization as not being a very good thing.

In the eyes of 2016 voters, this would make me “establishment,” but establishment versus anti-establishment is really just code for internecine class warfare. It’s poor Republicans versus rich Republicans, and poor Democrats versus rich ones.

The anti-elite sentiment is interesting, right? Because—paraphrasing a political analyst friend of mine—the notion that we would ever be governed by anyone other than our so-called elites would have been abhorrent to the Founding Fathers.

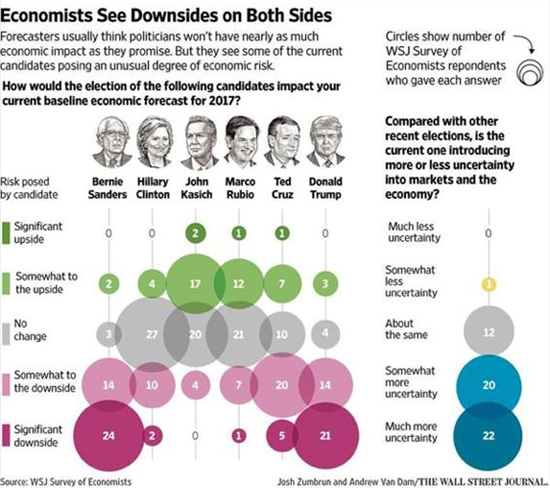

But existentially speaking, I’m starting to view moderation as a virtue. A moderate political environment is best for business and markets. For years, Dennis Gartman has said that a center-right government is best for markets. Center-left works, too, if taxes are reasonable and trade is free. But when you start talking about red reactionaries or blue reactionaries, people who want to halt trade and cut off America from the outside world, economists get worried.

I give economists a lot of crap, but they have this right:

Moderation is good in trading, too. It’s nice to get excited about trades. I get excited all the time. You can get too excited. I hear stories about people who go all-in on trades, 100% of the portfolio, and it always makes me shudder. I am just not that sure about anything. I am pretty sure about being short the Canadian dollar, and I have just taken a giant mark to market in the last two months.

I have a theory about polarization—the Internet enhances it.

It’s pretty simple. In the past, if you had an extreme point of view, it was unlikely that you were going to come in contact with someone who had that same point of view. You were isolated. Now, the extreme people can find each other on the Web and reinforce their views.

90% income tax rates is not a mainstream view. But because of Bernie, and because of the Internet, a lot of people share it. Bernie won’t be the nominee, and he’ll be too old in 2020, but I bet you that we get someone even more extreme than Bernie in 2020. And I bet the Republicans will have a candidate who is even more extreme than Trump. Because the trend toward polarization is relentless.

Any candidate who got up and extolled the virtues of moderation would be laughed off the stage.

So going back to the infographic, polarization is bad for the economy. And polarization is relentless. It doesn’t look good.

Speaking of failed candidates, let’s take a look at Jeb Bush’s proposed tax plan (now irrelevant) from taxfoundation.org:

- Consolidates the current 7 tax brackets into three, with a top marginal income tax rate of 28 percent.

- Taxes long-term capital gains and qualified dividends at a top marginal rate of 20 percent.

- Increases the standard deduction from $6,300 to $11,300 for single filers, from $12,600 to $22,600 for married joint filers, and from $9,250 to $16,750 for heads of household. The personal exemption would remain at $4,000.

- Eliminates the personal exemption phase-out (PEP) and the Pease limitation on itemized deductions.

- Eliminates the state and local income tax deduction.

- Caps all remaining itemized deductions except for the charitable deduction at 2 percent of adjusted gross income (AGI).

- Eliminates the Alternative Minimum Tax.

- Eliminates the Net Investment Income Tax of 3.8 percent, which was passed as part of the Affordable Care Act.

- Doubles the Earned Income Tax Credit (EITC) for childless filers.

- Allows second earners to file their tax returns separately.

- Exempts taxpayers over the age of 67 from the employee-side payroll tax.

- Taxes carried interest at ordinary income tax rates instead of capital gains and dividends tax rates.

- Eliminates the Estate Tax and ends stepped-up basis in capital gains for estates currently liable for the estate tax.

- Taxes all interest income at the lower capital gains and dividend tax rates.

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

As much as I would like a flat tax of 10%, it is not reasonable. 90% taxes are not reasonable. I agree with Ted Cruz that you should send your taxes in on a postcard. That’s nice. Not going to happen.

I will tell you my college yearbook quote:

“Life without idealism is empty indeed. We must have hope or starve to death.”

—Pearl S. Buck

And then I got old.

subscribers@mauldineconomics.com

Jared Dillian

Jared Dillian