The Cost of Pessimism

-

Jared Dillian

Jared Dillian

- |

- January 30, 2020

- |

- Comments

If you’ve ever spent time hiking the Appalachian Trail, you know that hikers give nicknames to each other. My nickname: Pessimist.

I always tend to look on the bad side of things. Of course, human beings are pessimistic by nature, but I elevate it to an art form. I will take the worst-case scenario, and in my head, make it the base case scenario. My logic is that if things work out better, I will be pleasantly surprised.

Much has been written about how pessimism has been a giant liability in this bull market. And it has.

In 2009, you could have thought that we would never escape the financial crisis.

In 2011, you could have thought that the European Debt Crisis would blow up the planet.

In 2012, you could have thought that the US debt downgrade would blow up the planet.

In 2015, you could have thought that Ebola was going to spread all over the planet.

In 2018, you could have thought the vol explosion would blow up the planet.

And so on. These were all legitimate concerns. But if you took these opportunities to add to your stock holdings, you were rewarded.

Now, “buy the dip” is a little simplistic. I’m not aware of any studies that show that buying the dip is a robust strategy, but I spend a lot of time wondering if and when it ever makes sense to not buy the dip, and how do you know? There have only been four bear markets in US history where stocks declined about 50% or more. You sure wouldn’t want to get that wrong.

One quick note: one thing I marvel at was the speed of the financial crisis. Top to bottom in stocks, it took less than two years. It speaks to the amount of leverage and how quickly losses were transmitted through the economy. But it didn’t last that long.

Let’s talk about some things that could go wrong in the next few years.

Things That Could Go Wrong

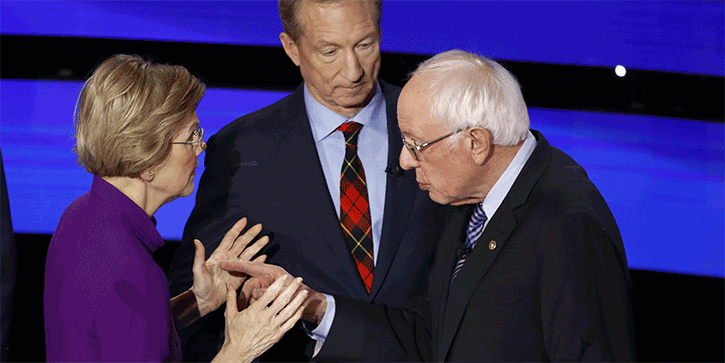

As The Daily Dirtnap readers know, top on my list is politics. People have been radicalized. It seems that a large percentage of the country would be willing to support an honest-to-goodness communist for president. That’s not good.

Second on my list is interest rates. The economy simply cannot withstand higher rates. Get 10-year notes up to 3.5% and alarms are going to go off at the White House and the Fed. There’s the potential for a mass deleveraging if interest rates rise significantly. This has led some people to predict that interest rates will not be permitted to rise.

War is always a possibility, though at this point in time, it seems unlikely.

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

Plus some oddball ones, like this coronavirus that’s spreading around China. Earthquakes, hurricanes, black swan stuff.

The funny thing is—people are so focused on the things that can go wrong, that almost nobody thinks about how things can go right.

For example, if you naively bought stocks when tax reform was announced in 2017, you’d have killed it. It doesn’t get much more obvious than that.

I don’t get too sad about missed opportunities. I am a macro guy and not big on the stock market anyway. I find other ways to make money. But if you’re a retail investor, and it’s a matter of being in stocks or stable value in your 401(k), your pessimism could be a hindrance rather than a help.

Help

But I am starting to wonder if pessimism might become an asset someday soon.

I had my day in the sun in 2008. I shorted a lot of stocks, especially the sketchball mortgage companies and muni bond insurers. I was in on all those trades. Those trades aren’t working these days. Just ask the TSLA shorts.

And I worry about this election. Yes, about the outcome of the election, but also the path we take to get there. It could be an election with a lot of volatility. One thing is for sure—whoever loses will characterize it as “rigged.”

I like to think of myself as an expert on sentiment and social mood, and I don’t like what I see out there. Trump, with all his crowing about the stock market going up, has caused some unintended consequences. His political opponents are starting to make noises about wanting the stock market to go down, which I think would be a first for the United States.

The old newsletter cop-out call was to predict volatility. I don’t know what’s going to happen, but it’s going to be volatile! Trump blew that out of the water—three years of insanity and the stock market hardly moves. Having said that, I’m not surprised by much anymore, but I’d be very surprised if we don’t have some volatility in 2020.

If we don’t, I should hang up my newsletter writer spikes and maybe be a radio host or something.

Jared Dillian

subscribers@mauldineconomics.com

Jared Dillian

Jared Dillian