The Good News About Consumer Debt

-

Jared Dillian

Jared Dillian

- |

- February 21, 2019

- |

- Comments

I saw a headline last week:

“More Americans Are Behind On Their Car Loans Than Ever Before”

Sounds ominous. It’s even worse when you dig into it. Seven million car loans were more than 90 days past due in the fourth quarter of last year. That’s more than during the Great Recession, when unemployment was twice as high.

A lot of the permabears on Twitter seized on this, and tweeted out a bunch of stuff about how the economy sucks because everyone is defaulting on their car loans.

Not really.

The economy may indeed suck, but it’s not because of the car loans. People are defaulting on car loans because underwriting standards declined significantly a few years ago. This was a big trade at the time in the credit world. I wrote about it a little bit in The Daily Dirtnap.

There are A LOT of subprime auto dealers around Myrtle Beach. You can’t swing a cat without hitting one. These are the types of places where you buy a car for $2,000 and end up paying $6,000 in interest.

No wonder people are defaulting!

It really has nothing to do with the economy. Cars are more expensive, and people are buying more SUVs, which are even more expensive.

And car dealerships (which are not subject to regulation by the CFPB, I might add) have been uber-aggressive in lending money. They will get you in that car, no matter what it takes.

Now that we’ve debunked that myth, let’s find another one.

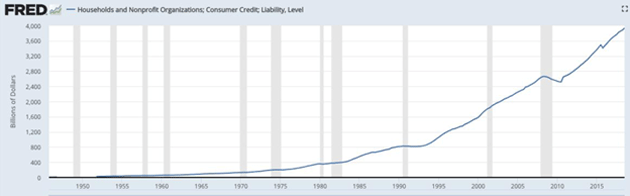

Household Debt Has Surged to an All-Time High!

I came across a Morgan Housel tweet when I was sitting on the couch over the weekend.

Shot:

Household debt surges to an all-time high!

Source: @morganhousel

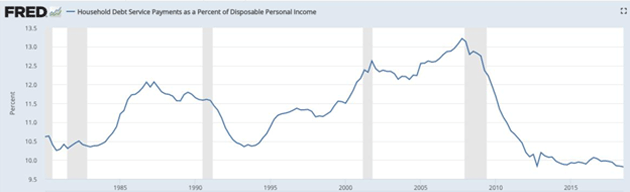

Chaser:

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

Source: @morganhousel

There is a fair bit of alarmism in the personal finance “community” about the state of American household’s balance sheets. Things are not that bad. They are better than ever, actually.

And people are getting smarter about stuff. They have been getting smarter about credit cards for a while. Credit scores keep putting in new highs!

Then again, you have situations like you had with the government shutdown, where a bunch of people did not pass Go and immediately went to the food bank. That’s a bit discouraging, and a reminder of how many people actually do live paycheck to paycheck—even government workers.

Tyler Cowen did a better job writing about this than I could have. The shutdown became a bit of a political third rail. You got zapped if you said it was people’s responsibility to put aside some emergency funds—and if you said they were at all culpable for not having any and ending up at the food bank.

But it’s true! You can’t yell at people for yelling at people for living paycheck to paycheck and then expect people to stop living paycheck to paycheck. Change comes from individuals taking personal responsibility.

So there is a lot of work to be done.

|

The Savings Rate

Where we need to improve is in savings. Gosh darn it, people just do not save. And when I say “save,” I do not mean invest. I mean cash in the bank.

Ten years of ZIRP destroyed a generation of savers.

But it makes sense to save, even if interest rates are zero. For reasons that should be obvious. I have said it before, but I will say it again. Stuff happens. If you don’t have cash lying around, you will be stuck.

How much cash do you need lying around?

Six months of pay, or $10,000, whichever is more.

$10,000 may sound like a lot of money to a lot of people, but it is attainable—if you save. And $10,000 covers pretty much all unforeseen circumstances.

What this means is that a $3,000 car repair isn’t going to end up on your credit card and send you into a debt tailspin from which you can never recover.

Yes, there is unemployment insurance if you lose your job. I would not count on it! I would not count on anything. Sure, there is a social safety net. You should get in the habit of not depending on it, because ideally you should not be dependent on anyone or anything.

I don’t think many people in my generation believe that Social Security will be around in its current form when it is time to retire. So we had better save for retirement. My personal opinion: I do think Social Security will be around in 20 years, but it will probably end up being means-tested.

Things Are Good, But They Could Be Better

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

If you spend your whole life preparing for something bad to happen, you will… end up with a big pile of money. There are worse things, for sure.

Savings is power. Savings is like plutonium, just a big pile of potential energy, with no-half life. It’s stored opportunities. It waits, until you decide what you want to do with it.

And if you decide you really have no use for it, you can just give it away.

Which is better than paying interest on a car loan.

We’re Close

I’m told SIC 2019 is very close to being sold out. If I were you, I would not wait much longer to get your ticket.

I started talking last March in The Daily Dirtnap (and more recently in Street Freak) about being bearish on healthcare, so I’m definitely going to be watching the SIC 2019 biotech panel for insights into the bigger picture, futuristic stuff. It’s a great lineup, with Jim Mellon, Mike Roizen and Mauldin Economics’ own Patrick Cox.

Of course, that’s only one slice of what will be an amazing conference. Take a look for yourself and get your ticket right here.

subscribers@mauldineconomics.com

Jared Dillian

Jared Dillian