What Comes After a Trillion?

-

Jared Dillian

Jared Dillian

- |

- February 28, 2019

- |

- Comments

Headline in Bloomberg the other day:

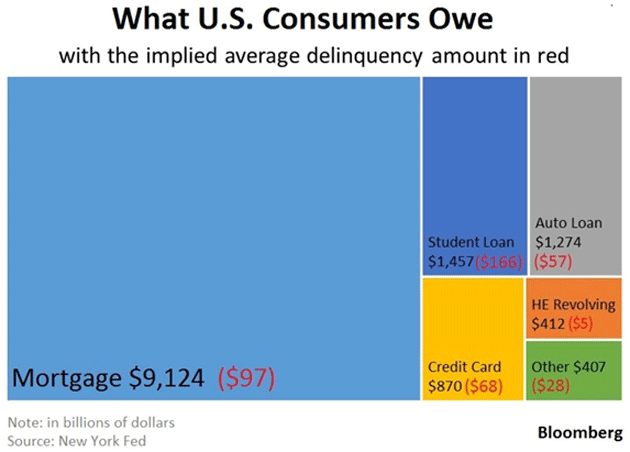

“Millennials Are Facing $1 Trillion in Debt.”

A trillion always sounds like a lot. It is a lot.

But while the absolute number is large, that is not the issue. The issue is the composition of this millennial debt. It’s mostly student loans, and a staggeringly high amount of these loans are in delinquency.

And this is at the top of an expansion!

As I’ve said a half a million times, debt kills. People contemplate suicide over debt. Usually because it’s gambling debt that they welched on, and they are about to get their legs broken. But also because some people have so much student loan debt that they’re 29 years old and it’s already checkmate.

On a societal level, imagine what happens if we hit a rough patch in the economy and these student loans—which are already 10% delinquent—go to 40% delinquent?

Revolution.

I don’t want to get all Book of Revelation on you, but debt historically led to war and inflation and autocracy.

Once you know that, you develop a healthy respect for debt and the destruction it can cause.

Wall Street folks often view debt as a numerical abstraction. Like, if the default rate rises to 6%, then high yield spreads over Treasurys will go from 300 to 700 over.

That’s the kind of gearhead stuff most analysts talk about. I recognize the opportunities that it will create in the corporate bond market, but I’m also conscious of the impact on human beings when people apply too much leverage.

Again: debt kills.

|

Millennials

In the case of millennials, they made decisions to take out student loans when they were too young to make these decisions.

Someone in the Bursar’s Office stuck a form in front of them and said “sign here,” and without a second thought, these 18-year-olds signed their future right down the drain.

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

Source: Bloomberg

When millennials say that it isn’t their fault and the debt should be forgiven, they’re half right. They’re guilty of having a high agreeableness score and shocking levels of innumeracy, but they’re not deadbeats any more than any other generation are deadbeats.

And they’re not any more prone to profligacy. In fact, student loan debt has crowded out other kinds of debt, notably, mortgage debt. They can’t get a mortgage, which means they can’t build equity, which means they can’t take part in the greatest savings program known to mankind.

Nobody does this deliberately. If I were contemplating taking out six figures in student debt, I would build a spreadsheet to figure out how long it would take me to pay it back. 99.9% of these people do not do this.

Are they wrong? Or do we just need to lower expectations?

This talk about forgiving student loan debt is dumb (because remember, you have to respect the rights and property of the lender).

If I were running this hamburger stand, I would work to compel student lenders to enforce the same sorts of credit standards that banks do when they issue mortgages. Naturally, that would result in fewer people going to college—or, at least, to expensive colleges.

That is okay! It would force colleges and universities to think a little harder on the sprawling bureaucracies they’ve built for themselves, along with the 5-star accommodations. The University of Michigan famously employs 93 full-time diversity staff, the top 26 of which make six figures.

Yes, college could be cheaper.

The Way Out

My colleague John Mauldin talks about debt a lot. He talks about it more from a macro perspective. Lately, I have been focusing on it from a micro perspective.

The national debt is huge, and growing, and is a problem. At our current trajectory, and unless we take corrective action, we will also be in checkmate.

Having said that, there may not be tangible economic effects for a while. Deficits do matter, but with a very long lag.

If a household goes into debt, the effects are not lagged—they are immediate.

Even if a recession doesn’t happen, the absolute best-case scenario is that people limp along with crushing debt service, crowding out consumption and investment. People live in poverty, retire in poverty, and die in poverty.

You might think this is a funny time to get revved up about debt, especially because in last week’s issue, we showed that debt service as a percentage of disposable income has dropped to an all-time low.

This is a personal mission of mine. I talk to people and I hear stories about how debt constrains behavior. It sucks up all the free cash flow. I bet if people had an extra $1,000 a month in free cash flow, they’d at least find something fun to do with it.

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

I hope one day everyone gets to experience the same feeling of liberation.

subscribers@mauldineconomics.com

Jared Dillian

Jared Dillian