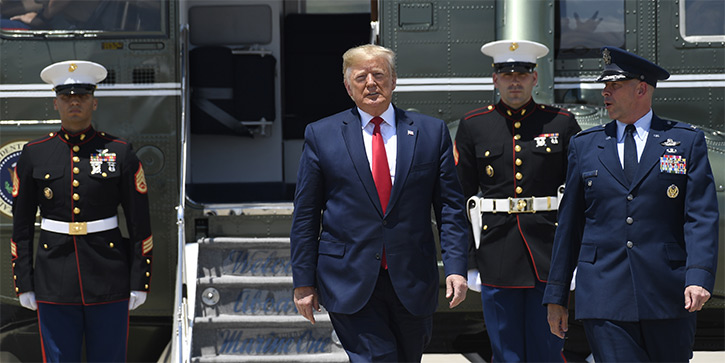

The Trump Train

-

Jared Dillian

Jared Dillian

- |

- June 27, 2019

- |

- Comments

Newsletter writers invite terrible peril when they mention Trump in an issue. He’s the most polarizing figure of all time. If you say something good about him, half of your readership will hate you. If you say something bad about him, the other half will hate you. It is a no-win situation. So newsletter writers, myself included, never write about him.

But that’s dumb! Donald J. Trump is the biggest driver of financial markets in the world. Hands down. How can you not write about him?

So here is what we are going to do. We are going to talk about Trump today. We are going to talk about Trump in a rational, nonpartisan, equitable fashion. I think you folks know me well enough by now to realize that I am not typically prone to partisan hackery. Trump is capable of both good and bad. You can make money off Trump by anticipating his moves—which are not hard to predict.

If you take offense to any portion of this piece, you are welcome to write into customer service, but I assure you that your submission will be promptly filed in “Deleted Items.”

Choo Choo

Let’s keep this really simple:

Trump wants stocks higher.

- Stocks are higher.

Trump wants interest rates lower.

- Interest rates are lower.

Trump wants the dollar weaker.

- The dollar is getting weaker.

Trump wants oil lower.

- Oil has not been especially high.

Do you really want to get into a fight with Trump?

Amazingly, people do. People get into a fight with Trump all the time. Lots of people out there trying to short bonds. Dude. The president is literally ordering the central bank to lower interest rates and threatening to fire the head guy unless he gets his way. And you want to short bonds? Right.

Trump’s influence on monetary policy is unquestionably bad. He has obliterated decades of presidential norms and has set a precedent that will result in more executive interference at the Fed, resulting in (eventually) sharply higher inflation. So yes, it is unquestionably bad. Doesn’t mean you can’t trade on it!

Let me tell you how powerful this is: Trump has been badgering the Fed for months. Interest rates have been coming down. Interest rates have been coming down around the world, in sympathy. Trump has lowered interest rates globally. You want to get into a fight with this?

Trump is not going to stop until interest rates are negative and we’re doing QE.

Think I’m kidding?

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

Really?

Trump, good or bad, is the most transformative president we’ve had in a really long time. The office will never be the same. Obama, Bush I and II, and Clinton all colored within the lines.

I am not much of a stock market bull… but I ain’t gonna short ‘em.

|

Predicting Trump

The goal here is to front-run Trump.

The thing about Trump is that he really only focuses on one thing at a time.

Back when tax reform was going on, Trump was focused on it to the exclusion of all else. I wondered, what’s next after tax reform? Trade! I figured that tariffs were coming and I made a bunch of steel stock recommendations in The Daily Dirtnap and Street Freak. They were great trades. Of course, the steel stocks are well off the highs and the tariffs have been counterproductive, but it was a great trade at the time, which is all that counts.

Right now, Trump is focused on the Fed. What comes after the Fed?

Honestly, I think he is going to be focused on the Fed (along with the ECB and the price of oil) for a really long time. Imagine you had a Bloomberg terminal and you had the power to affect any price in the world. That’s what he is doing.

In a way, having Trump as president has made trading easier rather than harder. I’m not gonna lie: I have made a lot of money off Trump trades. I just typically don’t crow about the fact that they’re Trump trades, because RIP my inbox.

We know where Trump stands on just about every financial asset in the world. Trump doesn’t like tech. Short tech. Trump thinks drug prices are too high. Short healthcare. Trump likes oil and coal and mining and such. Buy XLB (a basic materials ETF). Trump hates Mexico and loves Japan. The list goes on and on and on.

I am shocked—shocked, I tell you, that some knucklehead hasn’t come up with a Trump ETF. It would be one of the best ETF launches of all time.

Like what you're reading?

Get this free newsletter in your inbox every Thursday! Read our privacy policy here.

Choo Choo Part 2

Going back to my point that Trump wants lower oil. You know what lower oil is a tailwind for? Transportation companies! My colleague Robert Ross is telling readers that transportation is “the best sector to buy right now,” and he has some pretty compelling proof to back the claim up.

Of course, not all transportation companies are created equal. So Robert is also sharing a stock pick he’s put through a rigorous vetting process. It’s right on this page (i.e. you don’t have to sign up for anything to get the pick). You should take a look.

Jared Dillian

subscribers@mauldineconomics.com

Jared Dillian

Jared Dillian